As the Q2 profits period covers, allow’s go into this quarter’s ideal and worst entertainers in the semiconductor production market, consisting of Semtech (NASDAQ: SMTC) and its peers.

The semiconductor market is driven by need for innovative digital items like smart devices, Computers, web servers, and information storage space. The requirement for innovations like expert system, 5G networks, and clever automobiles is likewise developing the following wave of development for the market. Staying on top of this dynamism calls for brand-new devices that can make, produce, and examination chips at ever before smaller sized dimensions and even more intricate styles, developing an alarming requirement for semiconductor resources production devices.

The 14 semiconductor production supplies we track reported a solid Q2. En masse, profits defeated experts’ agreement price quotes by 1.9% while following quarter’s income support was 2.7% listed below.

Rising cost of living advanced in the direction of the Fed’s 2% objective just recently, leading the Fed to lower its plan price by 50bps (half a percent or 0.5%) in September 2024. This is the very first cut in 4 years. While CPI (rising cost of living) analyses have actually been encouraging recently, work actions have actually approached uneasy. The marketplaces will certainly be questioning whether this price cut’s timing (and a lot more prospective ones in 2024 and 2025) is suitable for sustaining the economic situation or a little bit far too late for a macro that has actually currently cooled down excessive.

Taking into account this information, semiconductor production supplies have actually held consistent with share rates up 1.8% generally considering that the most up to date profits outcomes.

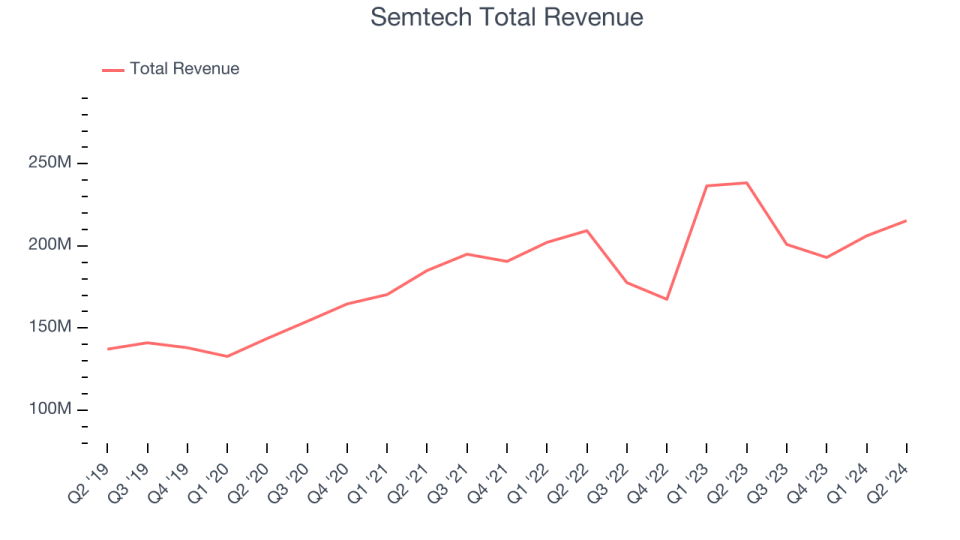

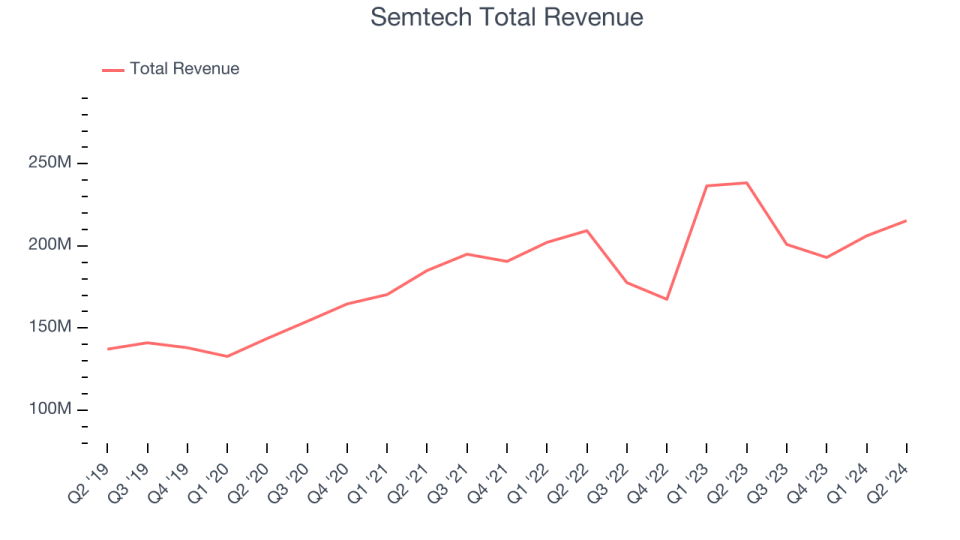

Semtech (NASDAQ: SMTC)

A public business considering that the late 1960s, Semtech (NASDAQ: SMTC) is a company of analog and mixed-signal semiconductors utilized for Net of Points systems and cloud connection.

Semtech reported profits of $215.4 million, down 9.7% year on year. This print surpassed experts’ assumptions by 1.5%. On the whole, it was a solid quarter for the business with an excellent beat of experts’ EPS price quotes and a substantial enhancement in its gross margin.

” Semtech remains to perform on a well established method to expand our organization, as shown by strong 2nd quarter monetary efficiency and a beneficial overview for our 3rd quarter that anticipates velocity of this development,” claimed Hong Hou, Semtech’s head of state and ceo.

Surprisingly, the supply is up 23.2% considering that reporting and presently trades at $47.

Is currently the moment to purchase Semtech? Access our full analysis of the earnings results here, it’s free.

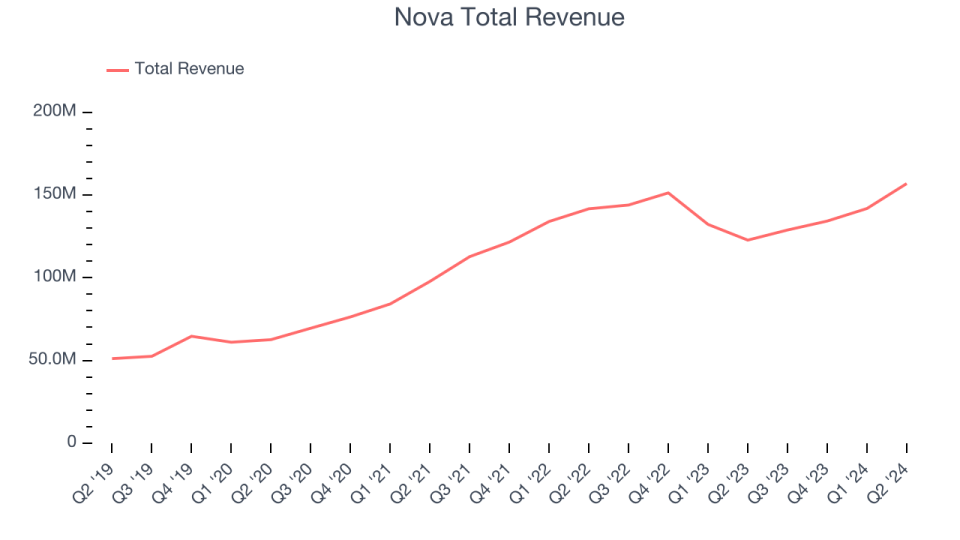

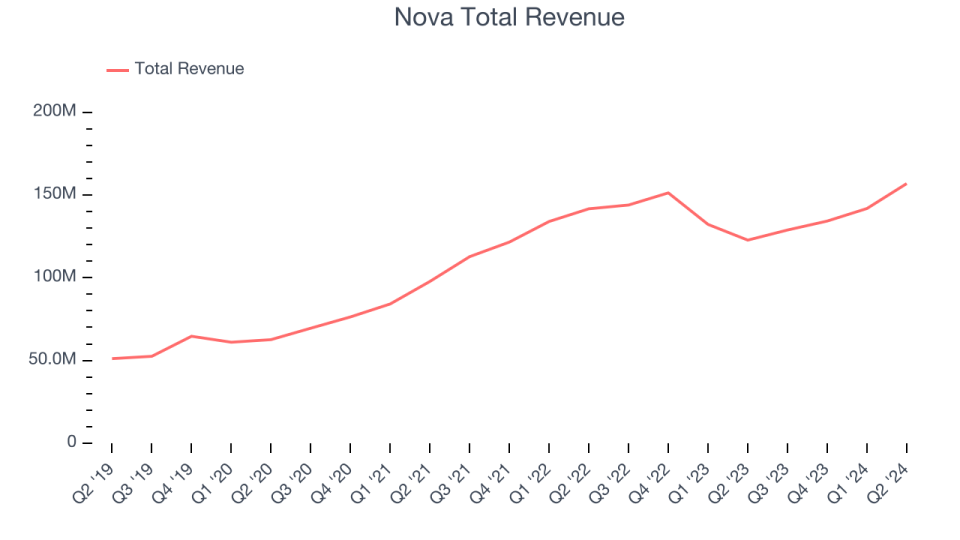

Finest Q2: Nova (NASDAQ: NVMI)

Headquartered in Israel, Nova (NASDAQ: NVMI) is a company of quality assurance systems utilized in semiconductor production.

Nova reported profits of $156.9 million, up 27.8% year on year, exceeding experts’ assumptions by 5.9%. Business had a phenomenal quarter with an excellent beat of experts’ EPS price quotes and a substantial enhancement in its operating margin.

Nova carried out the fastest income development amongst its peers. The marketplace appears satisfied with the outcomes as the supply is up 15.3% considering that coverage. It presently trades at $209.09.

Is currently the moment to purchase Nova? Access our full analysis of the earnings results here, it’s free.

Photronics (NASDAQ: PLAB)

Sporting a worldwide impact of centers, Photronics (NASDAQ: PLAB) is a producer of photomasks, layouts utilized to move patterns onto semiconductor wafers.

Photronics reported profits of $211 million, down 5.9% year on year, disappointing experts’ assumptions by 6.2%. It was a softer quarter as it uploaded underwhelming income support for the following quarter and a miss out on of experts’ EPS price quotes.

Photronics provided the weakest efficiency versus expert price quotes in the team. The supply is level considering that the outcomes and presently trades at $24.03.

Read our full analysis of Photronics’s results here.

Amtech (NASDAQ: ASYS)

Concentrating on the silicon carbide and power semiconductor fields, Amtech Equipment (NASDAQ: ASYS) generates the equipment and associated chemicals required for making semiconductors.

Amtech reported profits of $26.75 million, down 13% year on year. This print went beyond experts’ assumptions by 10.8%. On the whole, it was a really solid quarter as it likewise logged an excellent beat of experts’ EPS price quotes and a substantial enhancement in its operating margin.

Amtech attained the largest expert approximates defeat amongst its peers. The supply is up 13.4% considering that reporting and presently trades at $6.

Read our full, actionable report on Amtech here, it’s free.

Teradyne (NASDAQ: TER)

Sporting most significant chip suppliers as its consumers, Teradyne (NASDAQ: TER) is a US-based provider of computerized examination devices for semiconductors along with various other innovations and tools.

Teradyne reported profits of $729.9 million, up 6.6% year on year. This number defeated experts’ assumptions by 4.1%. It was a solid quarter as it likewise generated a substantial enhancement in its stock degrees and an excellent beat of experts’ EPS price quotes.

The supply is down 4.1% considering that reporting and presently trades at $137.30.

Read our full, actionable report on Teradyne here, it’s free.

Sign Up With Paid Supply Capitalist Research Study

Aid us make StockStory a lot more practical to capitalists like on your own. Join our paid individual research study session and get a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.