Robinhood and Revolut are thinking about stablecoin launches, as Markets in Crypto-Assets (MiCA) policy might interfere with Tether’s market dominance in the EU.

Nevertheless, neither company has actually made concrete guarantees, and there are various other rivals.

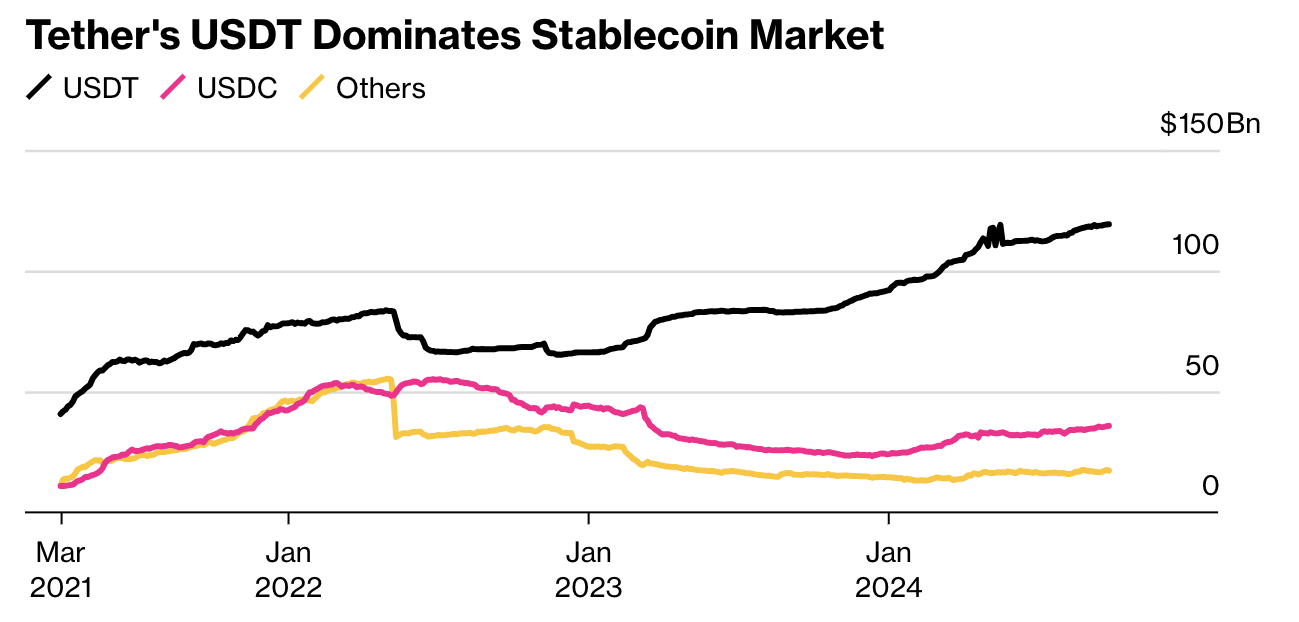

Tether’s Market Supremacy

Bloomberg reports that Robinhood and Revolut, 2 large fintech companies, are thinking about getting in the stablecoins market. Both business wish to loosen up Tether’s frustrating prominence in the stablecoin market. Neither firm has actually formally confirmed dedications on the topic, and no workers have actually talked on the document.

Find Out More: An Overview to the very best Stablecoins in 2024

Still, the timing is really ripe. Robinhood and Revolut would certainly not be the only significant resources companies checking out stablecoins.

On Thursday, Ethena Labs released a brand-new stablecoin backed by the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). This stablecoin is made to mimic the security of standard stablecoins by connecting its worth to BUIDL, a fund that consists of United States bucks, temporary United States Treasury costs, and bought arrangements.

MiCA: A Significant Possibility

The factor for this high degree of passion is basic. MiCA, the EU’s brand-new thorough crypto guidelines, is readied to work quickly, and it consists of strict policies for stablecoins.

Circle currently has the appropriate licensing to run in the EU, however it hasn’t seriously tested Tether’s prominence in over 2 years. If Tether can not satisfy conformity, the whole EU market would certainly be ripe for brand-new competitors. That’s a reward as well alluring to disregard, specifically for large companies like Robinhood and Revolut.

” Lots of organizations have actually taken a look at the similarity Circle and Tether and the numbers they have actually uploaded. It seemed like an attractive service version, and there are lots of around that may wish to duplicate tha,” Thomas Eichenberger, Principal Item Police Officer at Sygnum, claimed.

Besides, Bloomberg kept in mind, Tether used around 100 individuals when it banked $5.2 billion in earnings previously this year. In possession under administration (AUM), it’s relatively big.

Stablecoins are an expanding market worldwide, specifically in arising economic situations. Enhancing varieties of clients are utilizing stablecoins as a store-of-value or day-to-day acquisitions. Their usage in aiding individuals escape United States assents has actually likewise collected big passion.

Also prior to the particular chance of MiCA, the opportunity of damaging Tether and Circle’s duopoly has actually brought in capitalists. PayPal released its very own stablecoin for this precise objective a year earlier, and today, it’s coming close to $1 billion. Tether has almost $120 billion, however. If the whole EU has the possibility to outcompete it, there will certainly be no scarcity of entrants.

Find Out More: What Is Markets in Crypto-Assets (MiCA)?

Nevertheless, Robinhood and Revolut have actually not made any type of strong dedications yet. To make use of MiCA, nonetheless, they’ll need to act quickly. Lots of exchanges in the EU have actually partly delisted Tether stablecoins, however there are some holdouts.

Tether will certainly run in a lawful grey location, and nevertheless Circle is currently certified. An extremely vast array of results is feasible.

Please Note

In adherence to the Depend on Task standards, BeInCrypto is devoted to objective, clear coverage. This newspaper article intends to give exact, prompt details. Nevertheless, visitors are suggested to validate realities separately and seek advice from a specialist prior to making any type of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.