Quarterly revenues outcomes are a great time to sign in on a business’s progression, specifically contrasted to its peers in the very same field. Today we are considering Qualcomm (NASDAQ: QCOM) and the most effective and worst entertainers in the cpus and graphics chips market.

The greatest need motorists for cpus (CPUs) and graphics chips right now are nonreligious fads connected to 5G and Net of Points, independent driving, and high efficiency computer in the information facility area, particularly around AI and artificial intelligence. Like all semiconductor business, electronic chip manufacturers show a level of cyclicality, driven by supply and need inequalities and direct exposure to computer and Mobile phone item cycles.

The 9 cpus and graphics chips supplies we track reported a blended Q2. En masse, earnings defeated experts’ agreement quotes by 0.9% while following quarter’s income support was 12.9% listed below.

The Fed reduced its plan price by 50bps (half a percent) in September 2024, the initial in about 4 years. This notes completion of its most sharp inflation-busting project considering that the 1980s. While CPI (rising cost of living) analyses have actually been encouraging recently, work actions have actually approached uneasy. The marketplaces will certainly be evaluating whether this price cut’s timing (and a lot more prospective ones in 2024 and 2025) is suitable for sustaining the economic situation or a little bit far too late for a macro that has actually currently cooled down excessive.

While some cpus and graphics chips supplies have actually gotten on rather far better than others, they have actually jointly decreased. Usually, share costs are down 1.3% considering that the current revenues outcomes.

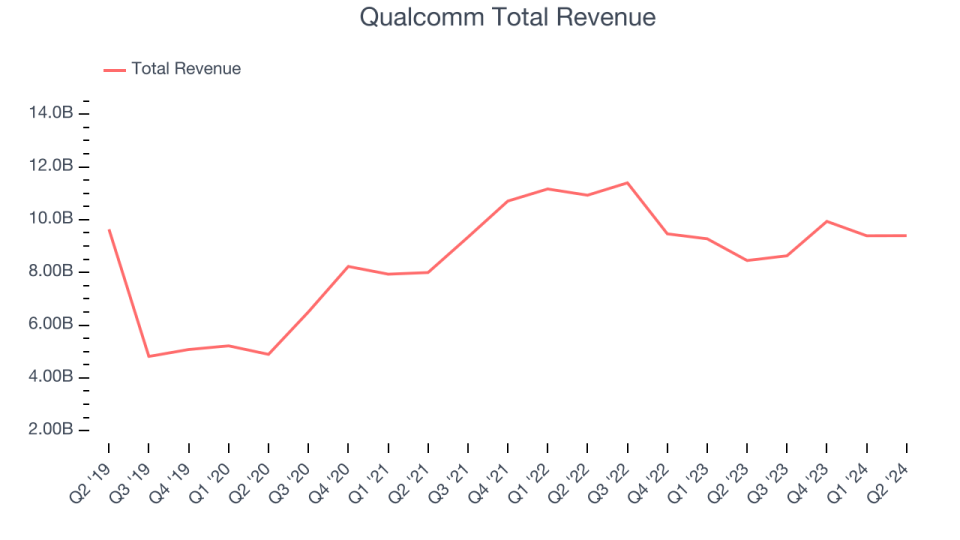

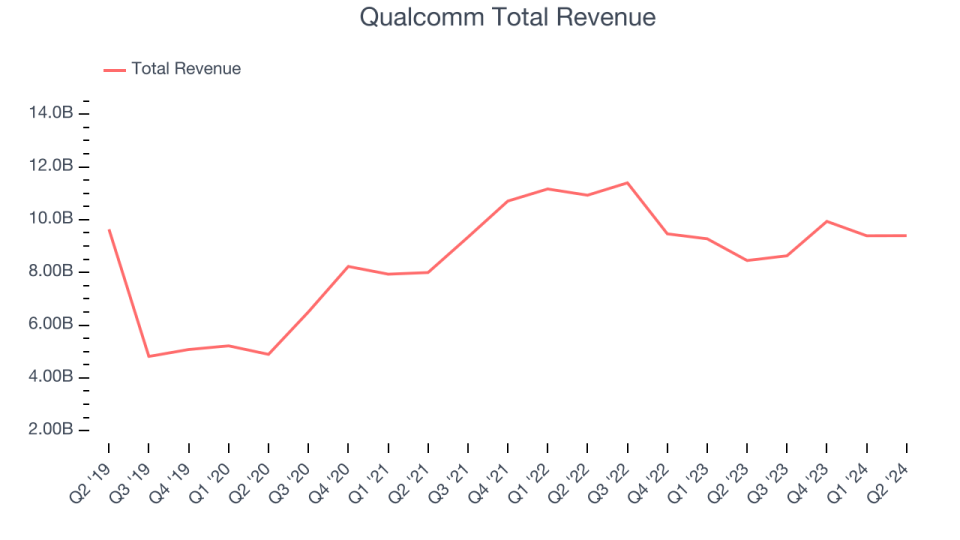

Qualcomm (NASDAQ: QCOM)

Having Actually gone to the center of creating the criteria for mobile connection for over 4 years, Qualcomm (NASDAQ: QCOM) is a leading trendsetter and a fabless producer of cordless innovation chips made use of in mobile phones, cars and net of points home appliances.

Qualcomm reported earnings of $9.39 billion, up 11.1% year on year. This print went beyond experts’ assumptions by 1.9%. Generally, it was a solid quarter for the firm with a respectable beat of experts’ EPS quotes and solid sales support for the following quarter.

Unsurprisingly, the supply is down 4.8% considering that reporting and presently trades at $172.03.

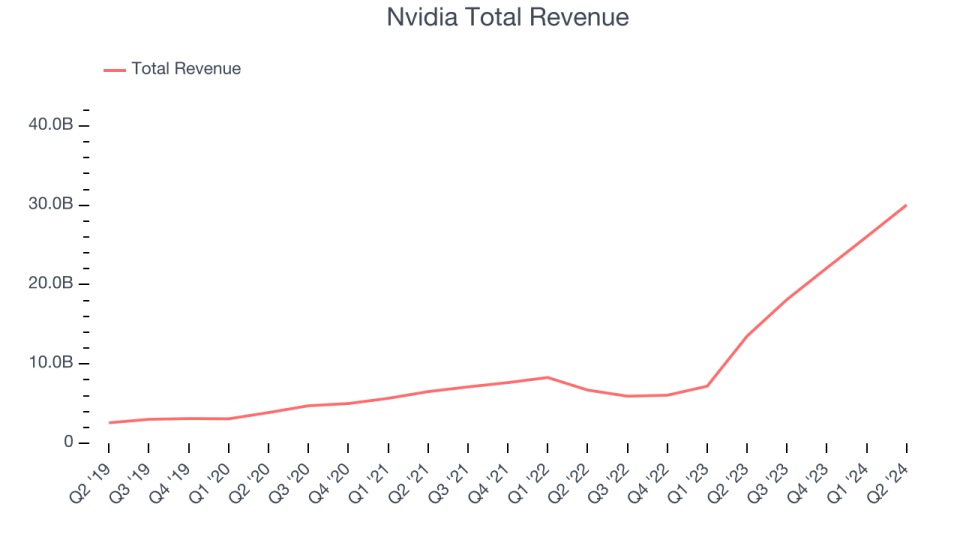

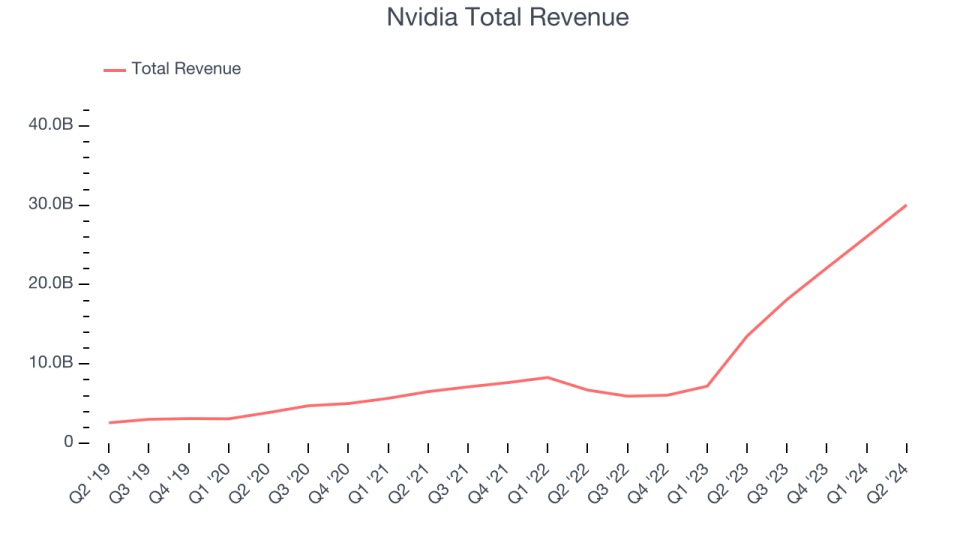

Finest Q2: Nvidia (NASDAQ: NVDA)

Established In 1993 by Jensen Huang and 2 previous Sunlight Microsystems designers, Nvidia (NASDAQ: NVDA) is a leading fabless developer of chips made use of in video gaming, Computers, information facilities, auto, and a range of end markets.

Nvidia reported earnings of $30.04 billion, up 122% year on year, surpassing experts’ assumptions by 4.5%. Business had a remarkable quarter with a substantial renovation in its supply degrees and a remarkable beat of experts’ EPS quotes.

Nvidia racked up the greatest expert approximates beat and fastest income development amongst its peers. Although it had a great quarter contrasted its peers, the marketplace appears miserable with the outcomes as the supply is down 2.5% considering that coverage. It presently trades at $122.50.

Is currently the moment to acquire Nvidia? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Latticework Semiconductor (NASDAQ: LSCC)

A worldwide leader in its classification, Latticework Semiconductor (NASDAQ: LSCC) is a semiconductor developer concentrating on customer-programmable chips that boost CPU efficiency for extensive jobs such as artificial intelligence.

Latticework Semiconductor reported earnings of $124.1 million, down 34.7% year on year, disappointing experts’ assumptions by 4.7%. It was an unsatisfactory quarter as it uploaded underwhelming income support for the following quarter and a decrease in its operating margin.

Latticework Semiconductor supplied the weakest efficiency versus expert quotes in the team. The supply is level considering that the outcomes and presently trades at $54.39.

Read our full analysis of Lattice Semiconductor’s results here.

Qorvo (NASDAQ: QRVO)

Developed by the merging of TriQuint and RF Micro Gadgets, Qorvo (NASDAQ: QRVO) is a developer and producer of RF chips made use of in mostly all mobile phones worldwide, in addition to a range of chips made use of in networking tools and framework.

Qorvo reported earnings of $886.7 million, up 36.2% year on year. This outcome defeated experts’ assumptions by 4.1%. Generally, it was a solid quarter as it additionally created a remarkable beat of experts’ EPS quotes and a substantial renovation in its operating margin.

The supply is down 11.7% considering that reporting and presently trades at $105.49.

Read our full, actionable report on Qorvo here, it’s free.

Broadcom (NASDAQ: AVGO)

Initially the semiconductor department of Hewlett Packard, Broadcom (NASDAQ: AVGO) is a semiconductor corporation that extends cordless, networking, information storage space, and commercial end markets in addition to a framework software application organization concentrated on data processors and cybersecurity.

Broadcom reported earnings of $13.07 billion, up 47.3% year on year. This outcome satisfied experts’ assumptions. Zooming out, it was a solid quarter as it additionally tape-recorded a respectable beat of experts’ EPS quotes however underwhelming income support for the following quarter.

The supply is up 15.5% considering that reporting and presently trades at $176.69.

Read our full, actionable report on Broadcom here, it’s free.

Sign Up With Paid Supply Financier Research Study

Aid us make StockStory a lot more useful to capitalists like on your own. Join our paid customer study session and get a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.