As the Q2 incomes period covers, allow’s explore this quarter’s finest and worst entertainers in the garments, devices and deluxe products market, consisting of Think (NYSE: GES) and its peers.

Within garments and devices, not just do designs transform a lot more often today than years previous as crazes take a trip via social networks and the net however customers are likewise moving the method they get their products, preferring omnichannel and ecommerce experiences. Some garments, devices, and deluxe products firms have actually made collective initiatives to adjust while those that are slower to relocate might fall back.

The 17 garments, devices and deluxe products supplies we track reported a slower Q2. En masse, incomes missed out on experts’ agreement quotes by 1.3% while following quarter’s profits support was 12.6% listed below.

Broad view, the Federal Book has a double required of rising cost of living and work. The previous had actually been running warm throughout 2021 and 2022 however cooled down in the direction of the reserve bank’s 2% target since late. This motivated the Fed to reduce its plan price by 50bps (half a percent) in September 2024. Offered current work information that recommends the United States economic climate might be tottering, the marketplaces will certainly be analyzing whether this price and future cuts (the Fed signified even more to find in 2024 and 2025) are the best relocations at the correct time or whether they’re insufficient, far too late for a macro that has actually currently cooled down.

The good news is, garments, devices and deluxe products supplies have actually been resistant with share rates up 5.5% typically because the most recent incomes outcomes.

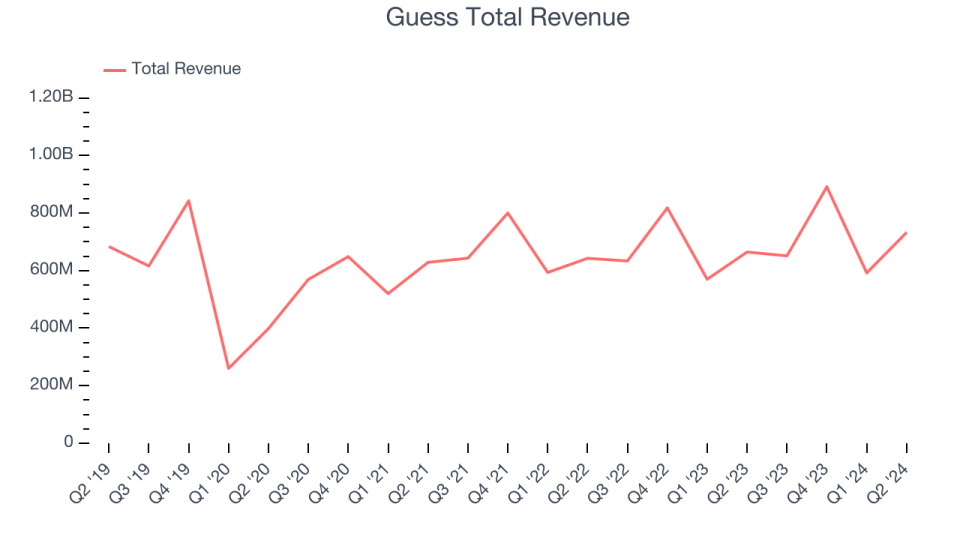

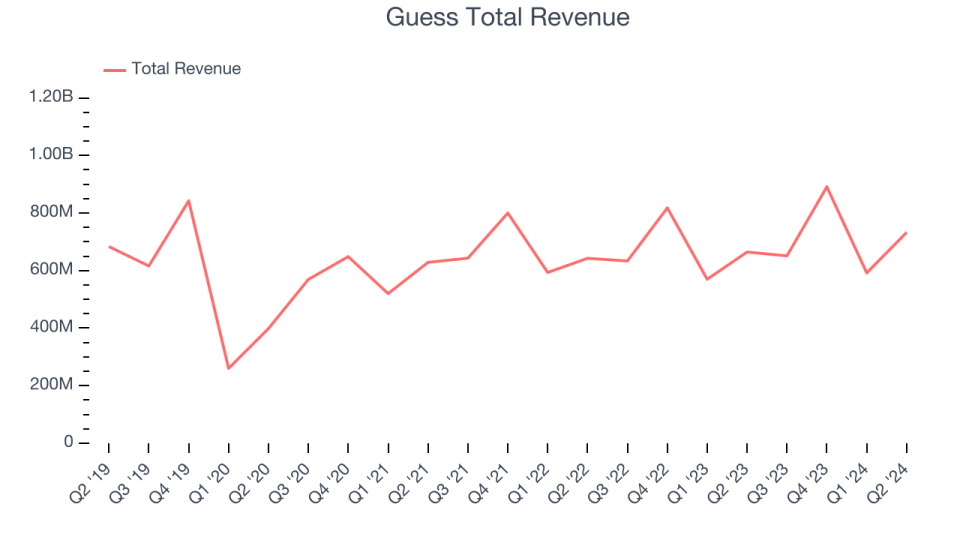

Ideal Q2: Think (NYSE: GES)

Bending the renowned bottom-side-up triangular logo design with an enigma, Think (NYSE: GES) is a worldwide style brand name recognized for its fashionable apparel, devices, and denim wear.

Think reported incomes of $732.6 million, up 10.2% year on year. This print remained in line with experts’ assumptions, however on the whole, it was a combined quarter for the business with underwhelming incomes support for the complete year.

Carlos Alberini, Ceo, commented, “Throughout the 2nd quarter we supplied profits development of 10%, according to our assumptions. This efficiency was sustained by the dustcloth & & bone procurement and solid wholesale efficiency in our Europe and Americas services. All our sectors, with the exception of Asia, supplied top-line development. Our fundamental outcomes show our choice to substantially raise our advertising financial investments contrasted to in 2015’s invest to sustain the worldwide development of our brand names, including our core Think brand name along with the brand-new enhancements to our profile– Think Pants and dustcloth & & bone.”

Think accomplished the fastest profits development of the entire team. Although it had an excellent quarter about its peers, the marketplace appears unhappiness with the outcomes. The supply is down 38.8% because reporting and presently trades at $2.29.

Read our full report on Guess here, it’s free

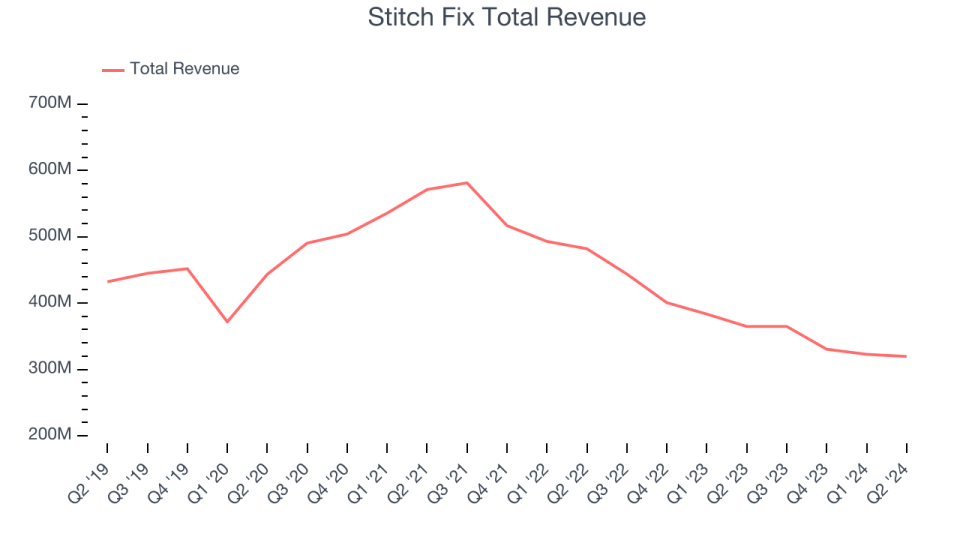

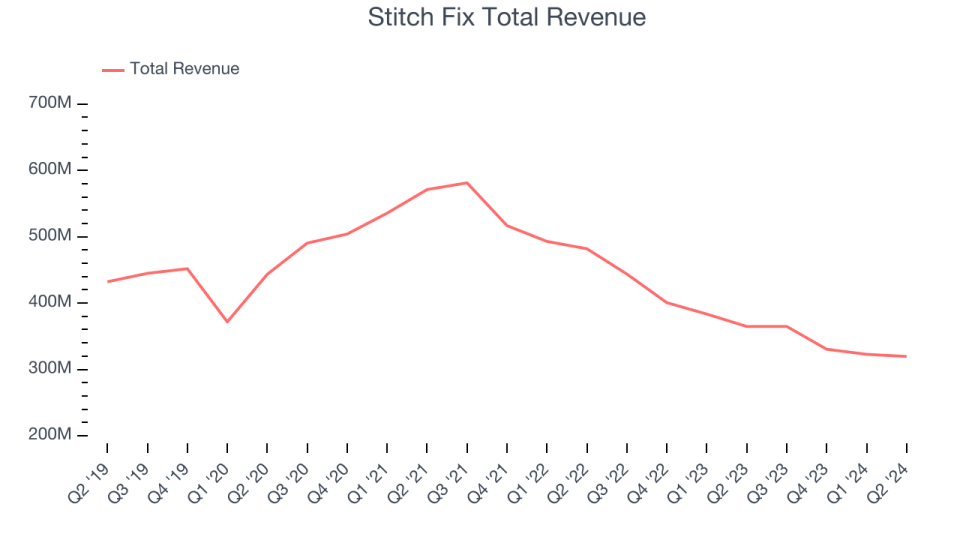

Stitch Take Care Of (NASDAQ: SFIX)

Among the initial registration box firms, Stitch Take care of (NASDAQ: SFIX) is an on-line individual designing and style solution that curates customized apparel choices for consumers.

Stitch Take care of reported incomes of $319.6 million, down 12.4% year on year, according to experts’ assumptions. It was a softer quarter with a miss out on of experts’ operating margin quotes and profits support for following quarter missing out on experts’ assumptions.

Although it had a great quarter contrasted its peers, the marketplace appears miserable with the outcomes as the supply is down 38.8% because coverage. It presently trades at $2.29.

Is currently the moment to get Stitch Take care of? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: ThredUp (NASDAQ: TDUP)

Established to reinvent thrifting, ThredUp (NASDAQ: TDUP) is a leading on-line style resale market that supplies a vast option of gently-used apparel and devices.

ThredUp reported incomes of $79.76 million, down 3.5% year on year, disappointing experts’ assumptions by 3.3%. It was a frustrating quarter as it published profits support for following quarter missing out on experts’ assumptions and a miss out on of experts’ incomes quotes.

As anticipated, the supply is down 52.5% because the outcomes and presently trades at $0.82.

Read our full analysis of ThredUp’s results here.

Figs (NYSE: FIGS)

Climbing to popularity by means of TikTok and established in 2013 by Heather Hasson and Trina Spear, Figs (NYSE: FIGS) is a health care garments business recognized for its trendy method to clinical clothes and attires.

Figs reported incomes of $144.2 million, up 4.4% year on year. This number covered experts’ assumptions by 1.4%. It was an extremely solid quarter as it likewise logged an outstanding beat of experts’ incomes quotes.

The supply is up 18% because reporting and presently trades at $6.74.

Read our full, actionable report on Figs here, it’s free.

Oxford Industries (NYSE: OXM)

The moms and dad business of Tommy Bahama, Oxford Industries (NYSE: OXM) is a way of living style empire with brand names that personify outside joy.

Oxford Industries reported incomes of $419.9 million, level year on year. This outcome was available in 4.2% listed below experts’ assumptions. It was a frustrating quarter as it likewise logged profits support for following quarter missing out on experts’ assumptions and underwhelming incomes support for the following quarter.

The supply is up 1.3% because reporting and presently trades at $84.67.

Read our full, actionable report on Oxford Industries here, it’s free.

Sign Up With Paid Supply Financier Study

Assist us make StockStory a lot more valuable to capitalists like on your own. Join our paid customer study session and obtain a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.