Supplies traded combined on Friday as financiers accepted a rising cost of living record viewed as important to the Federal Book’s following choice on rate of interest cuts.

The S&P 500 (^ GSPC) ticked simply listed below the flatline after squeezing out a 3rd record-high close today. The Dow Jones Industrial Standard (^ DJI) got 0.5%, while the tech-heavy Nasdaq Compound (^ IXIC) sank 0.2%.

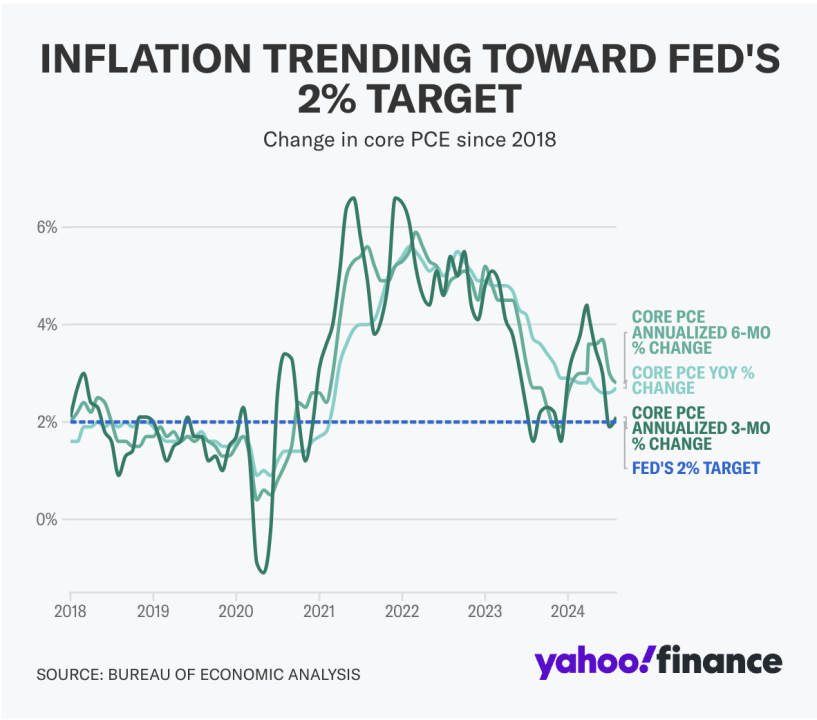

The August analysis of the Personal Intake Expenses (PCE) index, the rising cost of living statistics preferred by the Fed, revealed ongoing air conditioning in rate stress. The “core” PCE index, which is most very closely viewed by policymakers, increased 0.1% month over month, less than Wall surface Road projections.

The PCE analysis showed up to goose up bank on one more jumbo-sized price reduced from the Fed following month. Over half of investors– around 52%– now expect a 50 basis factor cut.

Learn More: What the Fed price reduced methods for checking account, CDs, fundings, and charge card

In spite of the combined trading on Friday, the supply assesses get on track for once a week success after self-confidence in the economic situation went back to the marketplace. A strong GDP analysis, incorporated with ongoing air conditioning in rising cost of living, has actually sealed expanding sentence that the Fed can toenail a “soft touchdown” as it starts a rate-cutting project.

In other places, China included in its stream of stimulation actions, increasing markets once more. Landmass supplies scored their largest once a week win because 2008, and high-end supplies are established for their ideal week in years as expect Chinese need surge. At the same time, shares of Alibaba (BABA, 9988. HK), JD.com (JD, 9618. HK), and Meituan (3690. HK, MPNGY) rose amidst the acquiring spree.

In various other private supply steps, Costco (EXPENSE) supply insinuated mid-day trading after the wholesale titan’s profits dissatisfied Wall surface Road.

Live 9 updates

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.