BONK cost has actually gotten on a wild experience recently, capturing the focus of investors with its quick changes. With energy signs blinking important signals, the following relocation can be critical for those holding or viewing the token.

Secret technological pens recommend that BONK can either development brand-new resistance degrees or deal with a prospective improvement.

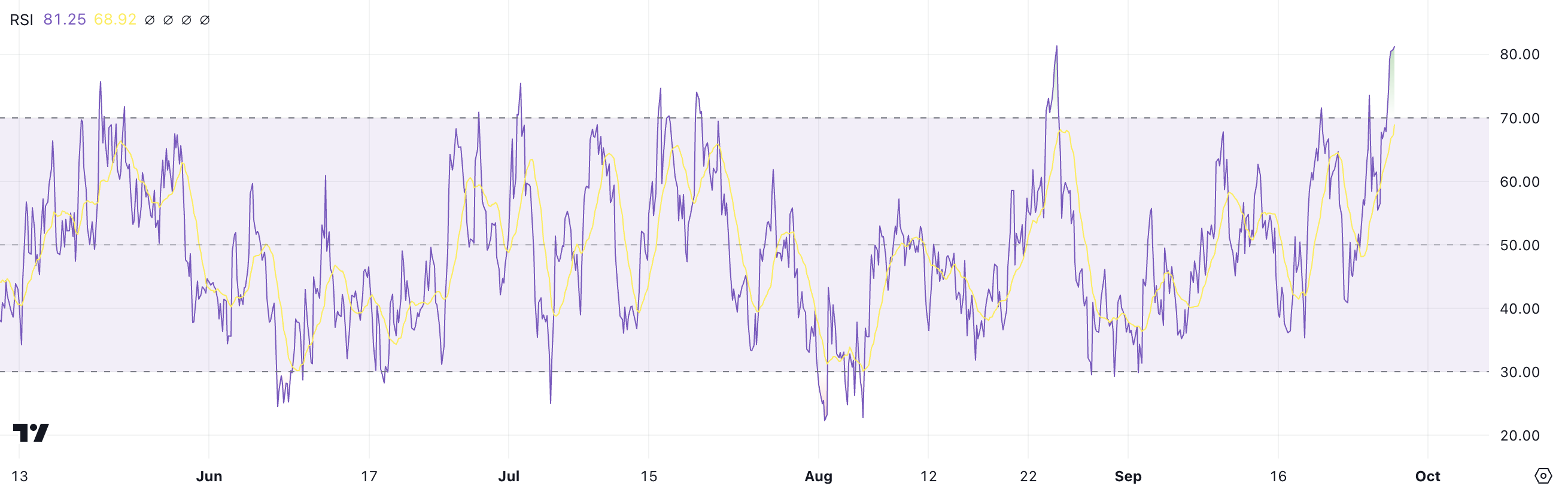

BONK RSI Goes To Overbought Degrees

BONK’s Loved one Stamina Index has actually risen to 81.25 after a 22% cost dive over the last 7 days, noting a significant change from simply 3 days back when its RSI went to 30. This quick increase is substantial due to the fact that it mirrors a sharp adjustment in market view, relocating from an oversold to an overbought problem quickly.

The Family Member Stamina Index is a commonly made use of energy indication that gauges the rate and size of cost modifications to determine overbought or oversold problems. Commonly, an RSI over 70 signals that a property is overbought and might schedule for an improvement, while an RSI listed below 30 suggests it is oversold and can be positioned for a bounce.

With BONK’s RSI at 81.25 and its relocating ordinary near 69, this recommends that the possession can be going into an overheated area where the cost might begin to deal with marketing stress.

Find Out More: Just How to Get Solana Meme Coins: A Step-By-Step Overview

While the solid favorable energy can press the cost higher in the short-term, such raised RSI degrees commonly show that a turnaround or cost loan consolidation can be unavoidable as purchasers might begin to secure earnings. Consequently, investors ought to beware of a prospective pullback while keeping an eye on the wider market view.

BONK Purchasing Stress: A Secret Transforming Factor Ahead

BONK’s Chaikin Cash Circulation (CMF) has actually gone down to 0.03, below virtually 0.30 in current weeks, signifying a significant weakening in acquiring stress. This decrease issues due to the fact that the CMF is a volume-weighted indication that gauges the circulation of cash in and out of a property, aiding to analyze the stamina of acquiring or marketing stress.

Commonly, a CMF over 0.20 suggests solid acquiring energy, while worths listed below -0.20 signal solid marketing stress. Regardless of being just one of one of the most appropriate meme coins in the Solana environment, BONK is still method behind WIF (dogwifhat) both in market cap and year-to-date gains. This can trigger marketing stress on BONK as investors relocate right into various other Solana properties that can bring even more return on their financial investments.

The closer the CMF is to no, the extra neutral the marketplace view ends up being, recommending an equilibrium in between purchasers and vendors. With BONK’s CMF currently at 0.03, it reveals that while there is still low acquiring rate of interest, it has actually compromised dramatically, possibly suggesting that the current cost rally can be slowing.

BONK Rate Forecast: Will The Energy Continue?

3 days back, BONK’s Exponential Relocating Standards (EMA) lines developed a gold cross– a favorable signal where the temporary relocating ordinary crosses over the long-lasting relocating standard– resulting in a 27% rise in cost. Nonetheless, it is essential to keep in mind that the lines are still not dramatically apart, which matters due to the fact that it recommends the favorable fad is still in its onset and hasn’t totally developed solid energy.

EMA lines are technological signs that stress current cost activities, aiding investors determine patterns and possible turnarounds. When these lines go across, they can show changes in market view, with a gold cross generally signifying the beginning of an uptrend.

Find Out More: 11 Leading Solana Meme Coins to View in September 2024

If the fad proceeds, BONK cost can possibly appear crucial resistances at $0.30, $0.35, and also $0.44, using a prospective 82% gain. Nonetheless, both the CMF and RSI are signifying that the gains might be reaching their restriction. With the CMF weakening and the RSI in overbought region, there’s a likelihood of a fad turnaround.

If this takes place, BONK can swiftly pull back to $0.16, and may also examine reduced degrees like $0.13 or $0.12, as investors start to take earnings and marketing stress rises. This develops a crucial point for BONK, where either extension or improvement is most likely coming up.

Please Note

According to the Count on Task standards, this cost evaluation write-up is for informative objectives just and ought to not be taken into consideration economic or financial investment suggestions. BeInCrypto is devoted to precise, objective coverage, yet market problems undergo alter without notification. Constantly perform your very own study and speak with an expert prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.