A CryptoQuant record evaluates the advantages and disadvantages of Bitcoin ETF Options Trading, calling it a “substantial turning point.” Boosted liquidity and institutional capitalists are favorable signals for Bitcoin.

IBIT choices trading might additionally unlock to boosted Bitcoin shorting, however the advantages much surpass this danger.

Bitcoin ETF Alternatives: An Institutional Landmark

Given that the SEC accepted choices trading on BlackRock’s IBIT ETF in late September, there is a brand-new opportunity for remarkable adjustment out there. This governing thumbs-up has actually been expected for a number of months, and the SEC also appears available to a comparable bargain for Ethereum ETFs. A special record from CryptoQuant can aid clarify the possibility.

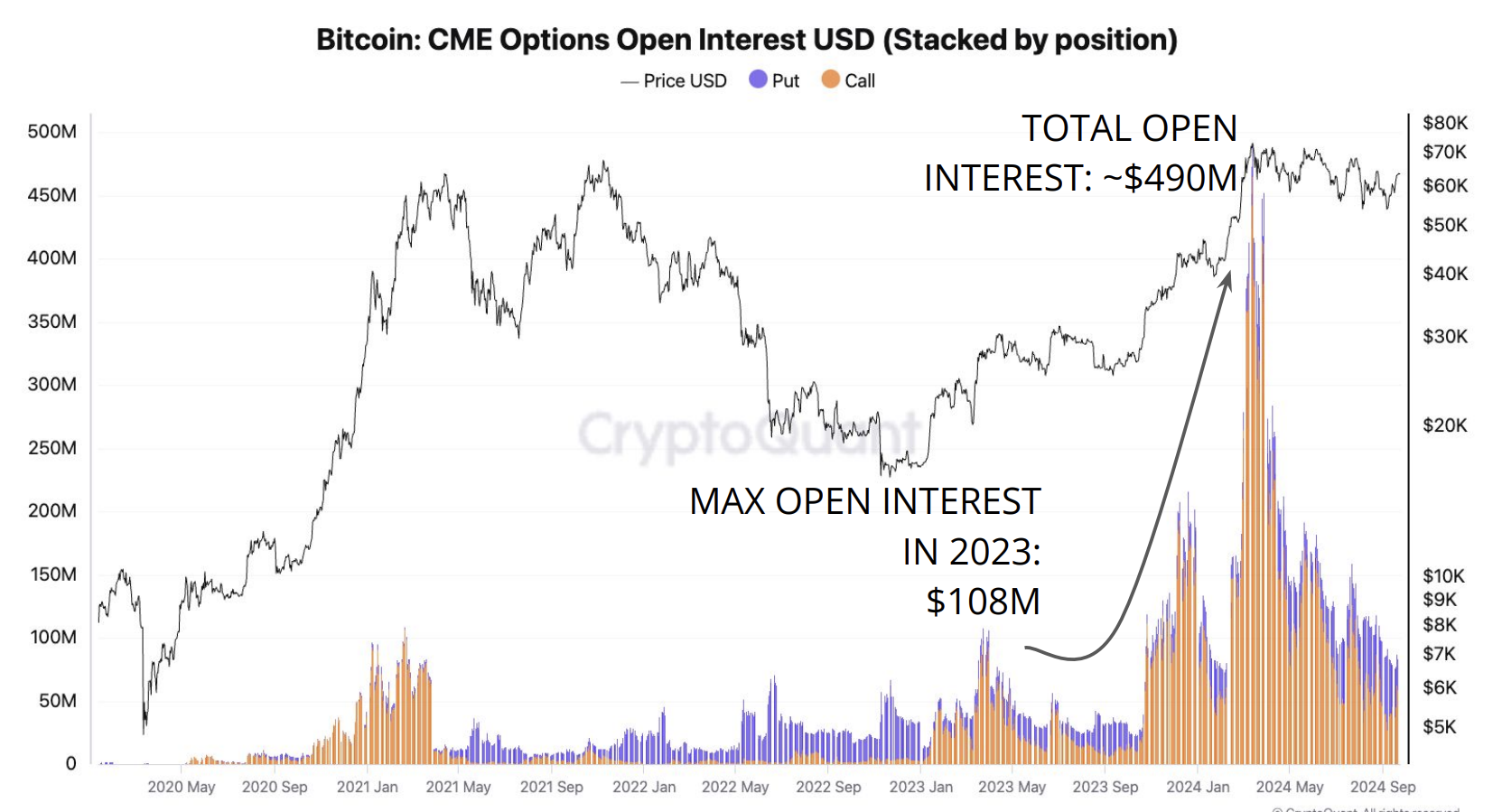

CryptoQuant called the SEC authorization a “substantial turning point”, and laid out a variety of advantages to the marketplace. For something, it’s really effective also when taken into consideration as a symbolic success. Open Up Passion for Bitcoin choices trading boosted by virtually fivefold from March 2023 to the ETF authorization one year later on, and choices trading on IBIT fractures open up a flexible brand-new market.

” The choice highlights the raising assimilation of cryptocurrency right into conventional monetary markets, adhering to an expanding fad of governing approval of Bitcoin-related monetary items. The authorization would certainly raise liquidity and capitalist involvement in the Bitcoin market, noting an additional action towards more comprehensive institutional fostering”, CryptoQuant declared.

Find Out More: An Intro to Crypto Options Trading

CryptoQuant’s record mostly concentrates on the authorizations’ concrete advantages, nonetheless, and not symbolic ones. For something, its information insurance claims that choices investors often tend to alter even more long-lasting in their financial investment choices than futures investors. In the pre-existing Bitcoin choices market, virtually fifty percent of all choices have an expiration day of 5 months of even more, contrasted to a bulk of futures professions ending in much less than 3.

Liquidity and Economic Instruments

The brand-new choices professions will certainly additionally branch out investors’ monetary tools, assisting raise liquidity in the marketplace generally. This mirrors Eric Balchunas’ sentiment that these IBIT choices will certainly draw in extra liquidity and even more big investors. One famous instance of these brand-new devices is the capacity to market protected telephone calls.

” Capitalists that hold area Bitcoin can market call choices and accumulate the costs from the telephone call alternative, obtaining return from their Bitcoin holdings in a controlled means”, the record declared.

Find Out More: Shorting Bitcoin: Exactly How It Functions and Where You Can Do It In 2024

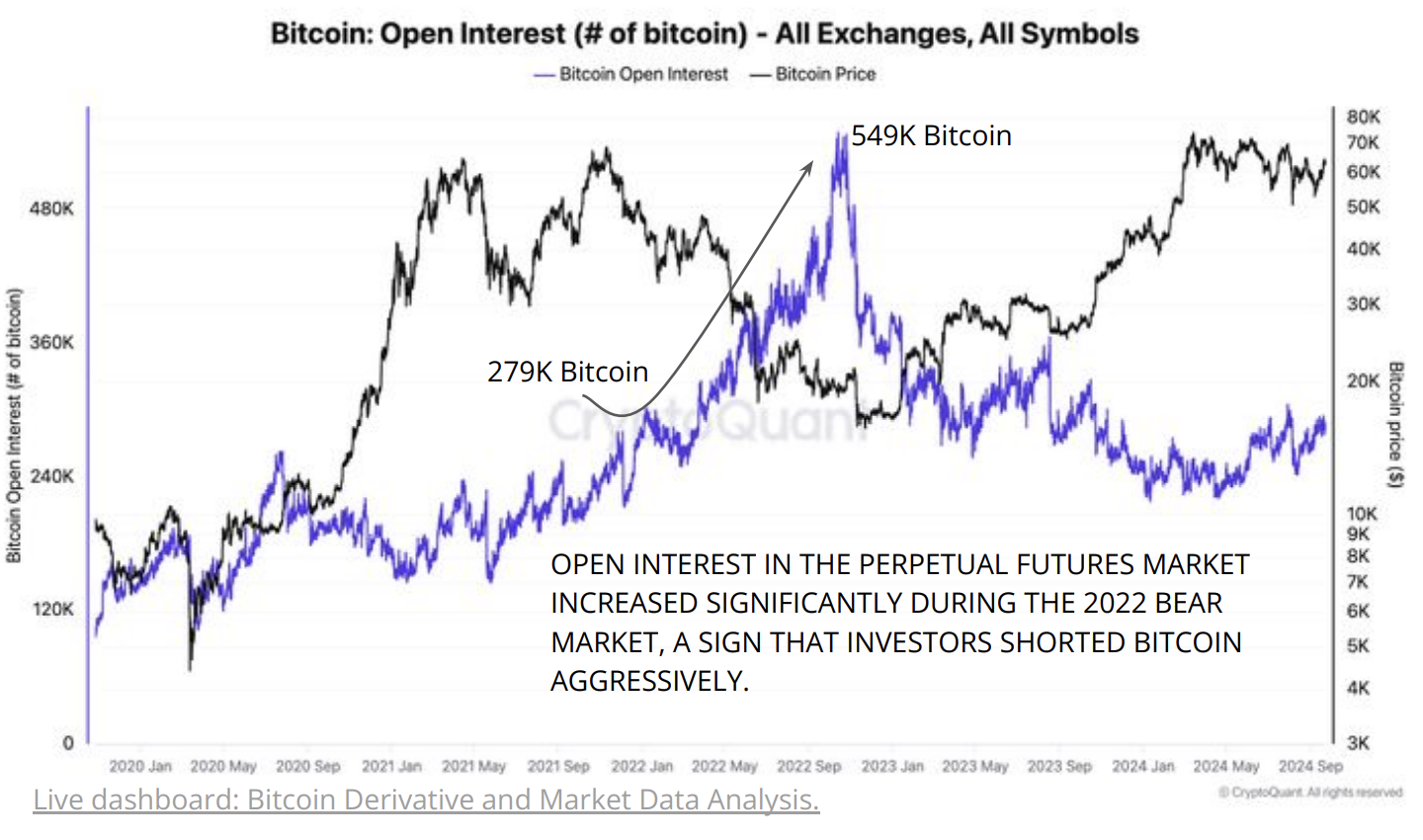

Nonetheless, these choices are additionally most likely to raise the “paper” supply of Bitcoin. Progressively innovative approaches of Bitcoin direct exposure do not entail Bitcoin trading hands, which’s not constantly an advantage. In the past, this boosted paper supply has really caused hostile shorting versus Bitcoin, a bearish signal.

Please Note

In adherence to the Depend on Job standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to give precise, prompt info. Nonetheless, visitors are recommended to validate truths separately and talk to an expert prior to making any kind of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.