FET is developing itself as the leading pressure in the AI cryptocurrency area, exceeding its rivals in both market cap and trading quantity. With 75% of addresses in revenue and a current gold cross signaling solid favorable energy, FET might get on the brink of a considerable rally.

As it comes close to crucial resistance degrees, the possibility for brand-new all-time highs ends up being significantly feasible.

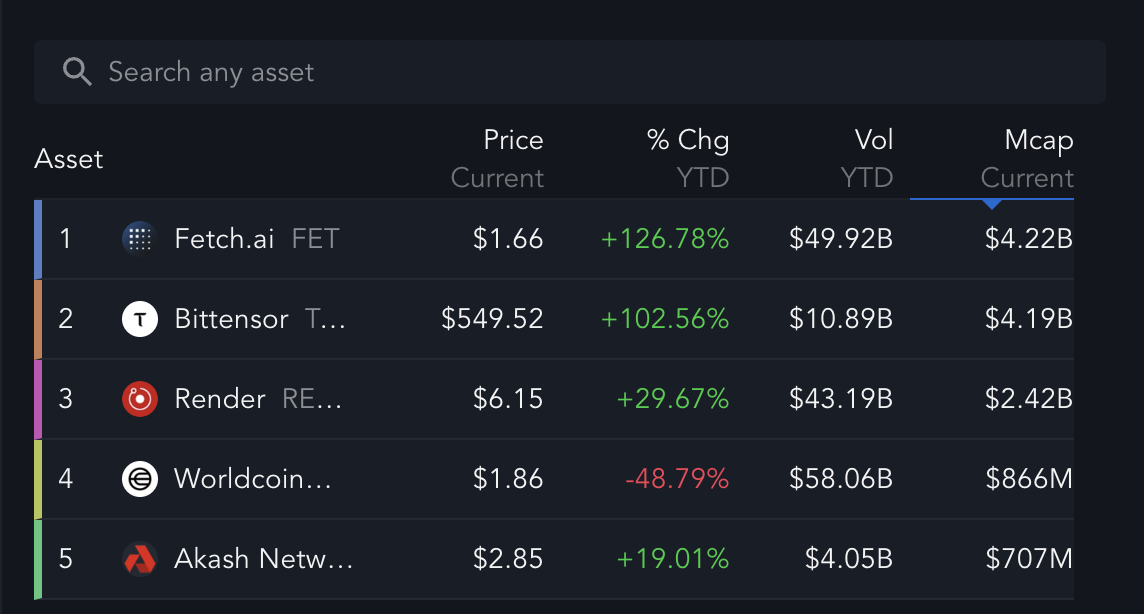

FET Is Outpacing Its AI Rivals

FET is placing itself as the frontrunner in the expert system cryptocurrency market, with numerous variables strengthening its prominence. Presently, FET holds the biggest market capitalization amongst AI-related coins, resting at $4.22 billion.

While Bittensor adheres to carefully behind with a market cap of $4.19 billion, FET lead ends up being a lot more noticable when contrasting it to the remainder of the area. Integrated, Make, Worldcoin, and Akash Network do not also match FET’s market cap.

In 2024, FET videotaped an unbelievable trading quantity of $49.92 billion, which is greater than 4.5 x that of Bittensor, its closest rival. This disparity in quantity is critical due to the fact that it shows the degree of market passion and liquidity moving with FET.

Learn More: Exactly How To Purchase Expert System (AI) Cryptocurrencies?

Additionally, FET year-to-date (YTD) cost rose by a remarkable 126.78%, surpassing not just Bittensor, which uploaded a solid however relatively reduced 102.56%. Greater quantity frequently mirrors more powerful need and larger involvement, every one of which play right into FET cost support.

Capitalists and investors are plainly inclining FET, which might produce a favorable responses loophole where its liquidity, presence, and significance in the marketplace just remain to expand. This might likewise develop FET as the leading AI coin in the marketplace, making it a lot more leading.

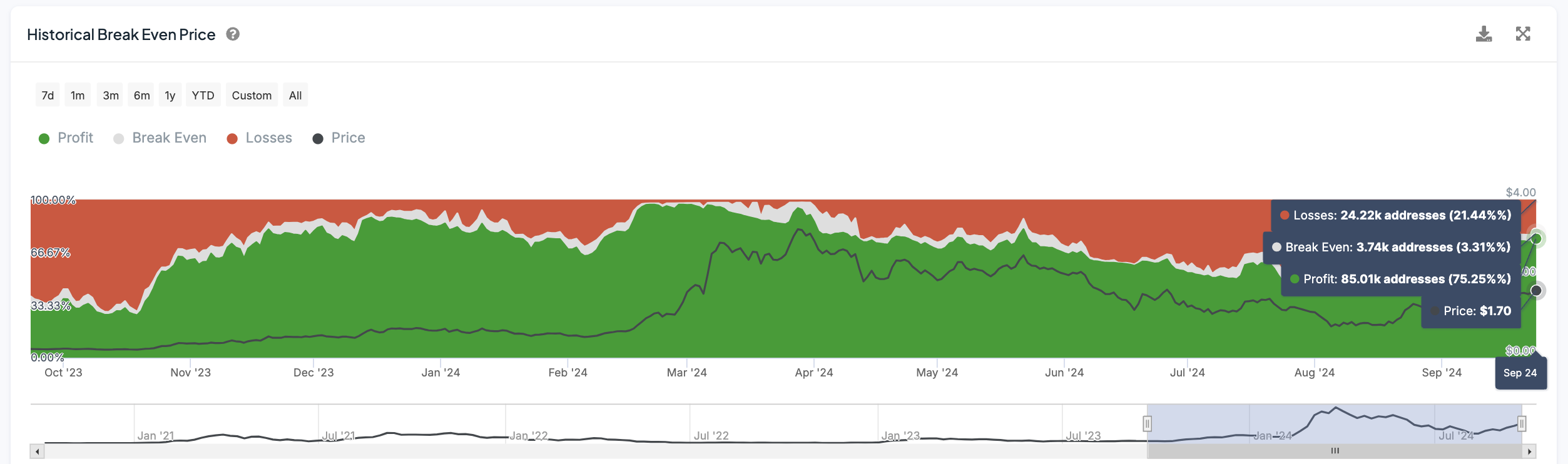

FET Profitable Addresses Might Drive a New Rate Rise

Presently, around 75.25% of all FET addresses remain in revenue, which suggests about 85,010 addresses are seeing gains at the existing cost of $1.70. On the other hand, regarding 21.44%, or 24,220 addresses, are experiencing losses, and a tiny portion, 3.31%, or 3,740 addresses, go to break-even.

This circulation recommends that most of FET owners are certain in the property’s future, having actually currently seen favorable returns on their settings. When a big percentage of owners remain in revenue, it normally signifies solid market view and possibility for additional higher energy as even more capitalists are urged to go into the marketplace.

Historically, a comparable percentage of addresses in revenue throughout an uptrend for FET caused an eruptive cost rise, where it increased by over 500% in simply one month. This previous efficiency recommends that when numerous owners are currently in revenue, it develops problems ripe for quick cost gratitude, especially if need remains to expand.

With the existing portion of addresses in revenue, FET cost might be establishing for one more considerable rally, attracting contrasts to previous bull runs in its cost background.

FET Rate Forecast: A New All-Time High Quickly?

FET lately created a gold cross, a favorable technological pattern where the shorter-term rapid relocating standard (EMA) goes across over the longer-term EMA. This pattern is frequently viewed as an indicator of structure upwards energy, normally complied with by additional cost gratitude. In FET’s situation, the various EMA lines on the graph reveal a favorable positioning, with shorter-term EMAs placed over longer-term ones.

EMAs are utilized to ravel cost information and recognize patterns extra plainly. Unlike straightforward relocating standards, EMAs offer better weight to current cost activities, making them extra receptive. Investors typically track several EMAs, such as the 20, 50, 100, and 200-day lines, to examine pattern toughness and instructions. In FET’s situation, these EMAs are revealing a clear higher trajectory, enhancing the favorable overview.

Learn More: Leading 9 Expert System (AI) Cryptocurrencies in 2024

If this uptrend holds, FET might examine crucial resistance degrees at $1.86 and $2.28. A break over these degrees would certainly reinforce the favorable situation, possibly causing additional resistance factors at $2.70 and $3.48. Exceeding these might press FET towards a brand-new all-time high, indicating a solid favorable action.

However if the uptrend compromises and FET’s cost turns around, assistance degrees at $1.24 and $1.00 might end up being important. Must bearish view proceed, the cost might drop even more, possibly getting to $0.80. These crucial degrees will certainly identify whether FET can preserve its favorable energy or if a much deeper modification is on the perspective.

Please Note

In accordance with the Trust fund Job standards, this cost evaluation short article is for educational objectives just and ought to not be thought about economic or financial investment guidance. BeInCrypto is dedicated to precise, honest coverage, however market problems go through transform without notification. Constantly perform your very own research study and seek advice from an expert prior to making any kind of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.