Onyx Method, a Substance Financing fork, endured a $3.8 million loss on Thursday to note an additional access in a collection of strikes as criminals discover system susceptability.

Cyber-attacks remain to afflict the crypto market, highlighting the requirement for boosted safety and security.

$ 3.8 Million Hack Strikes Onyx Method

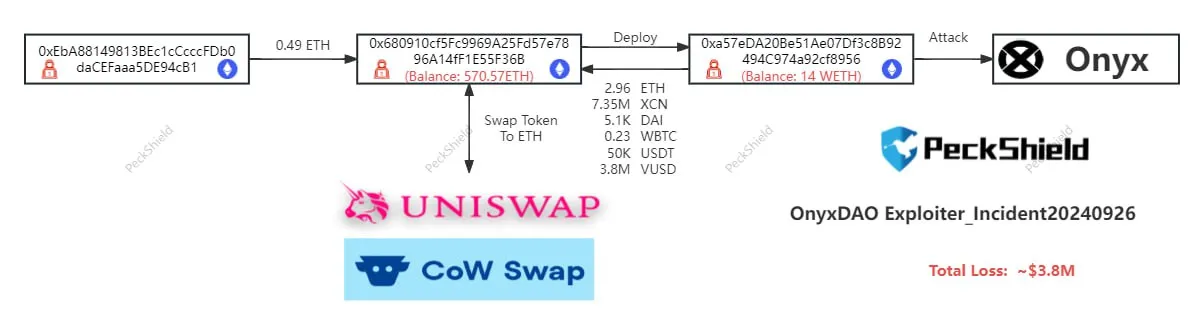

Blockchain safety and security company PeckShield highlighted dubious deals on OnyxDAO, accentuating a feasible strike on the procedure. In a follow-up message, the on-chain investigative disclosed losses getting to $3.8 million, indicating that the cyberpunk was currently exchanging the funds.

Web3 safety and security company Cyvers substantiated the occurrence, pointing out dubious deals entailing OnyxDAO on the Ethereum blockchain. According to Cyvers, a lot of the loss remained in VUSD stablecoin.

” Our system has actually found a questionable purchase entailing OnyxDAO on the ETH chain! The failure is around $3.2 million[at the time] A lot of the losses remain in VUSD. Assailant presently holds 521 ETH ($ 1.36 million). The remainder of the electronic possessions are not exchanged yet,” Cyvers wrote.

Learn More: Crypto Job Protection: An Overview to Very Early Risk Discovery

Extra examinations by PeckShield revealed that the enemy maximized a recognized accuracy concern provided as a pest in the forked Substance V2 code base. They after that siphoned 4.1 million VUSD, 7.35 million XCN, 5,000 DAI, 0.23 WBTC, and 50,000 USDT. Supposedly, the insect leveraged a virtually vacant market to adjust the currency exchange rate.

Especially, cyberpunks made use of the very same strategy in October 2023, hacking the very same procedure for $2.1 million. In the October occurrence, the susceptability was a rounding mistake. At the time, scientists referred the susceptability to Onyx Method being a fork of Substance Financing.

Exactly How the Code Susceptability Happens

With several DeFi procedures being open-source, designers often tend to prevent the lengthy strategy. They decide to construct off of an existing code rather than applying capability from the ground up.

The strategy is taken into consideration prominent as it can enhance performance and safety and security when done properly. The disadvantage is that if the design template code is not protect, the fork might acquire the susceptabilities.

” When it comes to the Onyx procedure, the Substance Financing code that it made use of had a recognized susceptability that had actually currently been manipulated in Hundred Financing and Midas Resources, which likewise forked the Substance Financing code. Nevertheless, the Onyx Method made use of the very same code and did not have the area assistance and alertness required to stop the susceptability from being manipulated,” safety and security company Halborn reported.

This suggests the Onyx Method hack might have been stopped, offered the occurrence of rounding mistakes. Especially, support currently exists when introducing brand-new markets on Substance Financing and its forks.

” At Hexagate, we advise any type of Substance V2 fork, when introducing brand-new markets to mint some cTokens and shed them to make certain the complete supply never ever mosts likely to absolutely no. When the complete supply mosts likely to absolutely no, the procedure ends up being at risk and this technique minimizes this circumstance,” safety and security company Hexgate guided in April 2023.

Learn More: What Is Substance Financing?

These occurrences, consisting of a $4.6 million attack on decentralized facilities Truflation on Wednesday, mirror the widespread obstacle in the crypto market, where criminals make use of various devices to take electronic possessions.

Please Note

In adherence to the Depend on Job standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to give precise, prompt details. Nevertheless, visitors are recommended to validate realities individually and speak with an expert prior to making any type of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.