Bitcoin’s category in the monetary community is extremely arguable. Some experts see it as a secure place and others as a dangerous possession.

Nevertheless, Robbie Mitchnick, the head of electronic properties at BlackRock Inc., suggests that Bitcoin is basically a risk-off possession.

BlackRock Exec Speak About Principles of Bitcoin

Risk-off properties like gold and federal government bonds are preferred in unpredictable times, supplying a risk-free harbor when the financial projection looks grim. On the other hand, risk-on properties, such as supplies, prosper when financier self-confidence is high. Regardless of periodic connections with the stock exchange, Mitchnick insists that Bitcoin inevitably acts in different ways over time.

” There’s been durations where Bitcoin’s relationship with equities has actually increased and there have actually been durations where it’s gone adverse. In fact gold reveals a great deal of the exact same patterns where you have these momentary durations where it increases, yet long-term, near to no,” Mitchnick said.

Find Out More: Exactly How To Profession a Bitcoin ETF: A Step-by-Step Method

Mitchnick better discovers Bitcoin’s distinct characteristics as an international, decentralized, non-sovereign possession. He thinks that Bitcoin is not linked to any kind of solitary nation’s financial wellness or plans. It’s a limited possession, unsusceptible to the typical threats of money misusage and political chaos.

According to Mitchnick, because of these factors, Bitcoin ends up being an eye-catching choice when standard money fail.

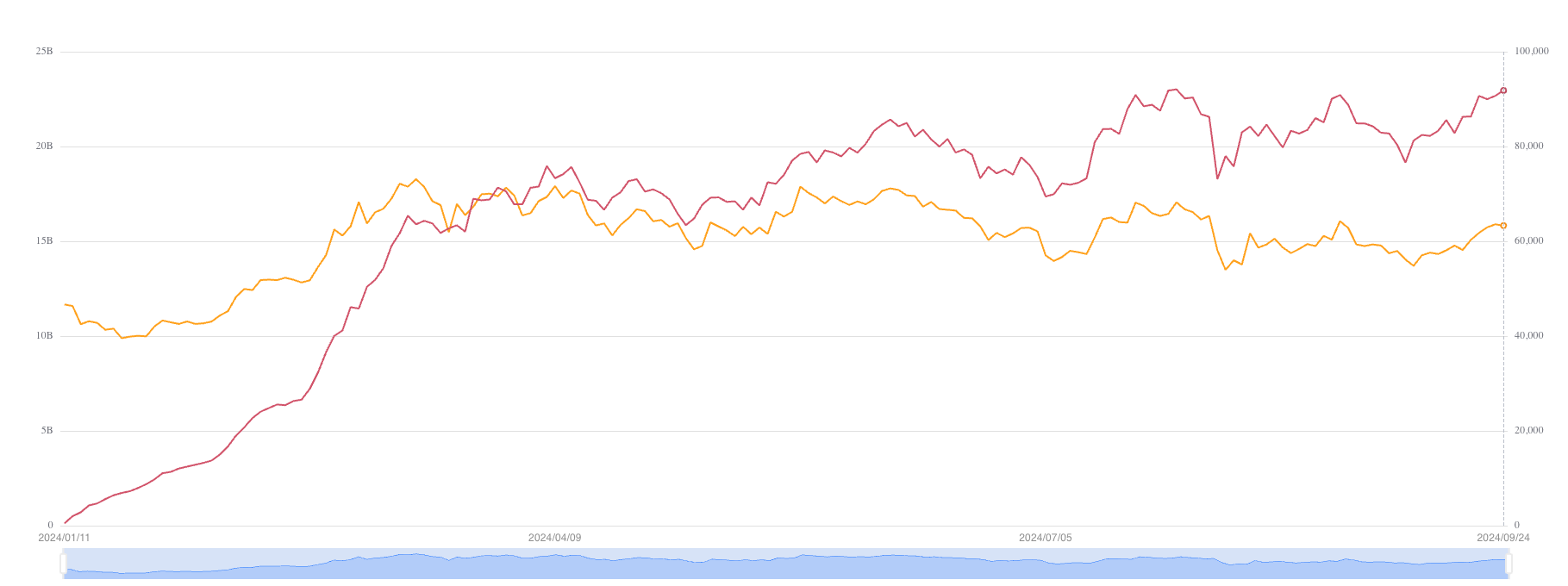

BlackRock’s interaction with Bitcoin highlights its risk-off capacity. The company’s iShares Bitcoin Trust fund (IBIT) currently holds almost $23 billion in properties. This considerable administration recommends a solid institutional and retail idea in Bitcoin’s security in troubled times.

This changing viewpoint appears past BlackRock. At the current Barron’s Expert 100 Top, a clear modification was kept in mind amongst leading monetary experts in the United States.

Find Out More: That Possesses one of the most Bitcoin in 2024?

Matt Hougan, Principal Financial Investment Policeman at Bitwise, stressed this fad, specifying that regarding 70% of top guests currently directly very own cryptocurrencies– considerably up from simply a couple of years back. This significant rise mirrors a wider market fad in which experts’ individual financial investments precede their referrals to customers.

As these obstacles wear down, integrating Bitcoin right into varied profiles could come to be extra conventional, enhancing its duty as a risk-off possession.

Please Note

In adherence to the Trust fund Job standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to give precise, prompt details. Nevertheless, viewers are suggested to validate truths separately and seek advice from a specialist prior to making any kind of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.