Leading altcoin Ethereum (ETH) is experiencing a renewal in favorable view. This comes with a time when Bitcoin’s (BTC) supremacy is compromising, recommending that financiers are moving their emphasis towards ETH and various other altcoins.

As ETH build-up steadies, the coin might be establishing the phase for trading over $2,900.

Ethereum Leads, Bitcoin Follows

Ethereum has actually risen 13% over the previous week, exceeding Bitcoin, which has actually climbed by simply 6% throughout the very same duration. The ETH/BTC proportion has actually likewise proceeded its higher pattern, raising by 33% over the last 7 days, suggesting an expanding choice for Ethereum over Bitcoin. Since this writing, the ETH/BTC proportion stands at 0.04.

Learn More: Ethereum Restaking: What Is it and Just how Does it Function?

The ETH/BTC proportion assesses Ethereum’s stamina about Bitcoin. A climbing proportion shows that ETH is exceeding BTC, indicating expanding bullishness towards Ethereum.

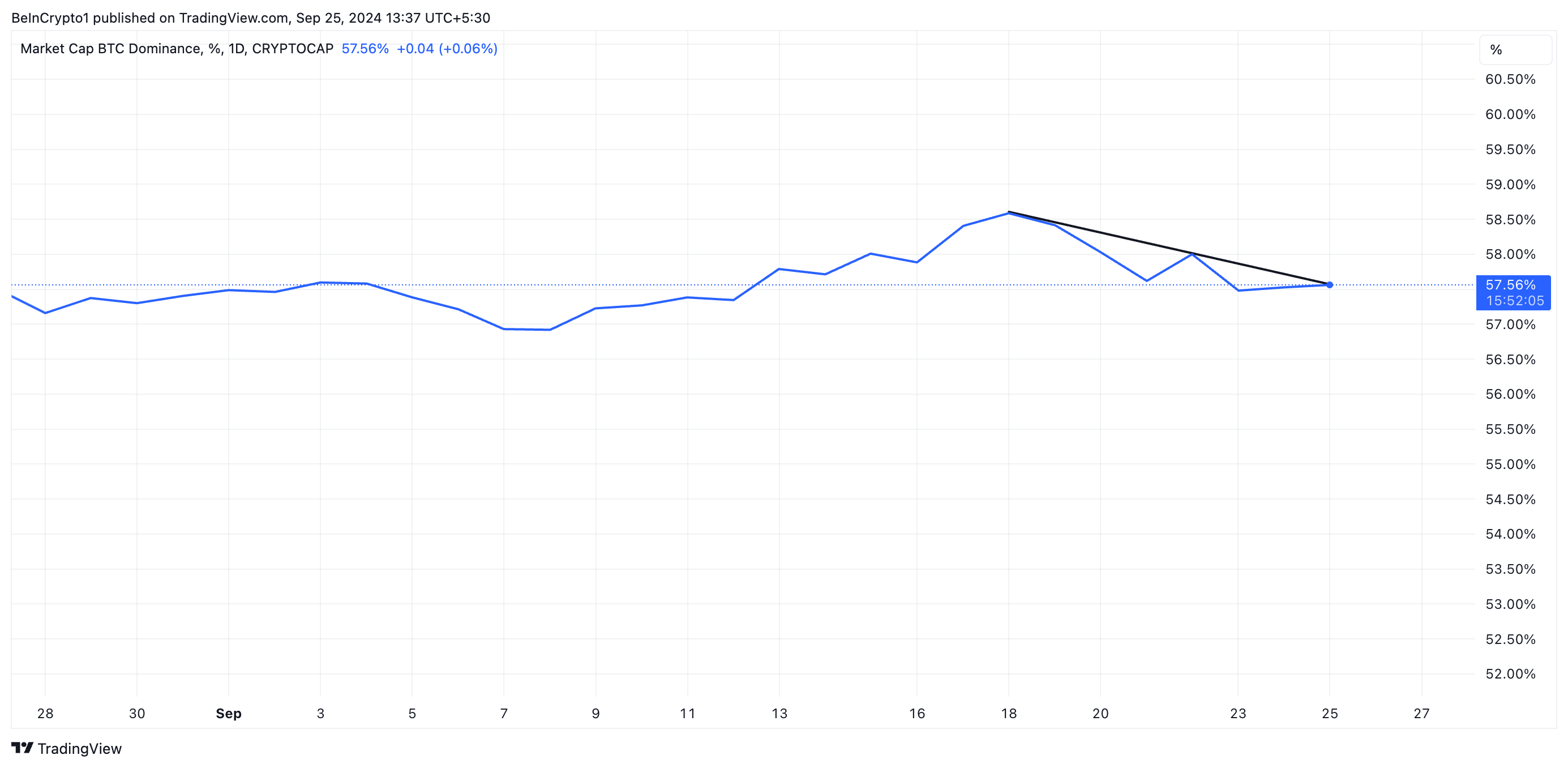

This spike in the ETH/BTC proportion accompanies a decrease in Bitcoin supremacy (BTC.D), which determines Bitcoin’s market capitalization as a portion of the whole cryptocurrency market. Presently at 57.56%, BTC.D has actually dropped by 0.01% over the previous week. A decrease in Bitcoin supremacy commonly indicates raising passion in altcoins, as shown by the higher pattern in the ETH/BTC proportion.

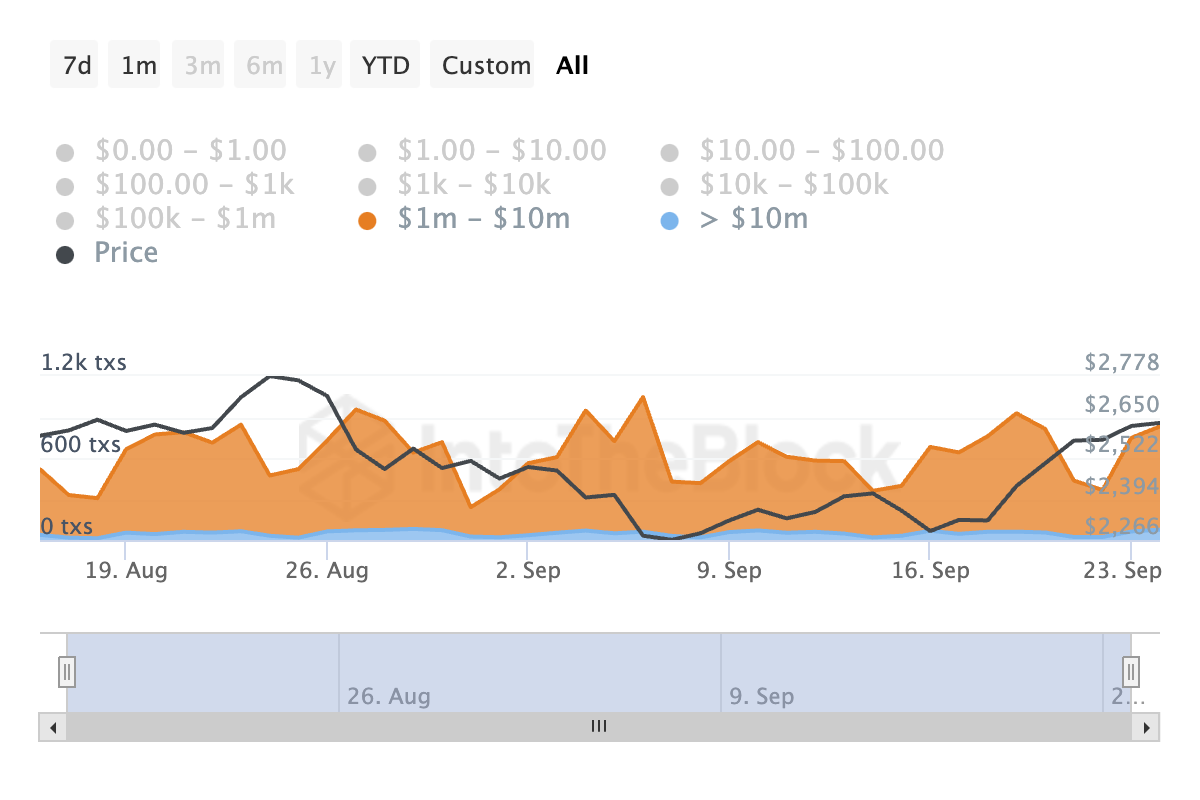

The current rise in Ethereum’s worth has actually been partially driven by raised task amongst big owners, or whales. On-chain information discloses a stable surge in considerable deals entailing ETH over the previous month.

As an example, the variety of ETH deals valued in between $1 million and $10 million has actually expanded by 14% over the last one month, while those over $10 million have actually risen by 21% throughout the very same duration.

A rise in big deals commonly signifies favorable energy. When retail financiers observe enhanced task amongst whales, it often tends to increase their self-confidence, bring about even more purchasing and adding to continual rate development.

ETH Cost Forecast: The Bulls Have Control

Ethereum’s Directional Motion Index (DMI) sustains the favorable expectation highlighted over. The coin’s DMI, which determines its rate fads and instructions, reveals the favorable directional indication (blue) relaxing over the adverse directional indication (red) at press time.

This configuration shows that getting stress is more powerful than marketing task amongst ETH market individuals.

Learn More: Exactly How To Purchase Ethereum (ETH) With a Bank Card: Total Overview

If need remains to expand, Ethereum might appear the resistance at $2,871, possibly pressing its rate over $2,900 and towards $3,104. Nevertheless, if build-up reduces and profit-taking boosts, ETH’s rate may go down to the assistance degree of $2,582 or reduced.

Please Note

In accordance with the Count on Job standards, this rate evaluation post is for informative objectives just and must not be taken into consideration economic or financial investment suggestions. BeInCrypto is dedicated to precise, objective coverage, yet market problems undergo transform without notification. Constantly perform your very own study and seek advice from an expert prior to making any type of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.