Bitcoin (BTC) has actually kept an uptrend given that last Wednesday’s Federal Get price cut. Presently trading at $63,509, the leading crypto property’s cost has actually expanded by virtually 10% in the previous 7 days.

With increasing need and boosting market view, the king coin can get to a two-month high of $69,000. This evaluation studies the vital variable driving this prospective rise.

Bitcoin Miners Might Be The Trick

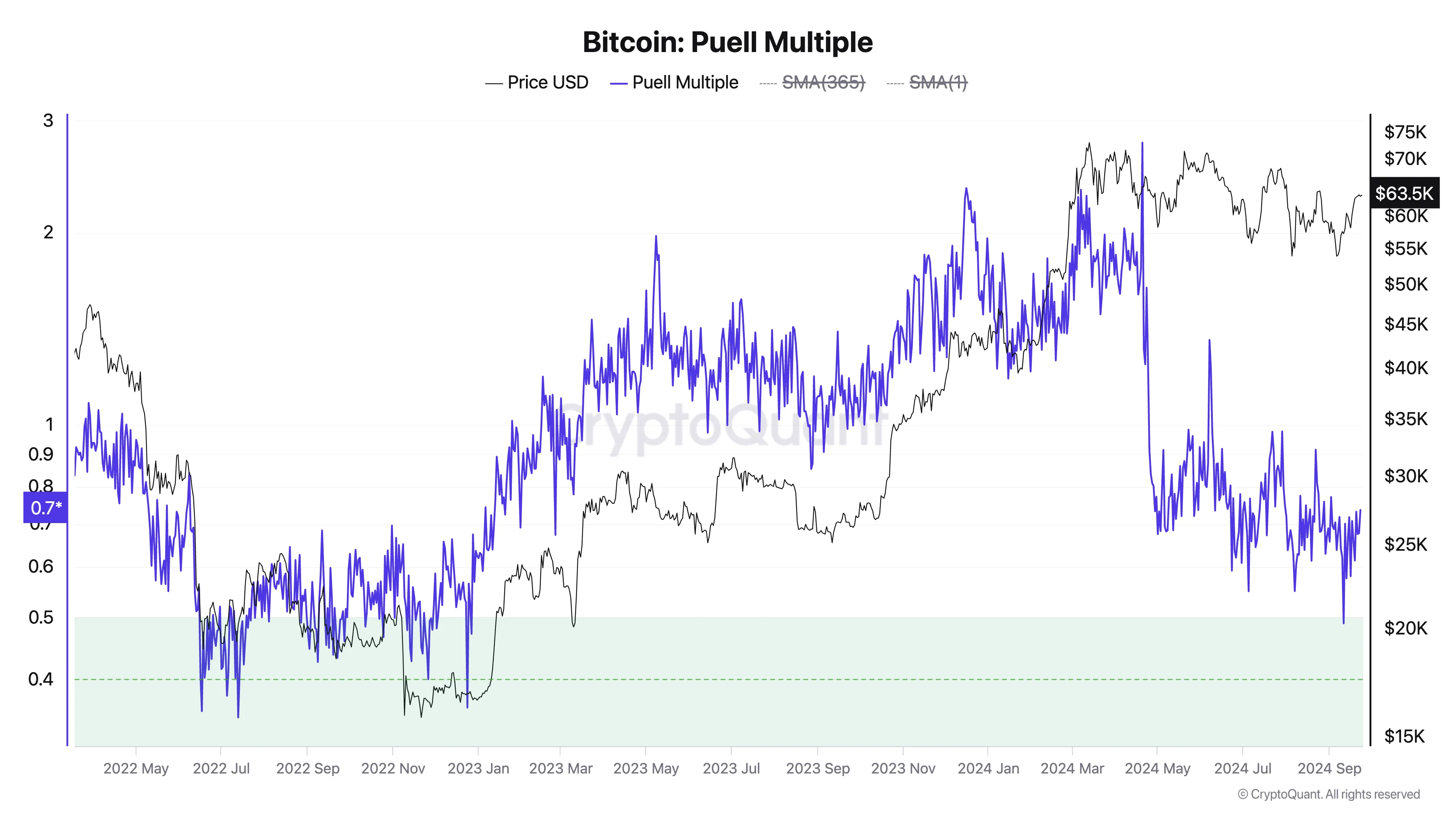

BeinCrypto’s evaluation of Bitcoin’s Puell Several recommends that the leading coin could be positioned for a prolonged rally. For the very first time given that completion of the 2022 bearish market, the worth of this statistics, which examines the productivity of Bitcoin miners, has actually struck the 0.5 “environment-friendly area.”

When BTC’s Puell Several is over 4, the marketplace is claimed to be in the “red area” where miners are making significant earnings. This frequently signifies a market top and is defined by a raised marketing stress, which triggers a rate decrease.

Learn More: Bitcoin Halving Background: Every Little Thing You Required To Know

On The Other Hand, when the coin’s Puell Several goes into the “environment-friendly area,” extracting productivity is substantially less than typical. This stage frequently leads to a higher cost motion since these unlucrative problems require miners to downsize or closed down procedures. The resulting reduction in BTC supply drives its worth greater.

In a current blog site post, CryptoQuant factor Darkfost verified this.

” Historically, when the environment-friendly area was gotten to, it was adhered to by a higher cost motion. Alternatively, getting to the red area has actually normally come before a down market relocation,” the expert kept in mind.

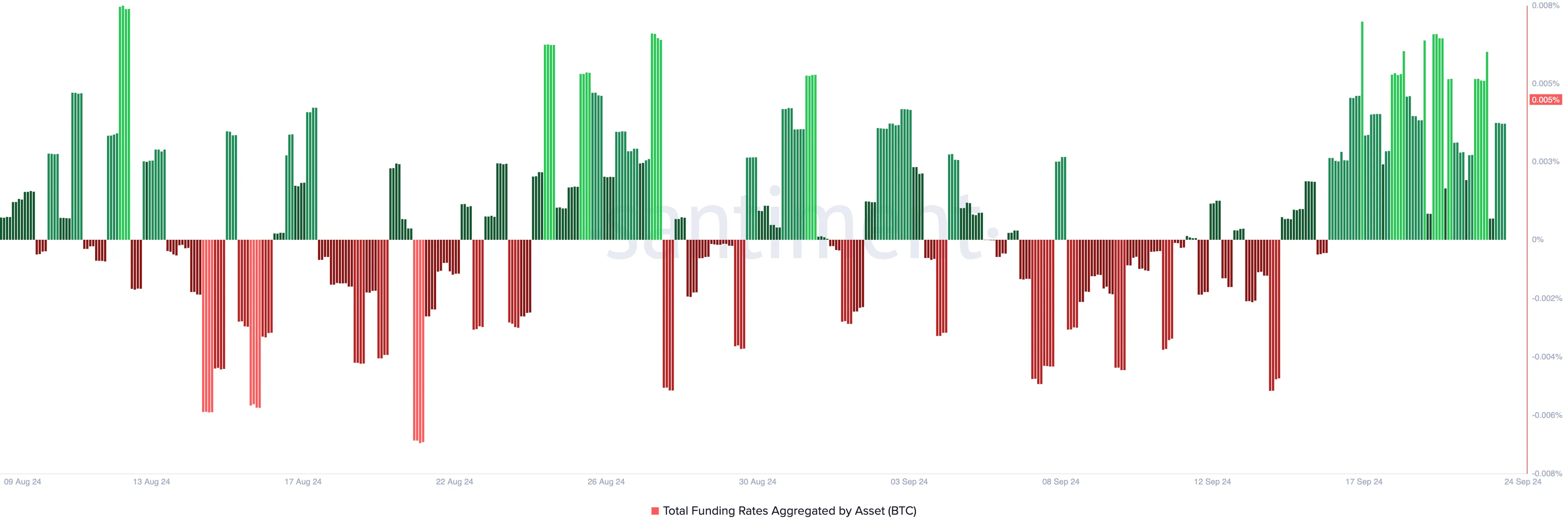

Bitcoin’s favorable financing price given that September 15 is an additional favorable indication that its cost might remain to rally. At press time, the coin’s financing price, which stands for a routine cost paid to make certain that its agreement cost remains near its area cost, is 0.005%.

A favorable financing price recommends that a lot of investors anticipate the cost to boost, resulting in even more need for lengthy settings than brief settings.

BTC Rate Forecast: $69,000 Unavoidable If Background Duplicates Itself

If background repeats itself and analyses from Bitcoin Puell Several apply, the leading cryptocurrency will likely witness an uptrend, possibly rallying towards the resistance at $67,078. An effective break over this degree can lead the way for Bitcoin to get to $69,000, a rate it last touched in July.

Learn More: Bitcoin Halving Background: Every Little Thing You Required To Know

Nonetheless, if the expected build-up spree stops working to appear and marketing stress magnifies rather, Bitcoin’s cost can decrease towards $54,672.

Please Note

According to the Depend on Task standards, this cost evaluation short article is for educational functions just and need to not be taken into consideration monetary or financial investment suggestions. BeInCrypto is dedicated to exact, objective coverage, yet market problems go through alter without notification. Constantly perform your very own research study and speak with an expert prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.