Celestia (TIA) has actually experienced a considerable 20% cost rise in the last 3 days. Component of it was driven by exhilaration around its $100 million financing round. C an this energy be maintained, or is a rate improvement imminent?

A noteworthy surge in continuous futures quantity, present RSI degrees that mirror recurring acquiring stress, and the current gold cross development on the EMAs bring crucial understandings.

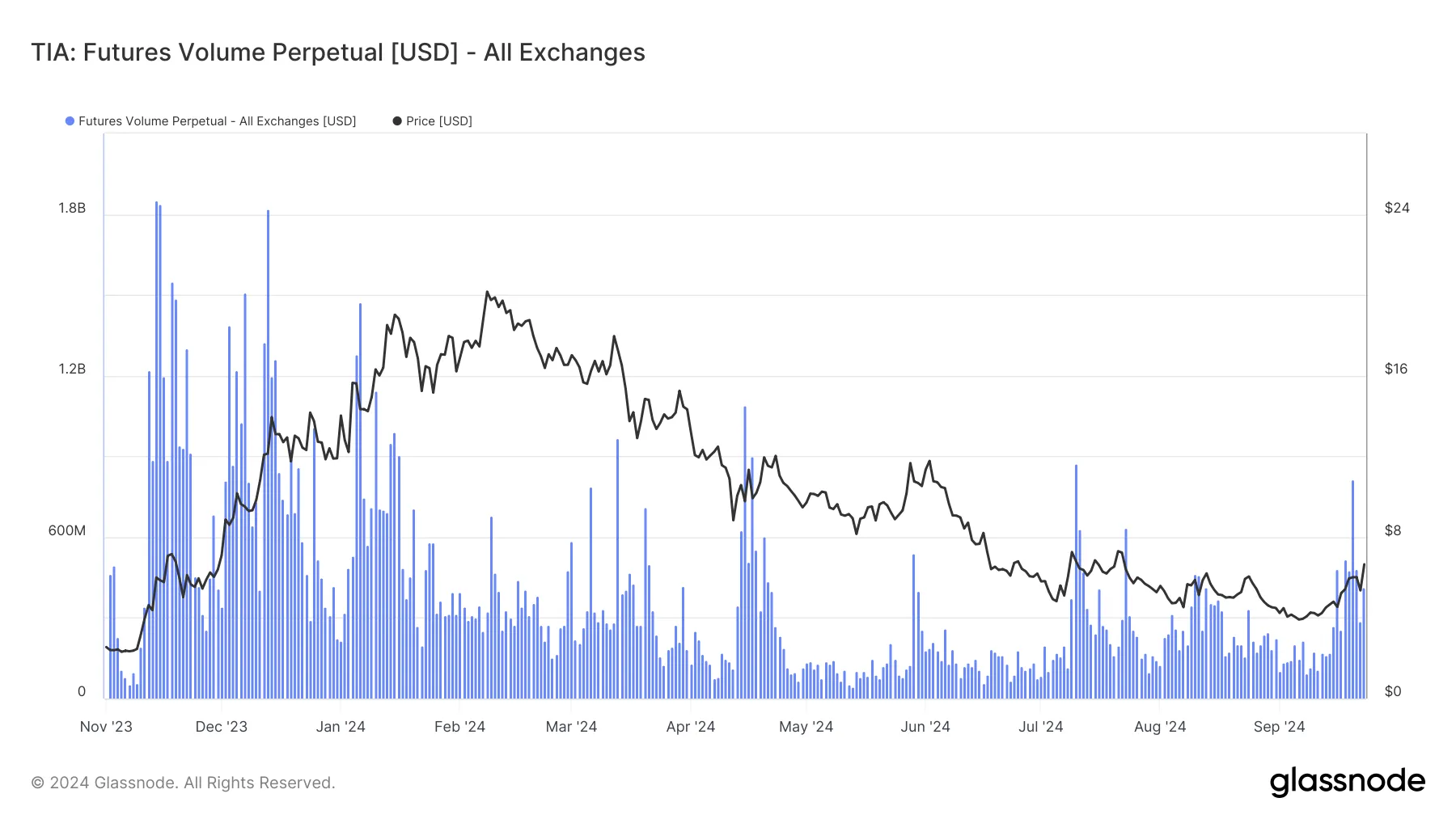

Celestia Futures Quantity: Current Rise Stops Working to Suit Late 2023 Peaks

In current days, there has actually been a visible rise in continuous futures quantity for Celestia. That signals restored passion and boosted trading task. Nonetheless, this quantity stays substantially reduced contrasted to the tops gotten to in November and December 2023, where futures quantity surpassed 1.8 billion USD.

Presently, it is still around 50% listed below those worths, despite having the current uptick. This decrease in quantity recommends that, regardless of the present increase in trading, the more comprehensive market belief and engagement in TIA’s continuous futures agreements have not yet gone back to their previous highs.

Learn More: 10 Ideal Altcoin Exchanges In 2024

Futures perpetuals are acquired agreements that enable investors to hypothesize on the future cost of a property without an expiry day. When futures quantity is enhancing, it usually signifies greater speculative passion. Alternatively, dropping futures quantity recommends minimized speculative task or passion, showing that investors might be much less going to handle brand-new placements.

The truth that TIA’s futures quantity stays less than its previous highs might suggest that while temporary passion has actually expanded, the marketplace has not yet completely recouped to the interest seen at the end of 2023. Nonetheless, if the energy proceeds, there is a great deal of space for TIA to expand in the following weeks.

TIA RSI at 59: Steady Energy with Prospective for More Gains

With an RSI of 59, Celestia (TIA) remains in a reasonably favorable area, showing constant acquiring passion without being overbought. Usually, an RSI in between 50 and 60 recommends space for more cost development, while an RSI over 70 would certainly signify overbought problems, possibly causing profit-taking or a pullback.

The RSI, an energy oscillator gauging the rate and adjustment of cost activities on a range from 0 to 100, highlights market problems. An analysis over 70 suggests overbought, while listed below 30 recommends oversold.

Presently, Celestia’s RSI at 59 indicate strong acquiring energy with space for added gains, though investors will certainly enjoy carefully if it nears 70 for indicators of a prospective retracement.

Celestia Rate Creates a Golden Cross: Could Energy Press It to $7.5?

On September 16, the rapid relocating standards (EMAs) for Celestia cost developed a gold cross, with the shorter-term EMA going across over the longer-term EMAs. A gold cross is usually viewed as a favorable signal. It suggests that higher energy is developing, and it can commonly bring about continual cost boosts.

The EMAs are determined to ravel cost changes and emphasize fads. The 20-period EMA (red) reacts rapidly to cost adjustments, while the 50-period (orange), 100-period (cyan), and 200-period (blue) EMAs mirror longer-term fads. In the present graph, all these EMAs are sloping upwards, enhancing the favorable energy that began around mid-September.

Learn More: 11 Cryptos To Contribute To Your Profile Prior To Altcoin Period

If Celestia cost can proceed this energy, it might damage the $7 resistance area, which is a considerable emotional obstacle. An effective violation might press the altcoin towards $7.5, its highest degree because July 2024.

Nonetheless, if the energy fails, the cost could retest the $5.06 assistance degree. Ought to this assistance stop working, a more decrease might take it to the $4.4 area, a degree of historic resistance.

Please Note

According to the Trust fund Task standards, this cost evaluation post is for educational objectives just and need to not be taken into consideration economic or financial investment recommendations. BeInCrypto is devoted to exact, impartial coverage, yet market problems undergo alter without notification. Constantly perform your very own study and talk to an expert prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.