Numerous Bitcoin (BTC) addresses with huge holdings have actually lately awakened after being inactive for many years. This abrupt spike has actually elevated brows, specifically after Bitcoin’s rate lately boosted.

Recognized for their critical steps, these long-lasting owners, additionally called Bitcoin whales, might impact the coin’s temporary trajectory. In this evaluation, BeInCrypto describes what this motion might imply for financiers preparing for a significant rally for BTC.

Old Bitcoin Purses Are on the Relocate

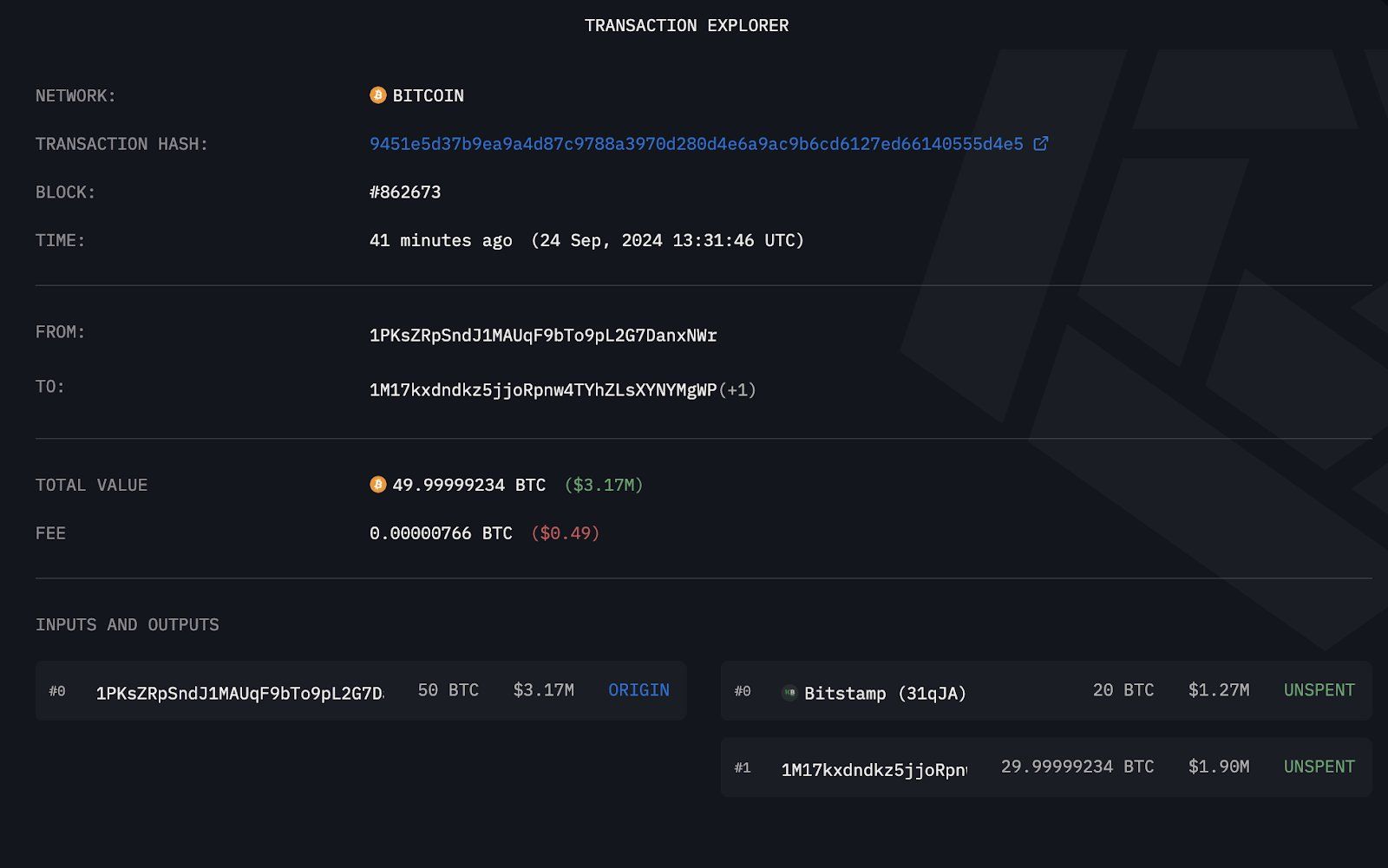

On Monday, September 24, blockchain company Arkham Knowledge reported that a 13-year-old Bitcoin whale moved 20 BTC, valued at $1.27 million, to Bitstamp. According to our searchings for, the whale holds 50 BTC and last made a purchase 4 years back.

The motion of the coins to the Bitstamp exchange may increase problems. This is since the majority of exchange inflows from formerly inactive pocketbooks show that the financiers agree to offer. Depending upon the quantity, deals similar to this can trigger down stress on the rate.

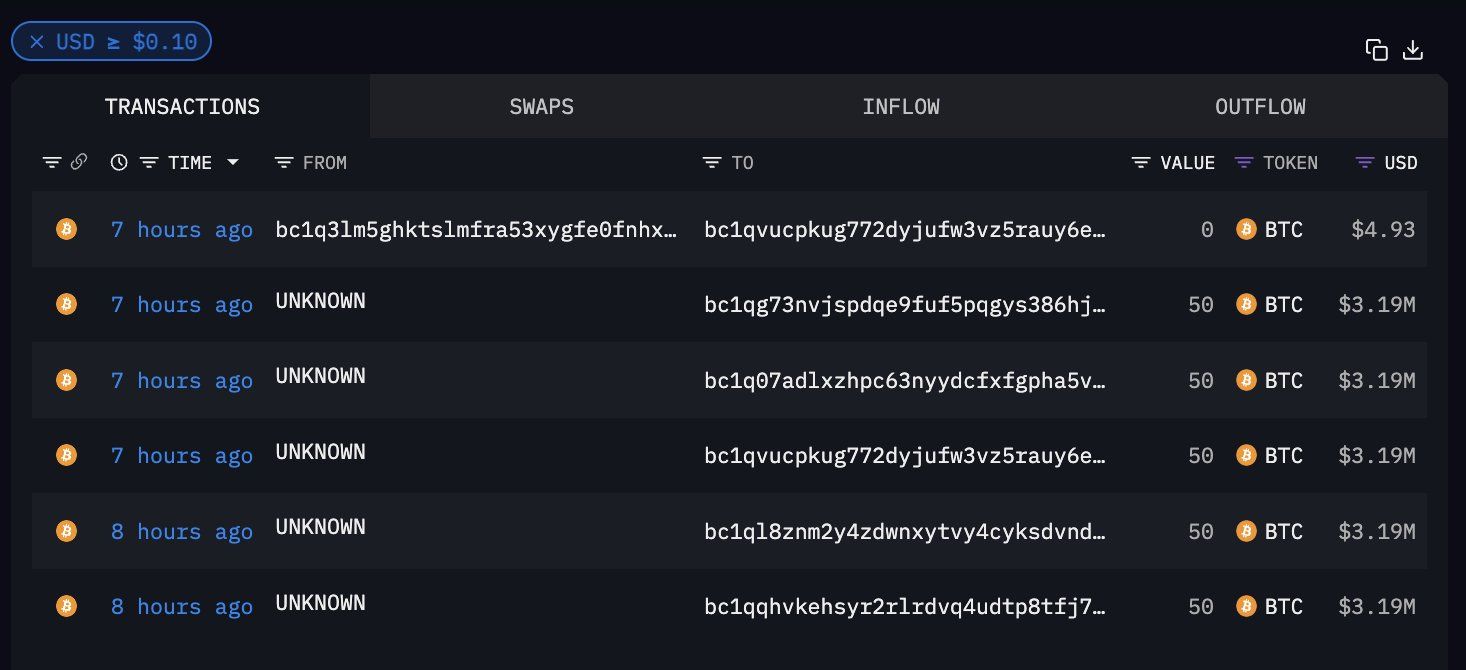

Nonetheless, this whale is not the just one that has actually awakened lately. On the exact same day, an additional Bitcoin whale, that has actually been holding 1,215 BTC because 2009, moved 5 coins to Sea serpent.

Besides these 2, an additional inactive address from the exact same year had actually awakened and moved 250 BTC from the stockpile in the purse on September 20.

These deals bring the overall variety of coins relocated by still pocketbooks to 275 BTC in 5 days. With Bitcoin’s rate trading at $63,725, this indicates that the worth relocated has to do with $17.52 million.

Learn More: That Has one of the most Bitcoin in 2024?

Regardless of the deals, the Big Owners’ Netflow to Exchange Netflow Proportion reveals a remarkable reduction over the last 7 days. This netflow is the distinction in between the variety of coins sent out right into exchanges by Bitcoin whales deducted from those taken out.

High worths of this statistics foreshadow rate reduces as offering stress escalates. Nonetheless, an unfavorable proportion, as it is presently, might be viewed as a duration of build-up and might come before a remarkable BTC pump. As a result, as it stands, BTC may not experience noteworthy down stress.

BTC Cost Forecast: $68,000 Following

On the everyday graph, Bitcoin’s rate has actually damaged over the coming down network that developed in between March and mid-September. As seen listed below, the assistance at $54,008 was important in assisting BTC stay clear of a reduction listed below $50,000. Likewise, the assistance at $60,296 made certain that the outbreak succeeded.

In Addition, the Relocating Typical Merging Aberration (MACD) declares. As a technological oscillator utilized to recognize patterns, the favorable MACD analysis suggests that the energy around Bitcoin is favorable.

Learn More: Just How To Earn Money in Bitcoin (BTC): Whatever You Required To Know

If this stays the exact same, Bitcoin’s rate might transfer to $68,225. On the various other hand, BTC may stop working to reach this target if Bitcoin whales start to disperse their coins in huge numbers. Ought to that occur, Bitcoin’s rate might go down to $60,296.

Please Note

In accordance with the Count on Job standards, this rate evaluation write-up is for educational functions just and must not be thought about monetary or financial investment recommendations. BeInCrypto is devoted to exact, impartial coverage, however market problems undergo transform without notification. Constantly perform your very own study and talk to a specialist prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.