Regardless of the expanding positive outlook around Solana’s (SOL) cost, numerous signs recommend care. Following its current surge, some forecasts declare SOL might review the $180 mark.

Nevertheless, while it’s appealing to adhere to the group, this evaluation cautions that such a rate target might be a timeless bull catch, where very early positive outlook entices capitalists prior to the cost takes a sharp decline.

Solana Financiers Ought To Beware

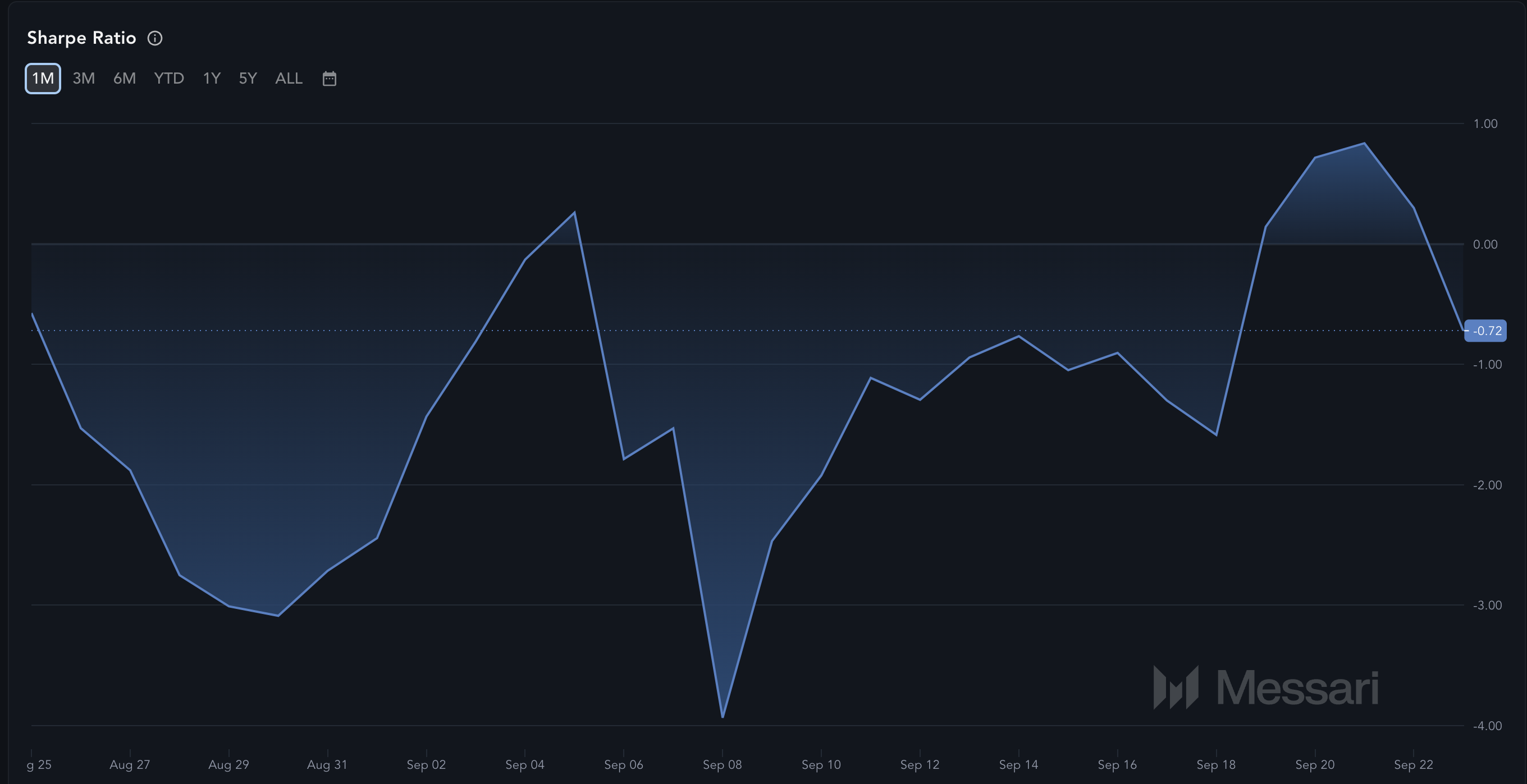

Over the previous 7 days, Solana’s cost has actually climbed by 9.20%, getting to $143.35. Nevertheless, the Sharpe proportion recommends care for those seeking to purchase SOL for temporary gains. The Sharpe proportion determines risk-adjusted returns, and while it relates to both conventional and electronic properties, cryptocurrencies bring dramatically greater danger.

A greater Sharpe proportion shows a far better risk-reward equilibrium, however Solana’s Sharpe proportion has actually gone down to -0.72, according to Messari information. This decrease recommends that the prospective returns might not warrant the threats associated with purchasing the present cost.

This indicates the opportunity that the $180 cost forecast might be a bull catch. A bull catch takes place when a possession’s cost surges, drawing in capitalists, just for the uptrend to turn around, resulting in losses for those that purchased in at the optimal.

Find Out More: Solana vs. Ethereum: An Ultimate Contrast

One more sign sustaining the mindful overview is the SOL/ETH set, which reveals Solana’s cost about Ethereum. When the SOL/ETH set climbs, it indicates Solana is outmatching ETH. Nevertheless, a decrease shows that ETH is currently outmatching Solana.

From June to August, Solana outmatched Ethereum by 63.94%, pressing both’s worth to 0.062. Over the previous 3 days, nonetheless, this worth has actually come by 6.27%, bringing it to 0.054. A comparable fad is observed in the Solana/Bitcoin (BTC) set. If this down fad proceeds, Solana’s temporary cost target of $180 might not be attained.

SOL Cost Forecast: Favorable Energy Decreases

The other day, Solana’s cost tried to damage above $150 however was consulted with resistance, avoiding it from relocating greater. This denial has actually maintained SOL trading within the $134 to $150 variety because last Monday.

In Addition, the Family Member Stamina Index (RSI), which tracks energy, has actually transformed downward, signaling weakening favorable energy. This change recommends that a rate decline might be on the perspective, with SOL possibly being up to $127.92 if the present fad proceeds.

Find Out More: 6 Finest Systems To Get Solana (SOL) in 2024

Nevertheless, if the bulls handle to breach the $150 resistance on an additional effort, Solana’s cost might burst out and climb up towards $161.74.

Please Note

In accordance with the Count on Task standards, this cost evaluation write-up is for informative objectives just and ought to not be taken into consideration monetary or financial investment recommendations. BeInCrypto is devoted to precise, impartial coverage, however market problems undergo alter without notification. Constantly perform your very own study and talk to a specialist prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.