Completion of the profits period is constantly a great time to take a go back and see that radiated (and that not a lot). Allow’s have a look at just how building and upkeep solutions supplies made out in Q2, beginning with Orion (NYSE: ORN).

Building and construction and upkeep solutions firms not just flaunt technological knowledge in specialized locations however likewise might hold unique licenses and authorizations. Those that operate in even more controlled locations can delight in a lot more foreseeable income streams – as an example, emergency exit demand to be checked every 5 years–. A lot more lately, solutions to attend to power effectiveness and labor accessibility are likewise developing step-by-step need. However like the more comprehensive industrials field, building and upkeep solutions firms go to the impulse of financial cycles as exterior elements like rates of interest can considerably influence the brand-new building that drives step-by-step need for these firms’ offerings.

The 13 building and upkeep solutions supplies we track reported a blended Q2. En masse, incomes missed out on experts’ agreement price quotes by 1% while following quarter’s income support was 2% listed below.

After much thriller, the Federal Get reduced its plan price by 50bps (half a percent) in September 2024. This notes the reserve bank’s very first easing of financial plan considering that 2020 and completion of its most sharp inflation-busting project considering that the 1980s. Rising cost of living had actually started to run warm in 2021 post-COVID as a result of a convergence of elements such as supply chain interruptions, labor lacks, and stimulation costs. While CPI (rising cost of living) analyses have actually been encouraging recently, work actions have actually motivated some issue. Moving forward, the marketplaces will certainly dispute whether this price cut (and a lot more possible ones in 2024 and 2025) is ideal timing to sustain the economic situation or a little bit far too late for a macro that has actually currently cooled down way too much.

The good news is, building and upkeep solutions supplies have actually been resistant with share rates up 9.1% usually considering that the current profits outcomes.

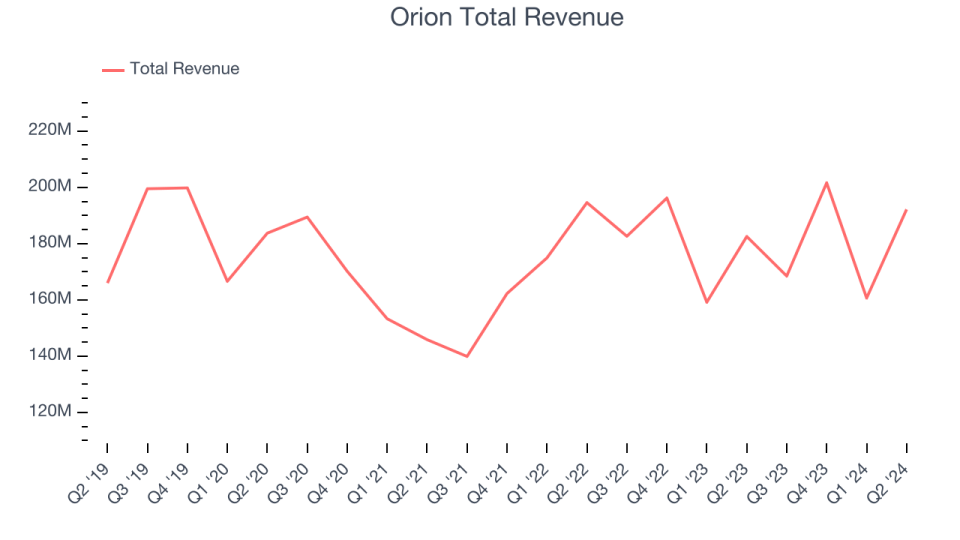

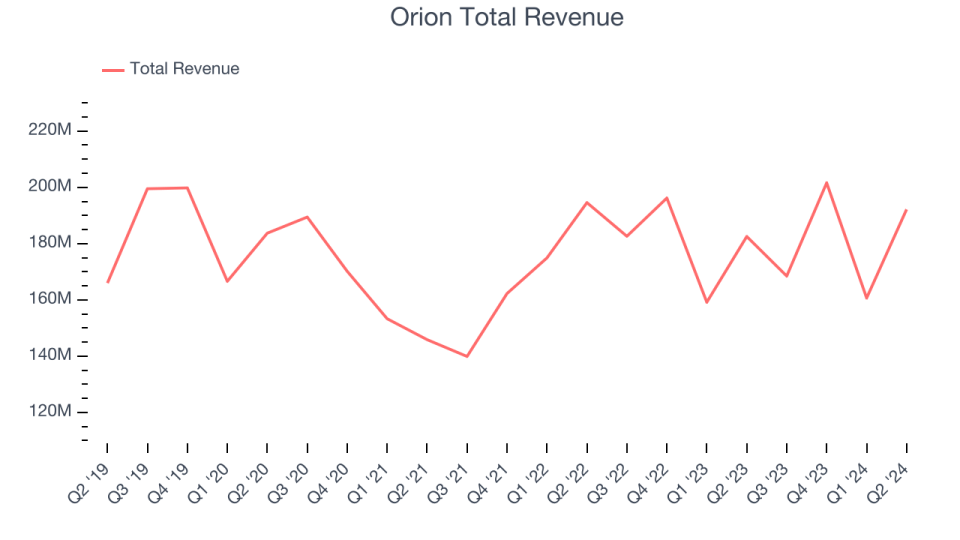

Weakest Q2: Orion (NYSE: ORN)

Developed in 1994, Orion (NYSE: ORN) offers building solutions for aquatic facilities and commercial jobs.

Orion reported incomes of $192.2 million, up 5.3% year on year. This print disappointed experts’ assumptions by 3.4%. Generally, it was a frustrating quarter for the business with a miss out on of experts’ profits price quotes.

” In the 2nd quarter, we produced income of $192.2 million and Adjusted EBITDA of $5.5 million. As formerly suggested, we prepared for a slower increase with 2 huge jobs.” stated Travis Boone, President of Orion Team Holdings, Inc.

Unsurprisingly, the supply is down 45.6% considering that reporting and presently trades at $6.01.

Read our full report on Orion here, it’s free

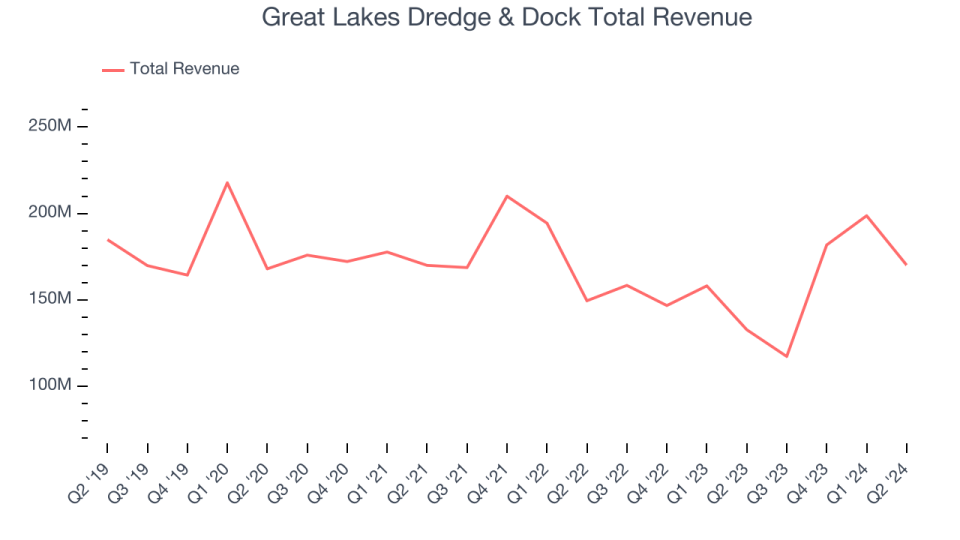

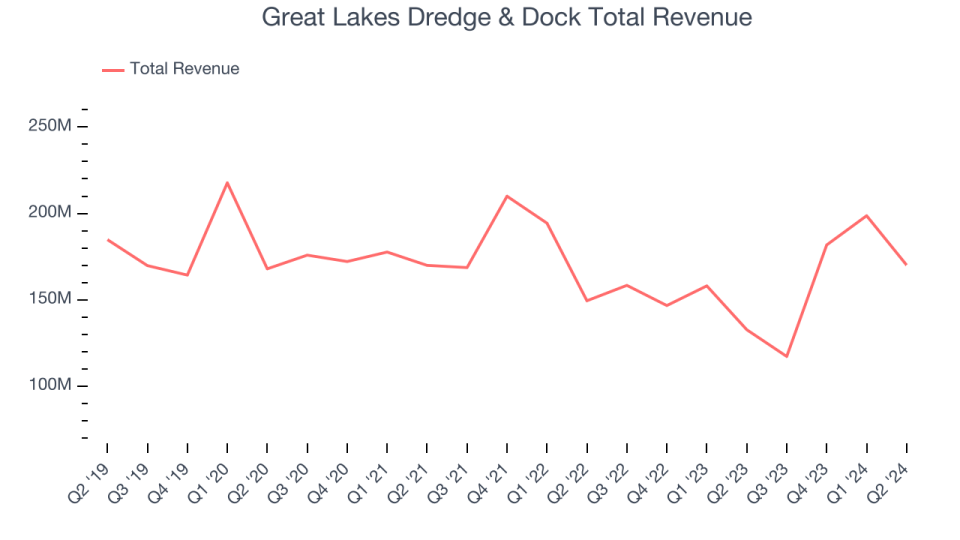

Finest Q2: Great Lakes Dredge & & Dock (NASDAQ: GLDD)

Established as Lydon & & Drews digging up business, Great Lakes Dredge & & Dock (NASDAQ: GLDD) offers digging up solutions, land improvement, and seaside defense jobs in the USA and worldwide.

Terrific Lakes Dredge & & Dock reported incomes of $170.1 million, up 28.2% year on year, exceeding experts’ assumptions by 3.5%. Business had an unbelievable quarter with a remarkable beat of experts’ profits price quotes.

The marketplace appears satisfied with the outcomes as the supply is up 33.8% considering that coverage. It presently trades at $10.84.

Is currently the moment to get Great Lakes Dredge & & Dock? Access our full analysis of the earnings results here, it’s free.

Tutor Perini (NYSE: TPC)

Understood for building the Philly Eagles’ Arena, Tutor Perini (NYSE: TPC) is a civil and structure construction business using varied basic having and design-build solutions.

Tutor Perini reported incomes of $1.13 billion, up 10.3% year on year, disappointing experts’ assumptions by 2%. It was a frustrating quarter as it uploaded a miss out on of experts’ profits price quotes.

Surprisingly, the supply is up 9.4% considering that the outcomes and presently trades at $25.94.

Read our full analysis of Tutor Perini’s results here.

Convenience Equipment (NYSE: SOLUTION)

Having actually traditionally expanded with natural methods in addition to purchases of various peers and rivals, Convenience Equipments United States (NYSE: SOLUTION) offers mechanical and electric having solutions.

Convenience Equipments reported incomes of $1.81 billion, up 39.6% year on year. This number covered experts’ assumptions by 6.9%. It was a solid quarter as it likewise created a remarkable beat of experts’ operating margin price quotes and a strong beat of experts’ profits price quotes.

Convenience Equipments supplied the fastest income development amongst its peers. The supply is up 32.7% considering that reporting and presently trades at $388.12.

Read our full, actionable report on Comfort Systems here, it’s free.

Primoris (NYSE: PRIM)

Provided on the NASDAQ in 2008, Primoris (NYSE: PRIM) develops, preserves, and upgrades facilities in the energy, power, and civil building sectors.

Primoris reported incomes of $1.56 billion, up 10.6% year on year. This outcome covered experts’ assumptions by 2.1%. It was a solid quarter as it likewise set up a remarkable beat of experts’ operating margin and profits price quotes.

The supply is up 21.9% considering that reporting and presently trades at $58.54.

Read our full, actionable report on Primoris here, it’s free.

Sign Up With Paid Supply Capitalist Study

Aid us make StockStory a lot more useful to capitalists like on your own. Join our paid customer study session and obtain a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.