As the Q2 revenues period covers, allow’s explore this quarter’s finest and worst entertainers in the money and human resources software application market, consisting of Marqeta (NASDAQ: MQ) and its peers.

Organizations are frequently wanting to enhance business effectiveness, whether it is monetary preparation, tax obligation monitoring or pay-roll. Money and human resources software application gain from the SaaS-ification of companies, big and little, that a lot like the adaptability of cloud-based, web-browser provided software application spent for on a registration basis than the inconvenience and expenditure of acquiring and taking care of on-premise venture software application.

The 15 money and human resources software application supplies we track reported a slower Q2. En masse, earnings defeated experts’ agreement quotes by 1.5% while following quarter’s income support was 0.5% listed below.

The Fed reduced its plan price by 50bps (half a percent) in September 2024, the initial in approximately 4 years. This notes completion of its most sharp inflation-busting project considering that the 1980s. While CPI (rising cost of living) analyses have actually been helpful recently, work steps have actually verged on uneasy. The marketplaces will certainly be analyzing whether this price cut’s timing (and a lot more prospective ones in 2024 and 2025) is optimal for sustaining the economic situation or a little bit far too late for a macro that has actually currently cooled down excessive.

The good news is, money and human resources software application supplies have actually been resistant with share rates up 6.2% generally considering that the current revenues outcomes.

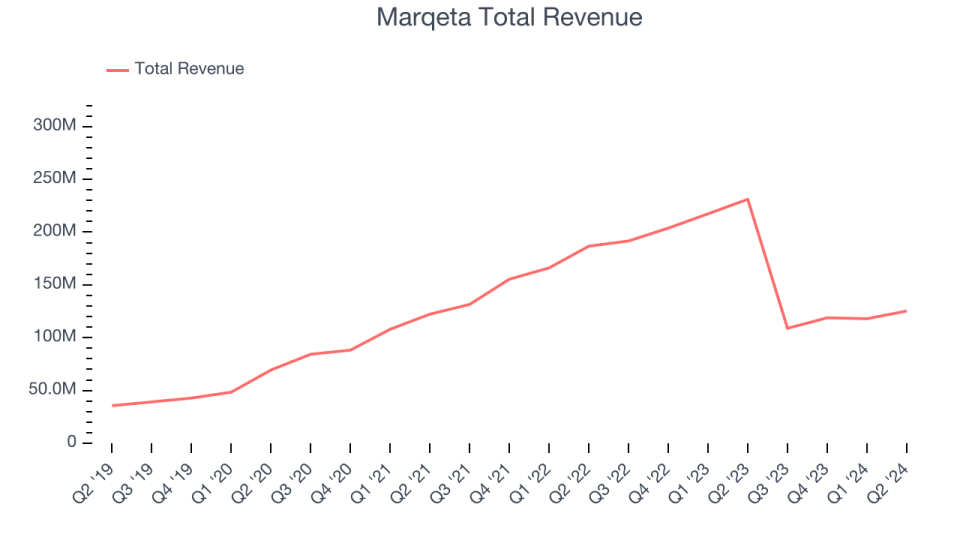

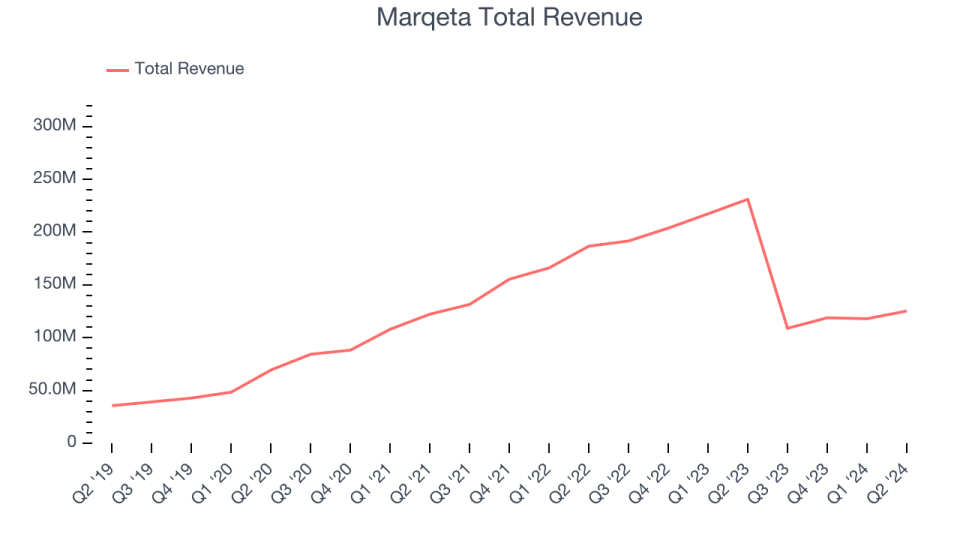

Marqeta (NASDAQ: MQ)

Established by Chief Executive Officer Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is a cutting-edge card provider that supplies business with the capability to problem and procedure online, physical, and tokenized credit report and debit cards.

Marqeta reported earnings of $125.3 million, down 45.8% year on year. This print went beyond experts’ assumptions by 3.1%. Generally, it was an adequate quarter for the business with a suitable beat of experts’ complete repayment quantity quotes however a decrease in its gross margin.

” The 2nd quarter shows the wonderful returns on our rejuvenated go-to-market technique incorporated with our capability to provide technology at range. We authorized an introducing techbank, released a brand-new repayment technology that reimagines what a card can be, and grew the variety of solutions we can provide around the world, all while remaining to expand our TPV and run with concentrated performance,” stated Simon Khalaf, Chief Executive Officer at Marqeta.

Marqeta provided the slowest income development of the entire team. Remarkably, the supply is up 3.4% considering that reporting and presently trades at $5.10.

Is currently the moment to purchase Marqeta? Access our full analysis of the earnings results here, it’s free.

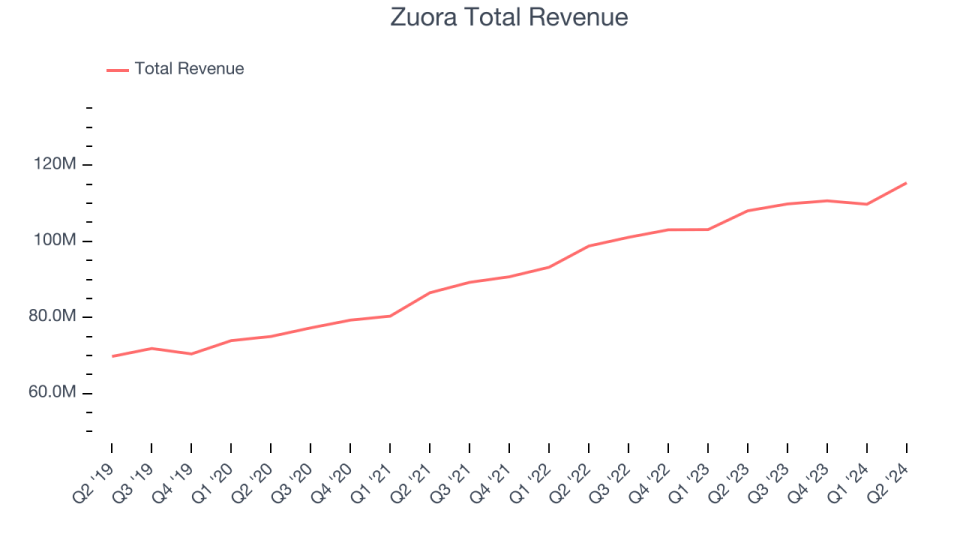

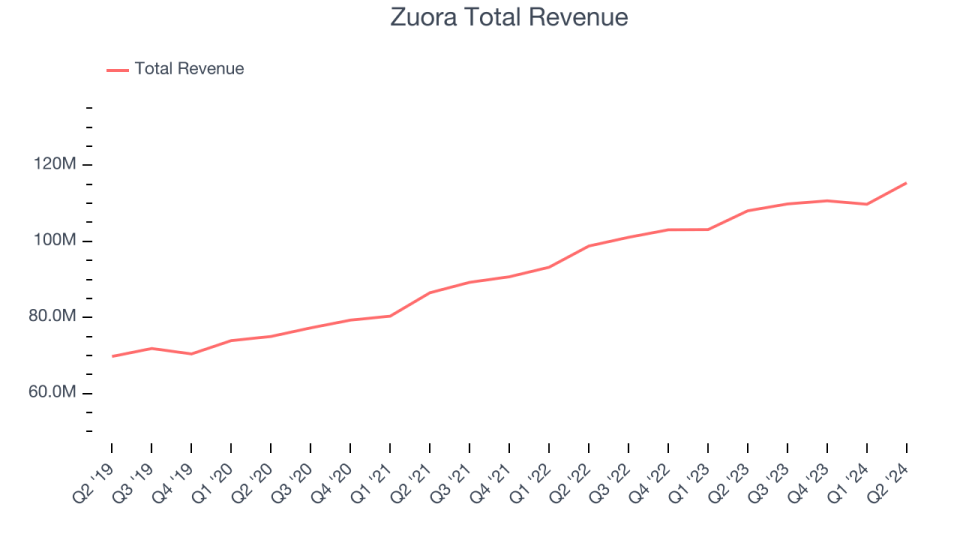

Finest Q2: Zuora (NYSE: ZUO)

Established In 2007, Zuora (NYSE: ZUO) uses software application as a solution system that enables business to costs and approve settlements for reoccuring membership items.

Zuora reported earnings of $115.4 million, up 6.8% year on year, outshining experts’ assumptions by 2.5%. Business had a solid quarter with a remarkable beat of experts’ invoicings quotes and in-line income support for the following quarter.

The marketplace appears material with the outcomes as the supply is up 1.5% considering that coverage. It presently trades at $8.64.

Is currently the moment to purchase Zuora? Access our full analysis of the earnings results here, it’s free.

Global Organization Traveling (NYSE: GBTG)

Holding close connections to American Express, Global Organization Traveling (NYSE: GBTG) is a detailed traveling and expenditure monitoring companies to companies worldwide.

Global Organization Traveling reported earnings of $625 million, up 5.6% year on year, disappointing experts’ assumptions by 1.1%. It was a frustrating quarter as it uploaded full-year income support missing out on experts’ assumptions.

Remarkably, the supply is up 25.7% considering that the outcomes and presently trades at $7.58.

Read our full analysis of Global Business Travel’s results here.

Workiva (NYSE: WK)

Established In 2010, Workiva (NYSE: WK) uses software application as a solution item that makes monetary and conformity coverage much easier, specifically for openly traded companies.

Workiva reported earnings of $177.5 million, up 14.5% year on year. This print exceeded experts’ assumptions by 1.3%. Other than that, it was an adequate quarter as it additionally logged speeding up client development however a miss out on of experts’ invoicings quotes.

Workiva provided the highest possible full-year support raising amongst its peers. The business included 72 venture clients paying greater than $100,000 yearly to get to an overall of 1,768. The supply is up 7.3% considering that reporting and presently trades at $77.80.

Read our full, actionable report on Workiva here, it’s free.

Flywire (NASDAQ: FLYW)

Initially developed to refine worldwide tuition settlements for colleges, Flywire (NASDAQ: FLYW) is a cross boundary settlements cpu and software application system concentrating on facility, high-value purchases like education and learning, medical care and B2B settlements.

Flywire reported earnings of $103.7 million, up 22.2% year on year. This number defeated experts’ assumptions by 3.3%. Other than that, it was a combined quarter as it additionally generated full-year income support covering experts’ assumptions however a decrease in its gross margin.

Flywire provided the fastest income development amongst its peers. The supply is down 7.9% considering that reporting and presently trades at $16.38.

Read our full, actionable report on Flywire here, it’s free.

Sign Up With Paid Supply Capitalist Research Study

Assist us make StockStory a lot more valuable to financiers like on your own. Join our paid individual study session and obtain a $50 Amazon present card for your point of views. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.