The United States Justice Division pursued Visa (V) on Tuesday in a government antitrust claim declaring that the business unlawfully utilized the range of its substantial card handling network to obstruct competitors.

Visa has and regulates the biggest debit card handling network in the United States, which refines greater than 60% of the country’s debit card purchases.

According to the DOJ, Visa leveraged its ecological community of customers, financial institutions, and vendors to punish vendors for picking an alternating debit network.

” Jointly … Visa’s organized initiatives to restrict competitors for debit purchases have actually caused considerable extra charges troubled American customers and services and slowed down advancement in the debit settlements ecological community,” the grievance claimed.

According to the DOJ, Visa made a “internet of agreements” with significant financial institutions and vendors that called for vendors to select Visa’s network or pay greater charges to Visa offer for sale purchases.

In 2022, Visa debit handling charges drove $7 billion in profits for the business. Visa supply went down greater than 5% Tuesday.

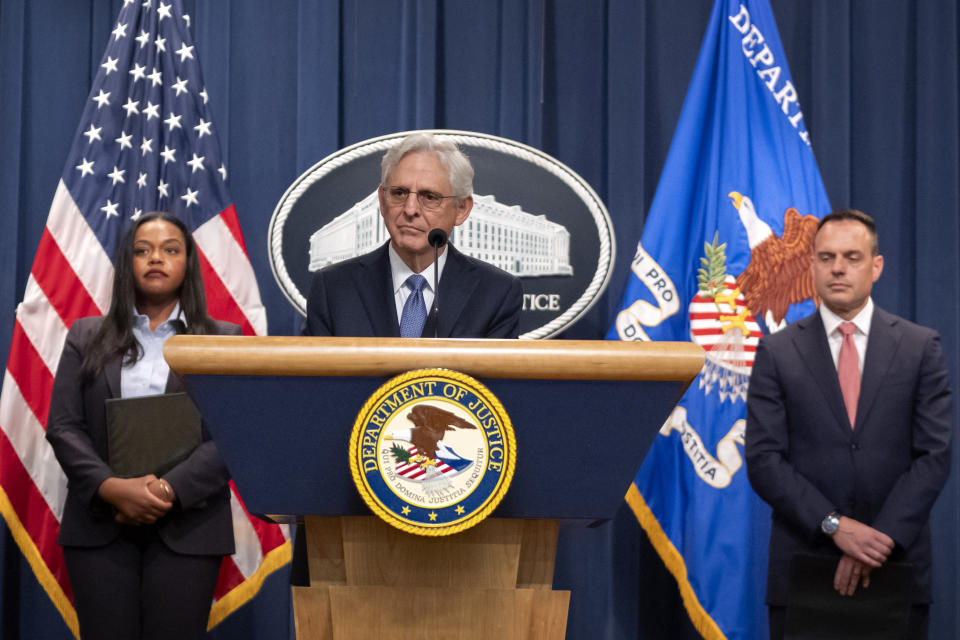

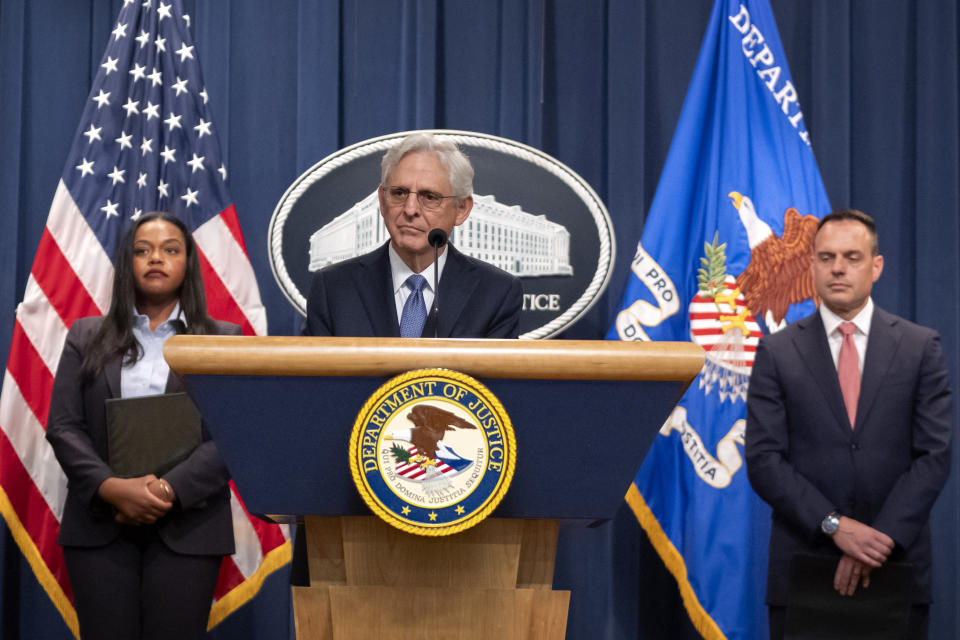

United States Chief Law Officer Merrick Garland claimed Visa’s unlawful conduct inhibited prospective opponents, especially fintech business like Square’s CashApp, from getting in the debit handling market.

” While Visa is the given name lots of debit card customers see when they get their card to purchase, they do not see the function that Visa plays behind the scenes,” Garland claimed.

” There, it regulates an intricate network of vendors, banks, and customers … It is billing a concealed toll on each of trillions of purchases, amounting to billions of bucks of charges enforced yearly on American customers and services.”

Especially, the DOJ claimed Visa unlawfully hung on to syndicates in 2 markets: the debit network solutions market, which is utilized to take out funds straight out of a customer’s checking account, and the card-not-present debit network solutions market.

The last is a narrower market within the more comprehensive solutions market that consists of conventional debit card purchases, in addition to fintech purchases.

Visa’s basic advise, Julie Rottenberg, reacted to the claim by claiming that it overlooked Visa’s “lots of rivals” in the expanding debit room.

” Any person that has actually purchased something online, or looked into at a shop, recognizes there is an ever-expanding world of business providing brand-new methods to spend for products and solutions,” Rottenberg claimed.

Alden Abbott, a Mercatus Center study other and previous basic advise for the United States Federal Profession Compensation, claimed the Visa situation is distinct for an antitrust situation because the Dodd-Frank Act established a cap on debit card charges.

Any kind of antitrust evaluation of Visa’s plans need to take the legislation’s influence right into account, Abbott claimed, since it might have inhibited opponents from getting in the marketplace, compromised then-existing opponents, and caused less poorer Americans having debit cards.

” It is absolutely feasible that Visa’s expanding debit card market share results from this legal cost cap, instead of anti-competitive activities by Visa,” Abbott claimed.

The DOJ is requesting for the government area court in Manhattan to obstruct Visa from utilizing the presumably damaging agreements and to obstruct it from packing credit history solutions or credit history motivations with debit network solutions.

It additionally requested for the court to quit Visa from enforcing rates motivations for use its network.

Alexis Keenan is a lawful press reporter for Yahoo Money. Adhere To Alexis on X @alexiskweed.

Visit this site for extensive evaluation of the most recent securities market information and occasions relocating supply rates

Check out the most recent monetary and organization information from Yahoo Money

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.