BlackRock, the globe’s biggest possession supervisor, is looking for to modify its Bitcoin ETF (IBIT), which has actually been the top-performing ETF amongst its peers considering that introducing on January 11.

Bitcoin ETFs remain to draw in institutional need, bringing Bitcoin direct exposure to Wall surface Road and increasing its reach past retail financiers.

BlackRock Data Bitcoin ETF Modification

In a filing with the United States Stocks and Exchange Payment (SEC) on September 16, BlackRock asked for that Bitcoin withdrawals from Coinbase, which works as custodian for the possession supervisor’s IBIT, be refined within 12 hours.

” Based on verification of the foregoing needed minimum equilibrium, Coinbase Protection will refine a withdrawal of Digital Possessions from the Custodial Account to a public blockchain address within 12 hours of getting a Guideline from Customer or Customer’s Authorized Reps,” a passage in the declaring read.

This demand comes as financiers increase issues regarding Coinbase’s custodial techniques for Bitcoin ETFs. Especially, financiers desire Coinbase, as custodian, to supply on-chain evidence of Bitcoin acquisitions for ETFs to make certain openness.

The issues have actually developed as a result of Bitcoin’s stationary rate efficiency over the previous 3 months, regardless of huge inflows right into Bitcoin ETFs. Some guess that Coinbase could be making use of “paper BTC” or Bitcoin IOUs for ETF companies, possibly adding to the dull rate motion.

Find Out More: Exactly How To Profession a Bitcoin ETF: A Step-by-Step Strategy

Among the issues, Coinbase chief executive officer Brian Armstrong pressed back in a strong effort to respond to worry, unpredictability, and question (FUD).

” All ETF mints and burns we procedure are inevitably worked out onchain. Institutional customers have profession funding and OTC choices prior to professions are worked out onchain. This is the standard for all our institutional customers. All funds are worked out in our Prime safes (onchain) within regarding one service day,” Armstrong wrote.

In knowledge, Tron creator Justin Sunlight initially increased issues by examining Coinbase’s Bitcoin wrapper, cbBTC, and slammed the exchange for doing not have evidence of gets, advising it can note “dark days for Bitcoin.”

BlackRock’s current relocate to modify its Bitcoin ETF intends to attend to these issues. The adjustments recommend the possession supervisor’s initiatives to boost functional structures while enhancing liquidity. ETF expert Eric Balchunas additionally decreased the supposition.

” I obtain why these concepts exist and individuals wish to scapegoat the ETFs. Due to the fact that it is also unimaginable that the indigenous HODLers can be the vendors. However they are … All the ETFs and BlackRock have actually done is save BTC’s rate from the void consistently,” Balchunas said.

Coinbase as a Possible Solitary Factor Of Assault

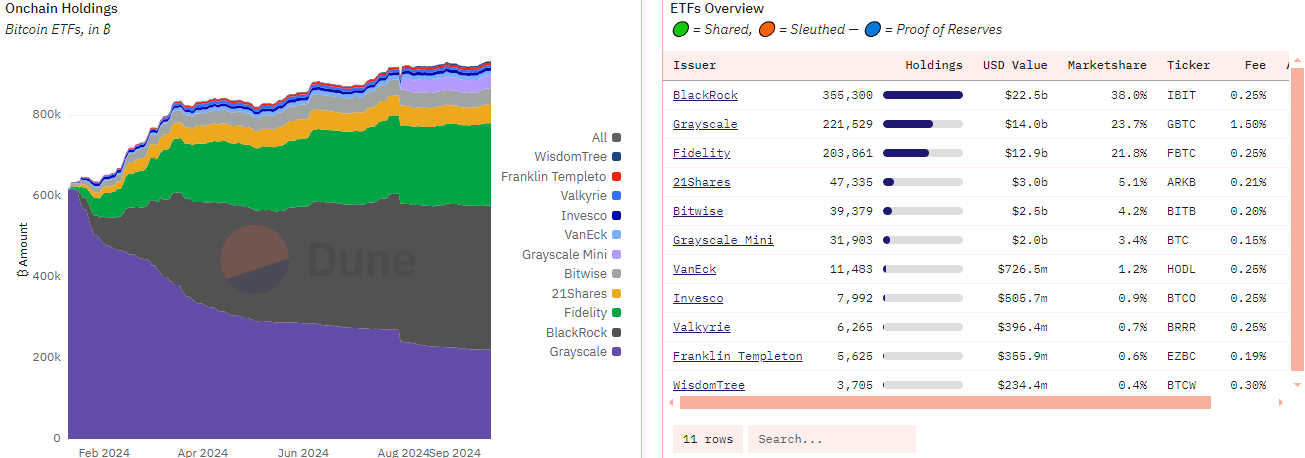

Without A Doubt, Bitcoin ETF inflows have actually been enormous considering that the economic tool struck markets on January 11. Dune information reveals that BlackRock’s IBIT controls the industry, holding over 38% of the marketplace share and taking care of $22.5 billion in on-chain possessions.

Find Out More: Bitcoin (BTC) Rate Forecast 2024/2025/2030

Coinbase plays a leading function in the crypto area ETFs market, offering protection solutions for 8 of 11 Bitcoin ETFs and 8 of 9 Ethereum ETFs. It additionally supplies trading implementation and market monitoring solutions.

Coinbase takes care of around 90% of the $37 billion in Bitcoin ETF possessions, resulting in issues regarding its setting as a prospective solitary factor of failing. Fox Company press reporter Eleanor Terrett, to name a few, lately increased worry regarding this setting of impact.

” It does not bode well that almost all crypto ETF companies have the very same custodian for all their BTC and ETH. This makes Coinbase a prospective solitary factor of failing which’s frightening,” Terrett wrote.

Past the most up to date issues regarding feasible IOUs to financiers, the hazard from North Oriental cyberpunks additionally placements Coinbase as a solitary factor of strike must the criminals target the custodian. Regardless of these issues, the system remains to play a crucial function in institutional Bitcoin financial investment, running a considerable part of the US-based BTC area trading market.

Please Note

In adherence to the Count on Task standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to supply exact, prompt details. Nonetheless, viewers are encouraged to confirm truths separately and speak with a specialist prior to making any type of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.