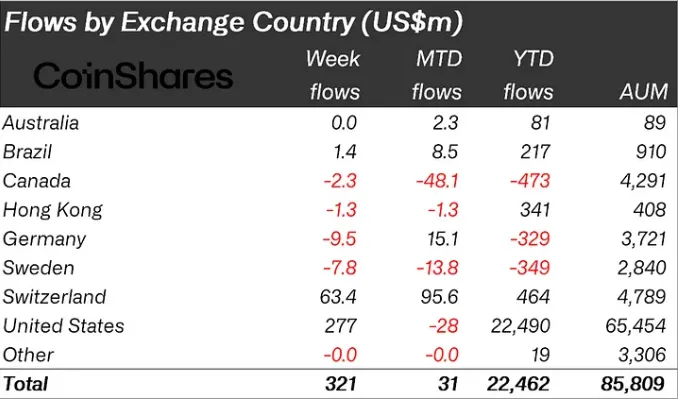

Crypto financial investment items saw inflows of approximately $321 million recently, a rise connected to rates of interest cuts by the Federal Free Market Board (FOMC).

Bitcoin (BTC) stays the leading property, attracting a lot of the financial investment interest, while altcoins remain to take their lead from the leader cryptocurrency.

Bitcoin Leads $321 Million Crypto Financial Investment Inflows

Digital property financial investment items saw an additional round of favorable inflows, with Bitcoin leading the cost, drawing in $284 million. This uptick likewise influenced inflows right into short-Bitcoin financial investment items.

According to the current CoinShares report, the Federal Book’s choice to reduce rates of interest by 50 basis factors recently played an essential duty in driving these inflows. The United States led local inflows, adding $277 million to the total amount. This response to the Fed’s price reduced highlights the expanding effect of financial plan on crypto financial investments.

” Considering our sight of Bitcoin as a shop of worth– albeit an arising one with substantial volatility– it takes on various other shops of worth like the USD, Treasuries, and gold. Consequently, Bitcoin needs to be considered as an interest-sensitive property, which appears in its -70% relationship to the USD. When rate of interest rate-sensitive macroeconomic information is launched, we typically observe an instant intraday response in Bitcoin’s rate. The current favorable rate activity was a straight reaction to the current 50 basis factor rates of interest cut,” CoinShares Head of Study James Butterfill informed BeInCrypto.

Learn More: What Is a Bitcoin ETF?

On the various other hand, Ethereum (ETH) saw its 5th successive week of discharges, completing $28.5 million recently. The current CoinShares report qualities this to continuous Grayscale discharges and the underperformance of Ethereum ETFs.

Ethereum ETFs remain to have a hard time, with collective internet discharges getting to $607.47 million, according toSosovalue data On September 20, Grayscale’s Ethereum ETF (ETHE) reported $2.77 billion in collective internet discharges, though various other companies, consisting of Grayscale’s Mini ETH ETF, published favorable circulations.

” Numerous aspects go to have fun with concerns to Ethereum’s underperformance. Initially, the timing of the ETF launches was unfavorable. Second, the more comprehensive macroeconomic atmosphere– noted by unpredictability around possible price cuts, problems regarding financial development, and the taking a break of the yen lug profession– has actually not agreed with. Most significantly, continuous problems regarding Ethereum’s earnings on Layer-1 adhering to the Dencun upgrade have actually triggered worry,” Butterfill included.

Bitcoin Resources Turning Into Altcoins

While Bitcoin remains to see climbing need, the long-awaited altcoin period stays postponed as resources has yet to move right into smaller sized market-cap coins. According to an expert on X (previously Twitter), this hold-up is partially as a result of Bitcoin ETFs placing BTC as a property in its very own course, developing a distinctive market for Bitcoin.

Institutional capitalists and Wall surface Road gamers have actually played a considerable duty in driving Bitcoin need, specifically adhering to the authorization of Bitcoin ETFs in January. Consequently, the concentrate on Bitcoin has actually reduced the turning of resources right into altcoins, delaying the anticipated altcoin rally.

” Establishments will certainly not be revolving out of their Bitcoin to play alts. Bitcoin ETF customers will certainly not be revolving. Investors playing choices on the Bitcoin ETFs will not be revolving right into shitters. It’s a completely various market currently and a lot of you do not have any type of BTC,” one expert wrote.

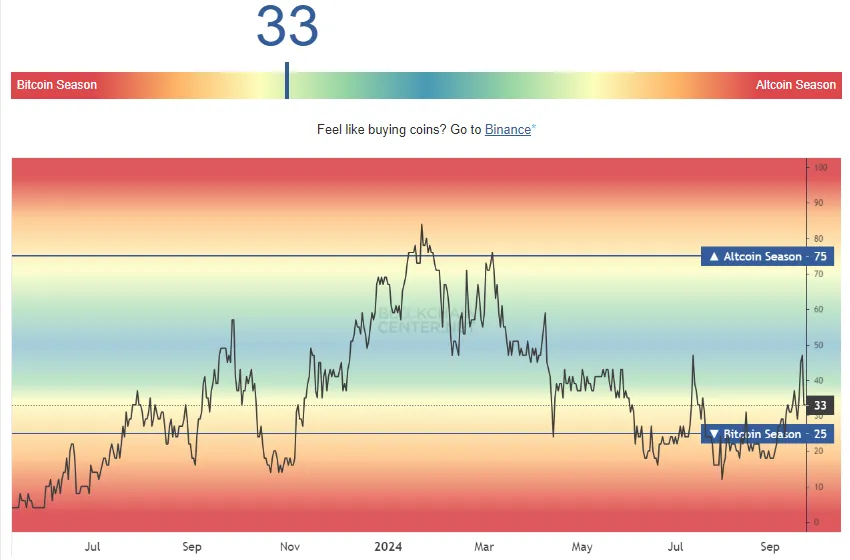

The prepared for “altcoin period” stays away, a stage when buying altcoins commonly generates far better returns than Bitcoin or Ethereum. According to the Altcoin Period Index, the marketplace is still in a Bitcoin period, with a rating of 33/100. This shows that Bitcoin remains to control, though altcoins are gradually obtaining grip.

Find Out More: What Is Altcoin Season? A Comprehensive Guide

Historically, altcoin periods have actually arised after Bitcoin supremacy comes to a head, which is why experts are purposefully placing themselves. If existing market problems hold steady with completion of Q3 in September, capitalists might ultimately witness the beginning of an altcoin period.

Please Note

In adherence to the Count on Task standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to offer exact, prompt details. Nevertheless, visitors are suggested to confirm realities separately and speak with an expert prior to making any type of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.