On September 23, 2024, Trouble Operatings systems released a main declaration outlining a negotiation contract with Bitfarms Ltd., properly bringing an end to Trouble’s unrequested quote to obtain the firm.

As component of this contract, Trouble has actually withdrawn its appropriation for an unique conference of Bitfarms’ investors, and a number of board-level adjustments were made to make sure a smoother calculated evaluation procedure for Bitfarms.

Trouble’s Purchase Difficulties: The Toxin Tablet Approach that Improved Settlements

According to the declaration, Bitfarms has actually selected Amy Freedman to its Board of Supervisors. This visit comes as Andrés Finkielsztain surrendered as component of the negotiation.

Freedman, a vital number in business administration, will certainly sign up with the Board’s Administration and Nominating Board and Settlement Board. The contract enables her to join any type of unique boards of independent supervisors that might be made up in the future.

Find Out More: 5 Finest Systems To Get Bitcoin Mining Supplies in 2024

Trouble has actually shown to check its risk in Bitfarm very closely. Nevertheless, the company has yet to intend any type of instant requisitions.

” Instantly prior to, and quickly after, the participating in of the Arrangement, Trouble beneficially had 90,110,912 usual shares (the ‘Typical Shares’) of Bitfarms, standing for roughly 19.9% of the released and impressive Typical Shares (as determined based upon details given by the Business),” the company’s main declaration reads.

BeInCrypto reported that Trouble made an unrequested deal of $950 million in Might to obtain Bitfarms. On June 20, Bitfarms applied an investor legal rights strategy, typically called a “poisonous substance tablet,” to stop an aggressive requisition.

The technique intended to secure Bitfarms’ investors. It set off details legal rights if any type of celebration, consisting of Trouble, tried to obtain greater than 15% of Bitfarms’ shares prior to September 10, 2024, or 20% afterwards day.

Consequently, the firm had the ability to get time to check out various other calculated choices, such as service mixes or a prospective sale. Trouble’s raised share acquisitions, which saw its risk surge to 19.9%, just heightened problems over endangering investor passions.

” Trouble’s activities, consisting of a proposition gotten on April 22, 2024, and its succeeding market acquisitions to raise its risk, have actually been considered to underestimate Bitfarms by the Unique Board of Independent Supervisors. This board thinks that Trouble’s ongoing procurement of shares interferes with the honesty of the calculated evaluation procedure and might impede making best use of investor worth,” Bitfarms specified previously this year.

Regardless of the negotiation, Trouble preserves the choice to reassess its risk in Bitfarms in the future. Its ongoing passion in the firm, as detailed in its very early caution record, might cause brand-new propositions or additional conversations depending upon Bitfarms’ efficiency and general market problems. In the meantime, nevertheless, both business show up concentrated on their particular approaches.

Find Out More: Finest Crypto Mining Supplies to Get or View Currently

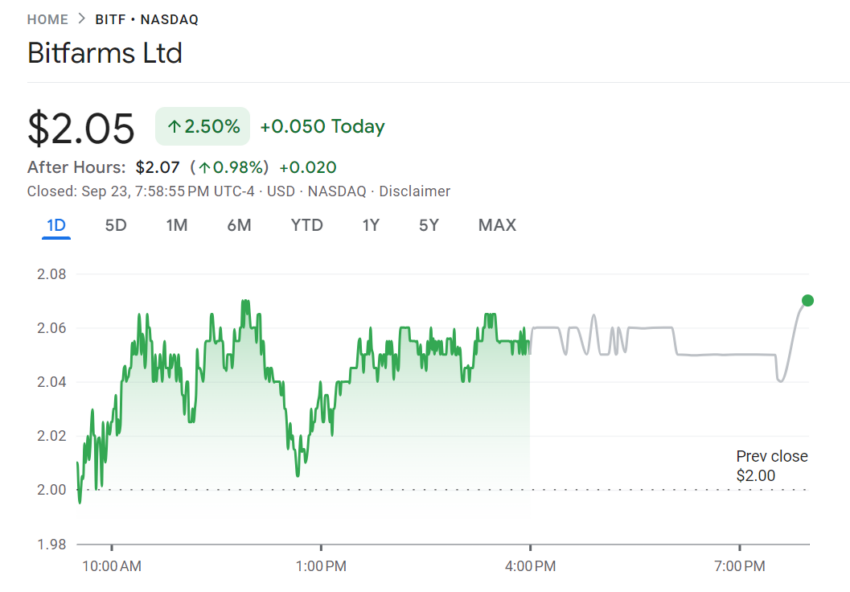

Since the negotiation day, Bitfarms’ supply (BITF) was trading at $2.05, mirroring a 2.05% boost. Nevertheless, year-to-date, the supply has actually seen a 27.82% decrease.

Please Note

In adherence to the Count on Job standards, BeInCrypto is dedicated to objective, clear coverage. This newspaper article intends to give precise, prompt details. Nevertheless, viewers are suggested to validate realities separately and talk to an expert prior to making any type of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.