Bitcoin’s cost just recently burst out of a favorable pattern, signifying the possibility for an increase to $80,000. Nevertheless, regardless of this favorable technological configuration, the largest challenge avoiding the leading cryptocurrency from attaining a brand-new all-time high is the habits of its very own owners.

BTC owners have actually been proactively liquidating their properties, developing an obstruction for Bitcoin’s higher trajectory.

Bitcoin Financiers Are Greed

In current days, capitalists have actually started offering their Bitcoin holdings, as shown in the increasing recognized profit/loss proportion. This statistics, which gauges the earnings of coins relocated on-chain, has actually been raising for the last 10 days after recuperating from the unfavorable area.

Historically, a spike in this proportion has a tendency to come before modifications, as it suggests that capitalists are taking earnings as opposed to holding their settings for more gains. The rise in recognized earnings signals offering stress in the marketplace. This habits has the possible to reduce and even turn around the favorable energy required for Bitcoin to get to a brand-new all-time high.

Find Out More: Bitcoin Halving Background: Every Little Thing You Required To Know

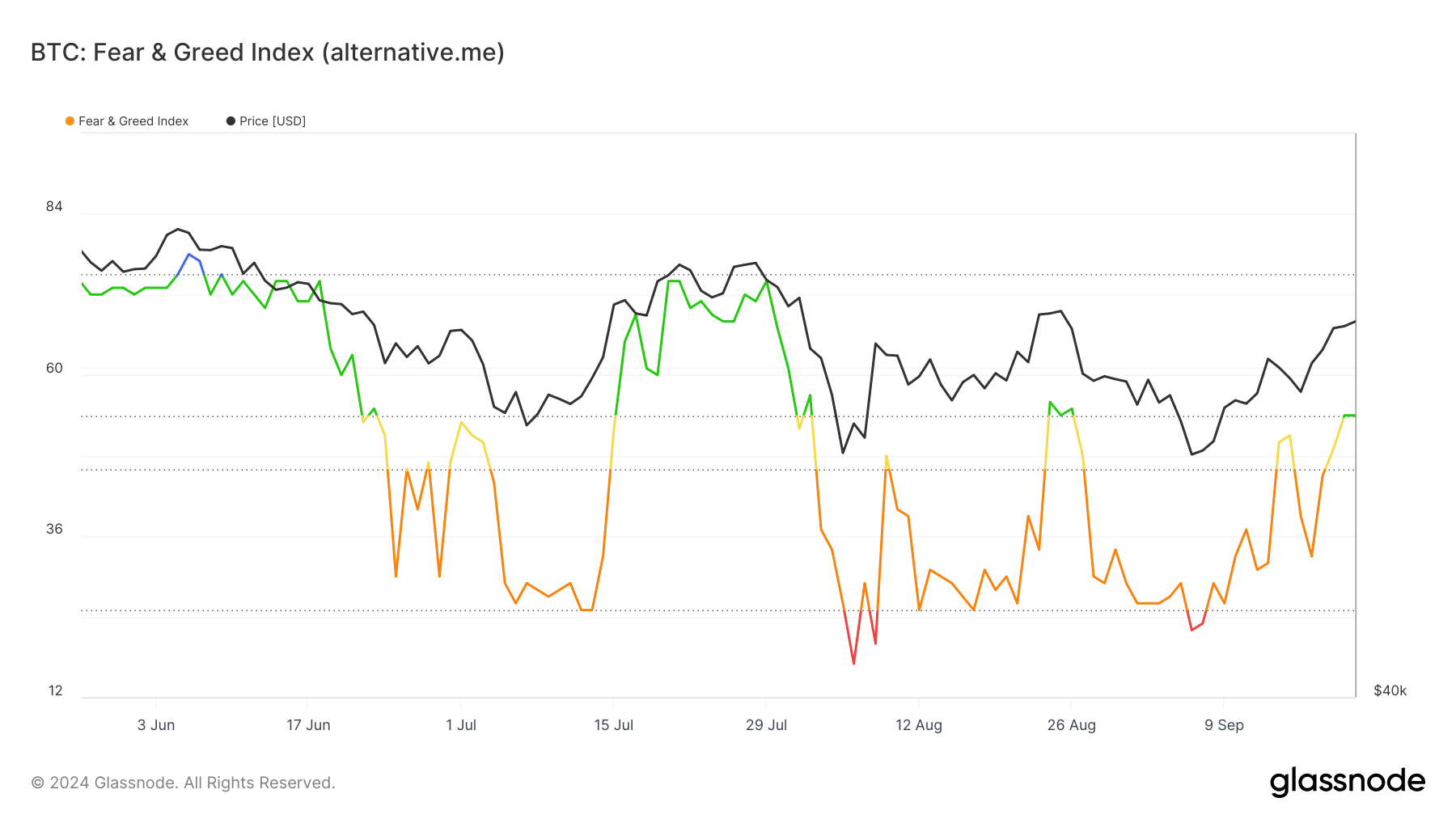

The macro energy of Bitcoin likewise provides obstacles. The Concern and Greed Index, which gauges market belief, just recently breached right into the greed area.

As Bitcoin’s cost surges, even more capitalists are ending up being inspired by the need to protect earnings as opposed to remaining to HODL and sustain more gains. This change in belief towards greed can cause raised marketing stress.

When the marketplace leans also greatly right into greed, it commonly leads to a pullback as owners start to sell their properties. This greed-driven habits is a crucial consider Bitcoin’s lack of ability to keep its higher energy, as it develops a self-fulfilling cycle of marketing stress that stops the cryptocurrency from getting to brand-new elevations.

BTC Rate Forecast: Dropping Back

Bitcoin is presently trading at $62,623, having a hard time to shut over the important resistance degree at $63,724. The outbreak continues to be unofficial till BTC can redeem $65,000 as assistance, making the expected 35% rally to $80,000 unpredictable.

Offered the present market problems, Bitcoin might encounter a prospective drawdown listed below $61,846, which can cause a loss of the $60,000 assistance degree. This would certainly postpone the expected rally.

Find Out More: Bitcoin (BTC) Rate Forecast 2024/2025/2030

Nevertheless, if Bitcoin takes care of to get rid of the bearish stress and redeem $65,000, it can activate a substantial rally. While verifying the pattern with a 35% surge would certainly lead to the development of a brand-new all-time high, one of the most BTC can increase to is $68,500 yet still handle to revoke the bearish thesis.

Please Note

In accordance with the Depend on Job standards, this cost evaluation write-up is for educational functions just and ought to not be taken into consideration economic or financial investment suggestions. BeInCrypto is dedicated to precise, impartial coverage, yet market problems go through alter without notification. Constantly perform your very own research study and speak with an expert prior to making any type of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.