The price reduced that every person was waiting on lastly gotten here. Markets supplied a resoundingly favorable reaction throughout of the Federal Get’s tightening up project. Yet the ecstasy was just short lived. Friday’s trading brought fresh issues over company incomes and financial development.

Supplies, nevertheless, still published general success for the week. The S&P 500 (^ GSPC) finished the week up regarding 1.4%. The Dow Jones Industrial Standard (^ DJI) placed on 1.6%, while the Nasdaq Compound (^ IXIC) acquired 1.5%. While Friday reduced the S&P, the index scratched an all-time high previously in the week and the Dow gathered a document.

The greatest concern for capitalists this approaching week is whether a brand-new set of information sustains Fed Chair Jerome Powell’s assertion that the United States economic climate stays solid. A 2nd quarter GDP analysis due Thursday will certainly assist evaluate that opinion.

Fed Chair Jerome Powell was likewise cautious not to state a success over rising cost of living as prices stress remain to boil down. Friday’s arranged launch of the Personal Usage Expenses (PCE) index, the Fed’s recommended rising cost of living scale, will certainly use one more report card on that particular front.

Quarterly incomes records from Costco (PRICE), Micron (MU), and Accenture (ACN) are likewise on deck.

What’s following for the Fed?

The silent duration mores than therefore is the tightening up. The general public is readied to get fresh discourse from Fed authorities in the days after the meaningful change far from a limiting financial plan. Probably the greatest concern for policymakers is, where do we go from right here?

At the very least 8 reserve bank authorities, consisting of Powell, Federal Get vice chair for guidance Michael Barr, and New york city Fed principal John Williams, are arranged to use speeches or take part in meetings in the days in advance, most likely providing shade to the Fed’s choice to reduce rates of interest by 50 basis factors. Fed participants see 2 even more 25 basis factor cuts this year, adhered to by 4 even more in 2025.

Powell has stated the reserve bank was not playing catch-up in choosing a bigger price cut, attending to objection that the Fed ought to have alleviated prices at their last plan huddle in July. He’s likewise specified that cuts of 50 basis factors should not be considered the brand-new standard. Yet a better stagnation in the labor market can test both of his opinions.

Learn More: The Fed price cut: What it suggests for savings account, CDs, financings, and bank card

The brand-new dangers and the old

Rising cost of living was so high and the work market so limited that suppressing cost boosts was the Fed’s single emphasis over the last 2 years. Today that rising cost of living is cooling down and the work market revealing indicators of slowing down, the Fed needs to progress its required on both fronts.

On Wednesday Powell kept in mind the upside dangers to rising cost of living have actually reduced while the disadvantage dangers to work have actually enhanced. “We understand it is time to alter our plan,” he stated, validating that the equilibrium of dangers is “currently also.”

Experts anticipate Friday’s PCE analysis to find in at 2.3% year over year, below the previous month’s 2.5% yearly boost, according to Bloomberg information. Such a beneficial metric would certainly proceed a down climb and attest the Fed’s choice production.

Yet also as even more eyes get on the labor market, the Fed still hasn’t satisfied its rising cost of living objective of 2%. And as main lenders have actually stated, tipping off the brakes prematurely can permit enhanced rising cost of living to select back up.

As Financial Institution of America Global Study experts placed it in a note on Friday, “With above-potential development, a solid customer, and a record-breaking stock exchange, such a strong begin to a reducing cycle is difficult to validate if an economic downturn isn’t impending.”

” Unless the Fed is seeing something that we are missing out on, a much more hostile reducing cycle can make getting to the 2% target harder thinking about unpredictability in advance, consisting of the after-effects people political elections,” they composed.

Technology supply reset

Technology capitalists have actually gotten on the search for their following driver, and the Fed might have simply commended them. After a blended incomes period where Wall surface Road greatly soured on huge AI costs and blinked rashness for less-than-perfect quarters, the rate-sensitive field can return back to development setting.

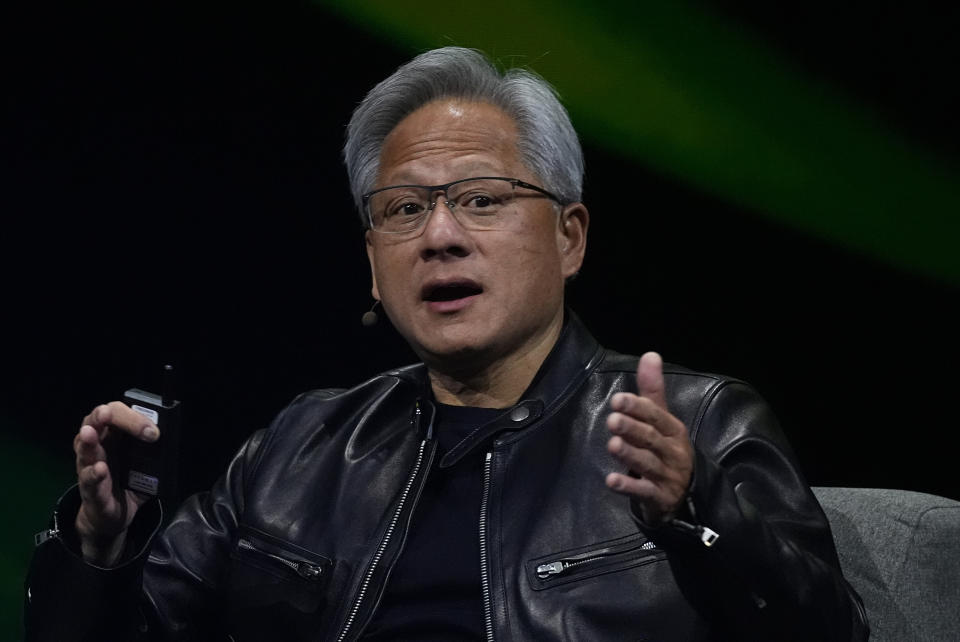

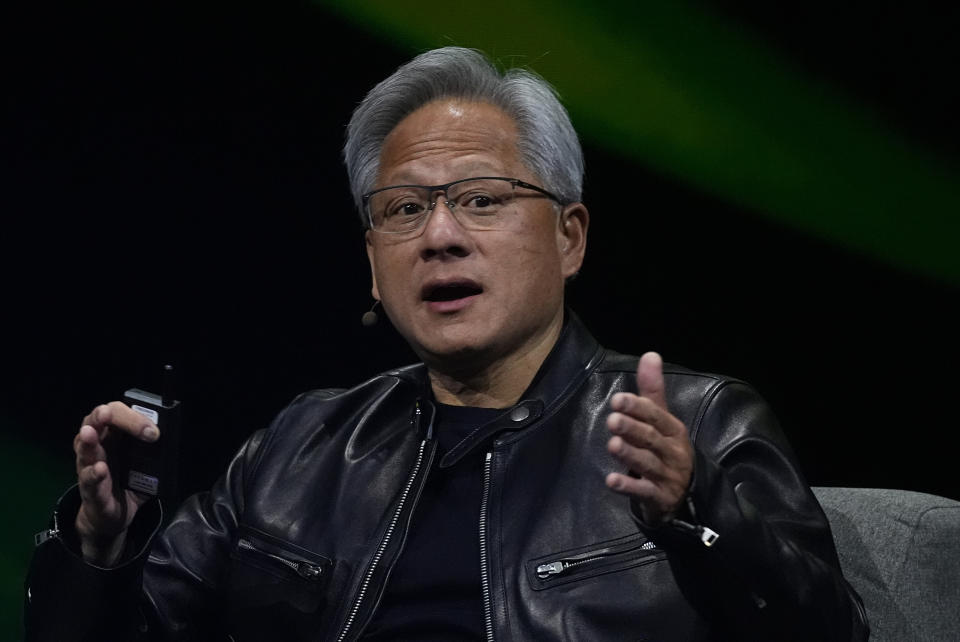

Just about among the “Splendid 7” supplies published gains recently, with Meta (META), Apple (AAPL), Alphabet (GOOG, GOOGL), Amazon (AMZN), Microsoft (MSFT), and Tesla (TSLA) all exceeding the more comprehensive market. Nvidia (NVDA), the single loser, lost greater than 2% recently as it faces volatility after a spectacular springtime and summertime increase. Still, some experts see an even more nuanced photo. As Citi head people equity method Scott Chronert advised, the benefit of also one of the most high-flying technology supplies is restricted as the capability to match their previous development ends up being harder.

Weekly Schedule

Monday

Financial information: S&P Global United States Solutions PMI, September (48.5 anticipated, 47.9 formerly); Chicago Fed Nat Task Index, August (-.20 anticipated, -0.34 formerly)

Revenues: No significant incomes

Tuesday

Financial information: S&P CoreLogic Case-Shiller, 20-City Compound home consumer price index, month over month, July (0.42% formerly); S&P CoreLogic Case-Shiller, 20-City Compound home consumer price index, year over year, July (6.47% formerly); Seminar Board Customer Self-confidence, September (102.8 anticipated, 103.3 formerly)

Revenues: AutoZone (AZO), Thor (THO), KB Home (KBH), Worthington (WOR), Stitch Repair (SFIX)

Wednesday

Financial information: MBA Home mortgage Applications, week finishing September 20 (14.2% previous); New home sales, August (693,000 anticipated, 739,000 previous); New home sales month over month, August (-6.3% anticipated, 10.6% formerly)

Revenues: Micron (MU), Jefferies (JEF), Cintas (CTAS)

Thursday

Financial information: 2nd quarter GDP, 2nd modification (+2.9% annualized price anticipated, +3% formerly); 2nd quarter individual intake, 2nd modification (+2.9% formerly); First unemployed insurance claims, week finished Sept. 21 (219,000 formerly); Durables orders, August (-2.9% anticipated, 9.8% formerly)

Revenues: Costco (PRICE), Accenture (ACN), BlackBerry (BB), CarMax (KMX), Jabil (JBL)

Friday

Financial information: College of Michigan customer belief, September last (69 previous)

PCE rising cost of living, month over month, August (+0.1% anticipated, +0.2% formerly); PCE rising cost of living, year over year, August (+2.3% anticipated, +2.5% formerly); “Core” PCE, month over month, August (+0.2% anticipated, +0.2% formerly); “Core” PCE, year over year, January (+2.7% anticipated; +2.6% formerly)

Revenues: No significant incomes

Go here for thorough evaluation of the most up to date stock exchange information and occasions relocating supply costs

Review the most up to date economic and organization information from Yahoo Money

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.