-

BMO’s Brian Belski elevated his S&P 500 rate target to 6,100, indicating 7% advantage by year-end.

-

The Fed’s price cut and positive seasonal information sustain the favorable position.

-

Belski mentions expanding market gains and a most likely soft touchdown for the United States economic climate as crucial elements to enjoy.

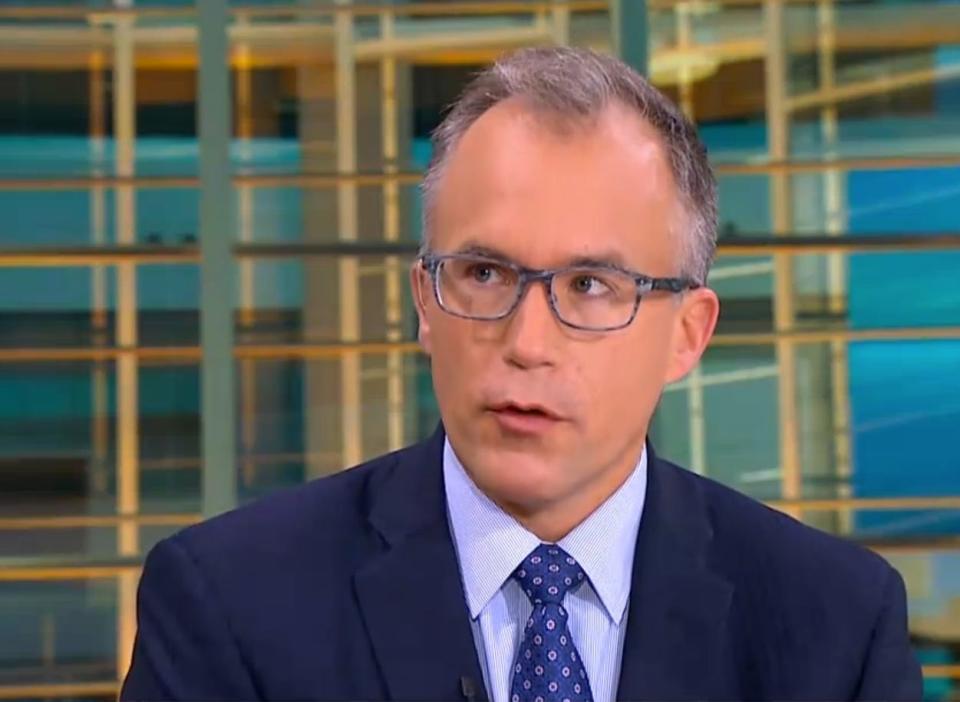

Brian Belski of BMO has actually taken the area as one of the most favorable equity planner on Wall surface Road.

In a note on Thursday, Belski elevated his S&P 500 rate target for 2024 to 6,100, standing for prospective advantage of 7% over the following 3 months.

Belski’s previous 2024 rate target for the S&P 500 was 5,600.

A mix of elements, consisting of the Federal Reserve’s 50 basis point interest rate cut on Wednesday, sufficed to make Belski much more favorable on supplies.

” Similar to our last target boost in May, we remain to be shocked by the stamina of market gains and determined yet once again that something greater than a step-by-step change was necessitated,” Belski claimed.

Belski claimed positive seasonal information recommends the securities market will certainly complete the year solid in the 4th quarter, “specifically given that the Fed has actually changed to relieving setting.”

Because 1950, there have actually been 8 years when the S&P 500 was greater by around 15% to 20% in the very first 9 months of the year.

According to Belski, in those years, the S&P 500 saw a typical 4th quarter return of regarding 6%, which has to do with 50% more than the typical 4th quarter return for all years.

Belski additionally discovers it motivating that current securities market gains have actually not been focused in simply the mega-cap modern technology supplies.

Rather, the securities market rally has been broadening out to other sectors and smaller-sized companies.

” This is a pattern we anticipate to proceed and need to aid to sustain future market gains also if the rate and basic efficiency of Mag-X supplies remains to slow down in the months in advance,” Belski described.

Lastly, with the enhanced probability of a soft touchdown in the United States economic climate, Belski claimed that raised assessments are warranted.

Based upon Belski’s 6,100 rate target, that suggests a price-to-earnings proportion of 24.4 x, which is over historic standards.

” We remain to think a soft touchdown is one of the most likely financial circumstance that makes the existing setting most similar to the mid-1990s – a duration where the index had the ability to maintain a greater-than 20x several for a number of years,” Belski claimed.

Review the initial short article on Business Insider

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.