After weeks of care, Bitcoin (BTC) investors are getting rid of their worries and boosting their trading task. This restored energy is available in feedback to the Federal Book’s choice to reduce rate of interest by 50 basis factors (0.50%), reigniting market self-confidence.

Bitcoin is currently trading over $61,000 for the very first time in almost a month, signifying a prospective rally coming up.

Bitcoin Sees Renewal in Trading Task

The Federal Book’s 50 basis factor price cut is anticipated to drive even more financial investment right into riskier properties, such as Bitcoin. This fad has actually currently started, noted by a favorable change in belief towards the leading cryptocurrency.

After weeks of anxiety controling the marketplace, belief changed to neutral on Wednesday complying with the price cut. This change signals restored self-confidence, with Bitcoin owners neither extremely cynical neither exceedingly hoggish. In such neutral problems, capitalists normally come back the marketplace progressively, improving trading quantities and adding to a stable rate rise.

Learn More: Bitcoin Halving Background: Whatever You Required To Know

Since press time, Bitcoin is trading at $61,967. Earlier Thursday early morning, BTC briefly got to $62,501 prior to experiencing a minor pullback. Over the previous 1 day, trading quantity rose by 12%, amounting to $46 billion.

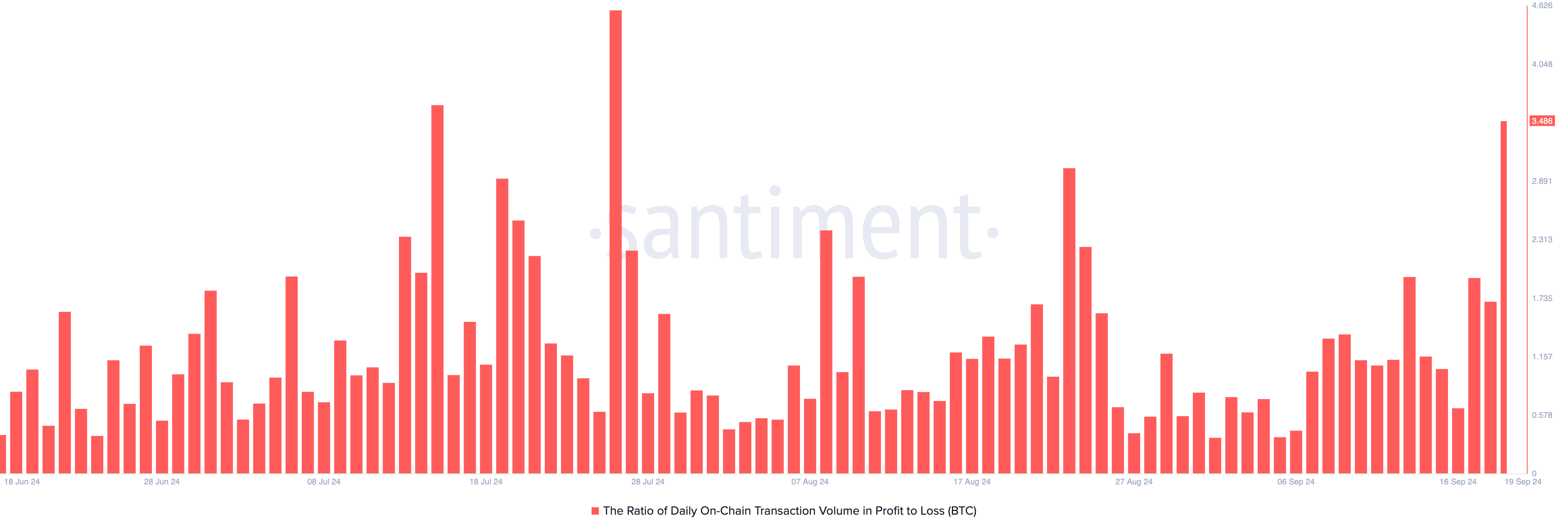

With Bitcoin trading at its greatest in almost a month, most of Thursday’s deals have actually paid. According to BeInCrypto, the proportion of BTC’s purchase quantity in revenue to loss has actually reached its highest degree given that July, standing at 3.48. This implies that for every single purchase leading to a loss, 3.48 deals have actually made a profit.

Regardless of Bitcoin’s favorable rate motion, Bitcoin area ETFs saw their initial web discharge after 4 successive days of inflows. SoSoValue reports that discharges from these funds amounted to $53 million on Wednesday.

BTC Rate Forecast: A Succesful Retest Might Drive Coin Towards $64,000

Bitcoin’s current rate spike has actually pressed it over the essential resistance degree of $61,388. Furthermore, it is currently trading over its 20-day rapid relocating standard (EMA), which shows that getting stress is exceeding marketing task.

While this rally is significant, Bitcoin is most likely to retest this resistance degree. Because the assistance flooring turned to resistance in very early August, BTC has actually just taken care of to appear it as soon as. Each rally effort has actually encountered solid marketing stress, causing a sag. A stopped working retest might see Bitcoin go down to look for assistance around $54,302.

Learn More: Bitcoin (BTC) Rate Forecast 2024/2025/2030

Nonetheless, if the retest prospers and BTC breaks over the resistance, the uptrend will certainly be verified, with Bitcoin possibly targeting $64,312.

Please Note

According to the Count on Job standards, this rate evaluation write-up is for educational objectives just and need to not be thought about monetary or financial investment guidance. BeInCrypto is dedicated to exact, impartial coverage, yet market problems undergo transform without notification. Constantly perform your very own study and talk to an expert prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.