Chainlink’s (WEB LINK) cost has actually climbed over $11 complying with the current Fed price cut. This rise has actually sparked fresh supposition regarding the coin’s temporary expectation.

In this evaluation, BeInCrypto takes a look at the variables adding to the walk, the prospective ramifications of the price cut, and what investors can get out of web link.

Chainlink Trick Drivers Need Much More

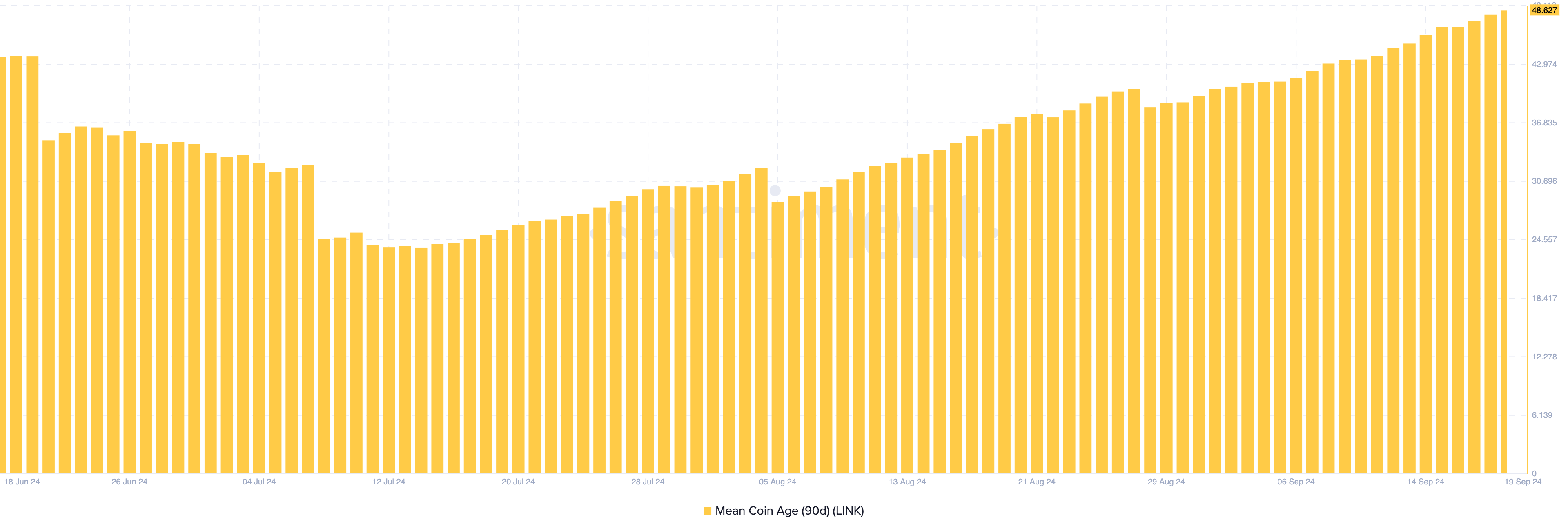

According to Santiment, together with the current price cut, Chainlink’s 90-day Mean Coin Age (MCA) has actually climbed. The MCA shows the typical age of symbols in blood circulation, with a reduced MCA recommending that formerly non-active symbols are being relocated from chilly pocketbooks, possibly resulting in a sell-off and placing descending stress on the cost.

Alternatively, an increasing MCA shows that capitalists are keeping their symbols and involving much less in trading task, usually signifying a long-lasting hold approach. In Chainlink’s instance, the spike in the MCA recommends that numerous capitalists are picking to maintain their web link symbols inactive or relocating them right into self-custody, decreasing marketing stress.

Find Out More: Exactly How To Purchase Chainlink (WEB LINK) and Whatever You Required To Know

Past the increasing coin age, the 4-hour LINK/USD graph exposes a rise in the Advancing Quantity Delta (CVD), a vital sign of market view. Each bar on the CVD reveals whether the marketplace is controlled by acquiring or offering task. Red bars signal marketing stress, which might drive the cost down.

In web link’s instance, the graph reveals 5 successive eco-friendly bars, showing continual acquiring stress. This recommends that the marketplace’s need for web link is expanding, possibly sustaining the extension of its uptrend.

Web Link Rate Forecast: More Gains

The everyday graph reveals that Chainlink is holding solid at the $10.02 assistance degree, which played a vital duty in its current outbreak over the $10.83 resistance. Presently, web link is trading at $11.30, without any substantial resistance visible to stop the uptrend.

Making use of Fibonacci retracement degrees to examine prospective cost targets, web link’s following most likely step might take it to $11.86, representing the 38.2% Fibonacci degree. If it damages past this factor, the following target might be about $12.98, a degree that shows up accessible offered the existing energy.

Find Out More: Chainlink (WEB LINK) Rate Forecast 2024/2025/2030

Nevertheless, the cryptocurrency might experience a pullback if it falls short to go beyond $11.86. If that takes place, web link could go down to $9.25.

Please Note

In accordance with the Count on Task standards, this cost evaluation write-up is for informative functions just and must not be thought about monetary or financial investment guidance. BeInCrypto is devoted to precise, objective coverage, yet market problems go through transform without notification. Constantly perform your very own research study and speak with an expert prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.