The crypto market is supporting for increased volatility as almost $1.6 billion well worth of Bitcoin (BTC) and Ethereum (ETH) alternatives end today.

This occasion accompanies the Federal Get’s current choice to reduce rate of interest by 50 basis factors (bps).

Fed’s Choice Gas the Crypto Market Rally Ahead of Major Options Expiration

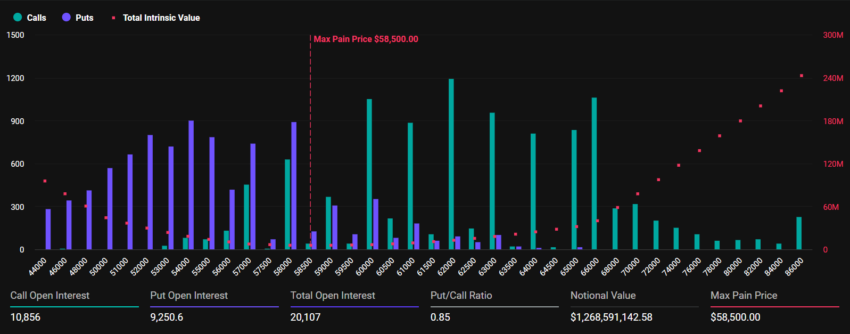

According to information from Deribit, 20,037 Bitcoin alternatives agreements worth roughly $1.26 billion will certainly end on September 20. These agreements have a put-to-call proportion of 0.85 and an optimum discomfort factor of $58,500.

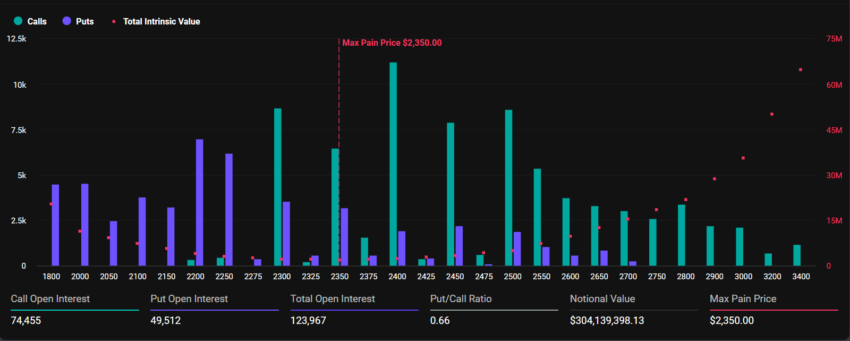

Likewise, Ethereum’s alternatives market is readied to end with 125,046 agreements worth $308.16 million. Today’s running out Ethereum agreements have a put-to-call proportion of 0.65, with an optimum discomfort factor of $2,350.

Learn More: An Intro to Crypto Options Trading

In alternatives trading, the optimum discomfort factor describes the cost degree at which alternative owners would certainly endure the biggest losses. It is basically the cost at which the greatest variety of alternatives (both phone calls and places) would certainly end useless, bring upon optimal economic “discomfort” on investors. On the various other hand, the put-to-call proportion determines market belief by contrasting the variety of put alternatives (bank on cost decreases) to call alternatives (bank on cost boosts).

Greeks. live’s current evaluation detailed the effect of the Fed’s choice to reduce prices for today’s running out crypto alternatives agreements. The experts kept in mind that the Fed’s action was mostly anticipated and lined up with macroeconomic projections.

” Suggested volatility decreased considerably throughout all significant maturations, with ultra-short-term IVs dropping by over 25%, as temporary short-selling assumptions by big capitalists failed,” they wrote.

Looking in advance, Greeks.live additionally kept in mind that there will certainly be one more rates of interest conference on November 8 and December 19 this year, where the marketplace anticipates an advancing 100 bps price cut. The following price cut might accompany the United States political election, enhancing the chance of increased market volatility.

BeInCrypto reported that today’s price cut has actually favorably influenced the crypto market. Adhering to the choice, Bitcoin rose from the $59,000 degree to go beyond the $63,500 mark.

Likewise, Ethereum additionally experienced a considerable boost throughout the duration. Information revealed that ETH escalated from $2,293 to as high as $2,482.

Nonetheless, both possessions have actually currently supported. At the time of composing, Bitcoin and Ethereum are trading at $62,890 and $2,450, specifically.

Learn More: 9 Finest Crypto Options Trading Operatings Systems

In spite of the favorable energy, investors are recommended to stay careful. Historically, alternatives expiry frequently results in temporary instability out there. The following couple of days will certainly be critical in establishing whether Bitcoin and Ethereum can maintain their higher patterns or if a duration of adjustment looms.

Please Note

In adherence to the Count on Task standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to give precise, prompt info. Nonetheless, viewers are recommended to confirm truths separately and speak with an expert prior to making any type of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.