Adhering to an extended duration of adjustment and debt consolidation, Shiba Inu (SHIB) might be established for a favorable outbreak. This advancement follows the Federal Get rates of interest cut, which has actually driven crypto rates up.

As the meme coin placements for an eruptive step, this evaluation checks out the variables behind the changed forecast and what investors ought to keep an eye out for.

Shiba Inu Uses a Possibility, Improves Investors’ Self-confidence

2 weeks earlier, SHIB was trading at $0.000012, in the middle of problems of a prospective capitulation. Nevertheless, the rate has actually considering that reached $0.000014, stimulated by the Federal Competitive market Board’s (FOMC) choice to execute a 50 basis factor rates of interest cut.

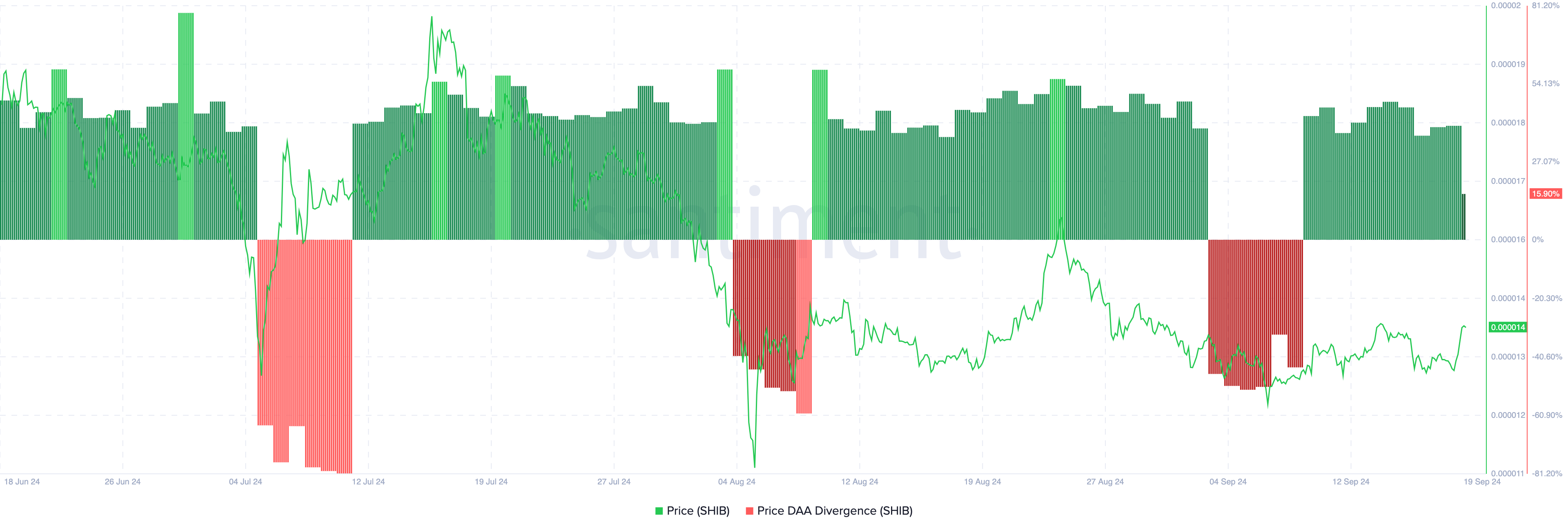

At the time when SHIB traded at $0.000012, its price-Daily Energetic Addresses (DAA) aberration revealed an adverse analysis. This on-chain metric is crucial for determining possible entrance and leave factors in the marketplace. An adverse price-DAA aberration signals reduced customer interaction on the blockchain, recommending that a cost increase might not be lasting as a result of not enough network task to preserve the pattern.

Nevertheless, as seen listed below, Shiba Inu’s price-DAA aberration has actually transformed favorable at 15.90%. This suggests that the current uptrend is backed by increasing network task. Thus, SHIB still supplies a chance to acquire as the rate might turn greater than its present degree.

Find Out More: Leading 9 Most Safe Crypto Exchanges in 2024

Mentioning SHIB’s future possibility, data from Coinglass exposes a rise in by-products quantity. Formerly, both the place and by-products markets revealed reduced task, mirroring restricted passion in the token.

As quantity raised, there was a noteworthy change in the Financing Price, which works as an indication of investor view. An adverse Financing Price usually indicates that the majority of investors hold brief placements. Nevertheless, at press time, the price has actually changed to favorable, recommending that investors are currently preparing for additional rate boosts and are backing this expectation with lengthy placements.

SHIB Cost Forecast: Favorable Outbreak visible

To give a more clear photo of SHIB’s rate forecast, BeInCrypto analyzes the regular graph. According to the evaluation, the meme coin has actually created a dropping wedge, which goes back to the annual high in March when the rate struck $0.000032.

A dropping wedge is a favorable technological pattern created by the down incline of reduced optimals and troughs. Based upon the picture listed below, purchasers are starting ahead in and take advantage of vendors’ fatigue.

Must this stay the exact same, SHIB’s rate may fall short to go down to $0.000010. Rather, the token might damage over the resistance around $0.000015 and climb by 40% towards $0.0000019, perhaps around the initial weeks of 2024’s last quarter.

Find Out More: 12 Ideal Shiba Inu (SHIB) Budgets in 2024

Nevertheless, if vendors counteract the purchaser’s lately located control, the forecast could be revoked. If that occurs, SHIB may decrease to $0.000010.

Please Note

In accordance with the Count on Job standards, this rate evaluation short article is for educational objectives just and ought to not be taken into consideration monetary or financial investment guidance. BeInCrypto is devoted to exact, impartial coverage, yet market problems undergo alter without notification. Constantly perform your very own study and talk to an expert prior to making any kind of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.