Chainlink founder Sergey Nazarov forecasts that tokenized real-world properties (RWAs) will certainly quickly be better than cryptocurrencies. He indicates the boosting participation of standard financing in decentralized financing, driven by an expanding rate of interest in tokenization.

Nazarov additionally kept in mind that Chainlink prepares to make use of this change in the blockchain room.

TradFi Rate Of Interest in Tokenized RWAs To Change Blockchain

Nazarov expects an interconnected globe where decentralized financing (DeFi) and TradFi proactively negotiate with each various other. Recognizing the expanding rate of interest in tokenized RWAs, he states TradFi would certainly be DeFi’s biggest client.

Talking at Token2049 in Singapore, Nazarov highlighted DeFi’s capacity to create return and develop reputable markets for RWAs. He advised the sector to plan for this change, keeping in mind that it’s currently taking place, driven by property tokenization. According to Nazarov, blockchain modern technology is providing TradFi precisely what it requires.

Chainlink founder additionally highlighted just how decentralized frameworks like Chainlink and wise agreements are changing the electronic room by eliminating the requirement for standard counterparty partnerships. As opposed to depending on human decision-making, automated code makes sure results, boosting performance and decreasing dangers that standard financing designs typically deal with.

Learn More: Real Life Property (RWA) Backed Tokens Explained

Nazarov stressed that this stands for a significant change from the present TradFi design, where hold-ups and dangers originate from human treatment.

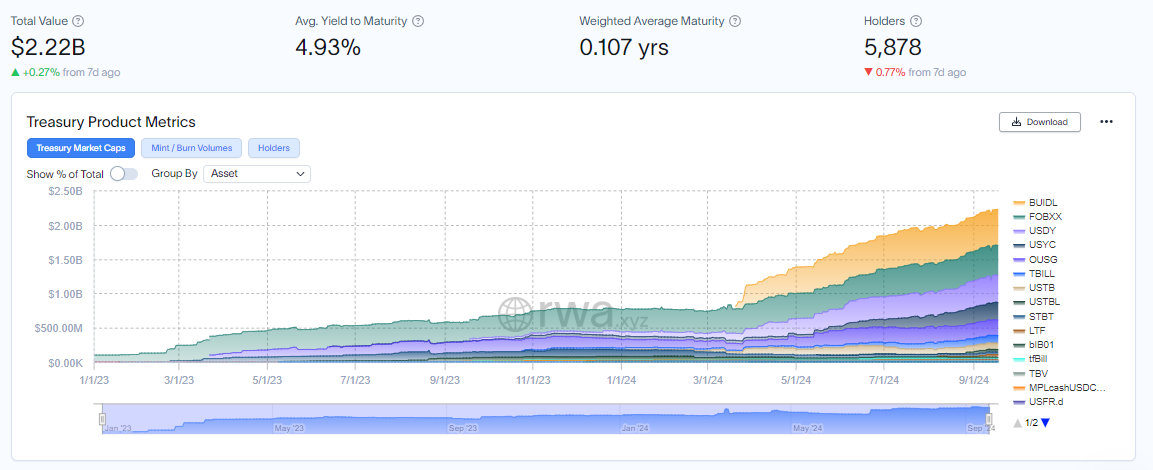

His comments straighten with his declarations from late August, when he anticipated that tokenized real-world properties (RWAs) would certainly go beyond crypto in worth by 2027, driven by institutional rate of interest and TradFi assimilation. Presently, the RWA market is expanding, with RWA.xyz information revealing it is currently a $2.22 billion sector.

This advancement comes as blockchain modern technology remains to deal with the framework tests encountered by standard financing, while additionally opening brand-new financial investment chances. Blockchain’s capacity to improve process and substantially enhance negotiation times is specifically attractive– resembling what Sergey Nazarov clarified regarding the performance and assurance that decentralized systems deal.

” TradFi requires all type of various information that permit those standard financing wise agreements to work effectively … the Web Property Worth (NAV) information of tokenized funds is an instance of a control panel reside on manufacturing revealing the evidence of Books of among the lots of ETF funds make use of to show features of them,” Nazarov stated.

Learn More: What is Tokenization on Blockchain?

Regardless of, the roadway to a total change to electronic framework is altered with difficulties. Amongst them are lawful factors to consider, identification criteria, and information personal privacy, which would certainly require cautious examination with governing systems in mind.

As Necessary, TradFi and DeFi gamers and the wider monetary solutions sector need to function to develop frameworks with the ability of sustaining wider tokenization fostering while making certain protection and conformity prior to Nazarov’s desire can come true.

Please Note

In adherence to the Depend on Job standards, BeInCrypto is dedicated to impartial, clear coverage. This newspaper article intends to offer exact, prompt info. Nonetheless, visitors are suggested to validate truths separately and speak with an expert prior to making any kind of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.