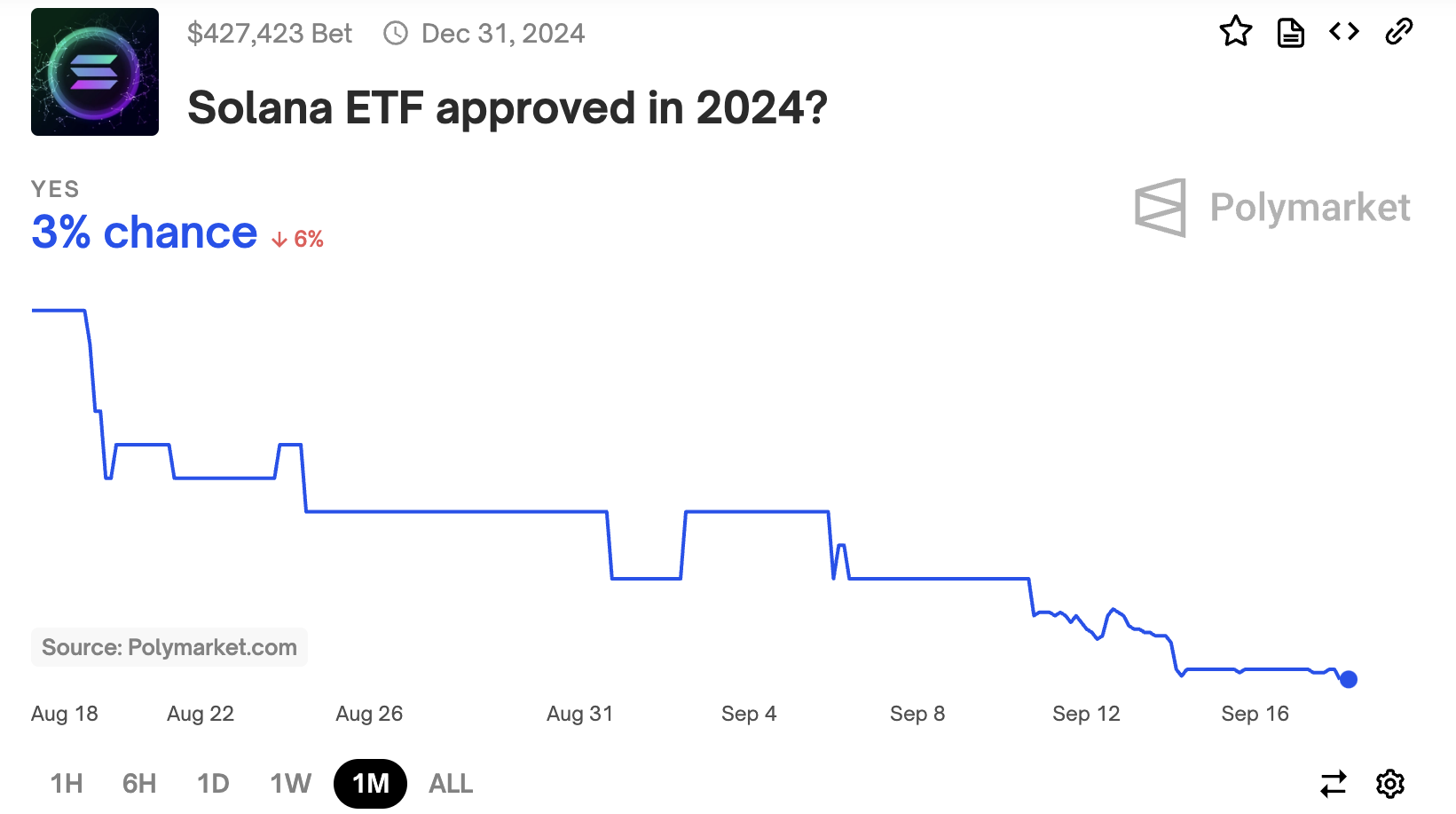

Polymarket forecasts for a Solana exchange-traded fund (ETF) dive less than ever, to a dark 3%. However, some professionals are favorable on the lengthy video game.

The significance of regulative adjustments is set, however the excellent type of these adjustments is contested.

Solana: The Longshot ETF

Polymarket, the decentralized forecast market system, has downgraded the probability of a Solana ETF yet once more. Given that the website started taking bank on the Solana ETF, its likelihood has actually never ever surpassed 15%. However, the previous month has actually seen this already-low opportunity accident, such that it currently rests at a disappointing 3%.

Learn More: Solana ETF Explained: What It Is and Just How It Functions

To put it simply, a Solana ETF has actually constantly been taken into consideration a longshot. And yet, it still has specific benefits that make it most likely than a lot of cryptoassets.

After a long term battle, the SEC accepted ETFs for Bitcoin and Ethereum in the exact same year, and lots of professionals assume that Solana is a sensible prospect for number 3. Brazil has actually currently revealed its authorization, and hope continues to be that this ETF will certainly act as a useful examination instance.

Positive Side?

Nate Geraci, Head Of State of The ETF Shop, was honest in his dismissal by means of social networks.

” It’s tough to imagine any kind of added area crypto ETFs concerning market under [the] present management. Absolutely nothing would certainly suggest an area Solana or XRP ETF is feasible in following year or more offered [the] present state,” Geraci stated.

For Geraci, simply put, the only expect a Solana exchange traded fund would certainly originate from the United States Governmental political election, though he did not clearly back a prospect.

Matt Hougan, the Principal Financial Investment Police Officer at Bitwise, was much more positive. In a current meeting, he said that Bitcoin ETFs invested 10 years combating beings rejected. Yet, the SEC ultimately offered a thumbs-up to Bitcoin and Ethereum ETFs in 2024.

The very first authorization can open up the floodgate, and succeeding success will certainly be much easier.

” From my viewpoint, resolution of unpredictability is one of the most crucial variable. We assume those points are mosting likely to integrate It’s gon na take regulative adjustments”, he included.

Learn More: XRP ETF Discussed: What It Is and Just How It Functions

Hougan appeared a lot less likely to connect ETF efficiency to the upcoming political election itself. Instead, he asserted that regulative unpredictability would certainly settle itself throughout the project, and brand-new ETF initiatives would certainly do much better in the resultant clearness. Bitwise prepares to lead these initiatives via information.

” Bitwise has actually constantly led with information in its SEC filings. We’re really thrilled concerning the Solana community. We assume it’s durable. We’re doing the job,” Hougan asserted.

Please Note

In adherence to the Trust fund Job standards, BeInCrypto is dedicated to objective, clear coverage. This newspaper article intends to give precise, prompt details. Nevertheless, viewers are recommended to confirm truths separately and seek advice from a specialist prior to making any kind of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.