The Federal Book set up a 50-point price cut, with encouraging liquidity problems for a Bitcoin cost spike. Nevertheless, threats are plentiful with cuts this serious, and crypto earnings are much from assured.

Worldwide liquidity is highly likely to raise, yet this could not amount to Bitcoin inflows.

Price Cuts, Liquidity and Bitcoin

The Federal Book has actually selected a 50-point price cut, and Bitcoin’s cost has actually been skyrocketing. Offered these and more comprehensive market fads, lots of in the neighborhood anticipate a Bitcoin booming market.

Nevertheless, price cuts alone can not assure such desirable market problems; various other aspects are likewise critical. The vital to comprehending every one of this is international liquidity.

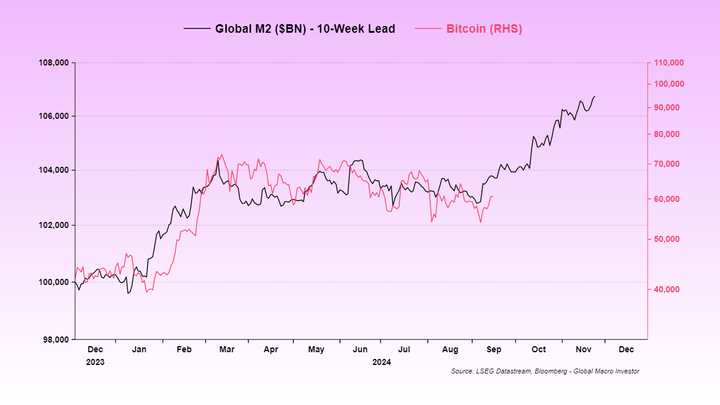

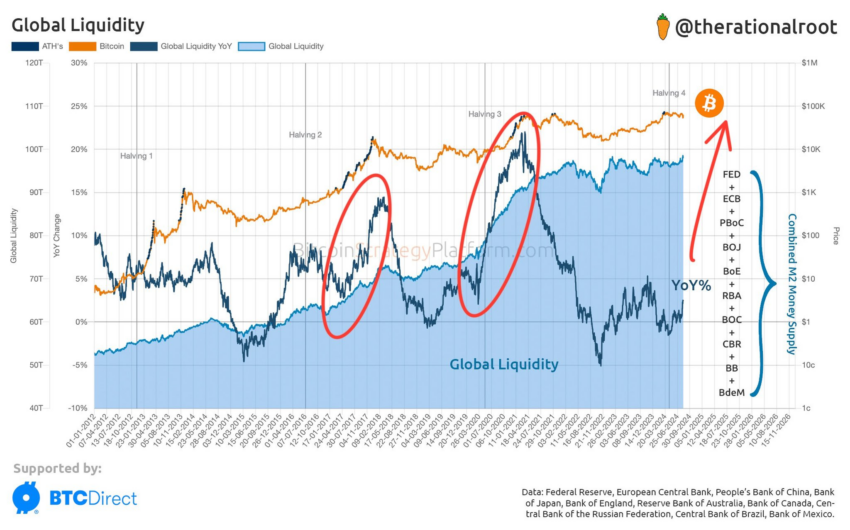

Initially glimpse, Bitcoin’s cost over the last couple of weeks has actually appeared ponderous, slow, and unclear. Upon a more detailed look, however, it is in fact trending closer than ever. Raoul Friend, chief executive officer and owner of Worldwide Macro Financier, noted that this connection was “close, extremely close” throughout 2024.

Contrasted to previous years’ data on Worldwide Liquidity (L2) and the cost of Bitcoin, this year’s distance is startling.

In a special meeting with BeInCrypto, Adrian Fritz, Head of Research Study at 21Shares, explained the partnership in between cuts and liquidity.

” The upcoming Fed price cut can cause temporary Bitcoin cost volatility. Nevertheless, the level of the cut will certainly play a vital function fit market responses. A much more hostile 50 bps reduced can supply temporary liquidity alleviation,” he included, with noticeable value for Bitcoin,” Fritz stated.

The “much more hostile” price cut has actually happened, and Bitcoin has actually currently reacted in kind. The buck is the international book money, and United States price cuts have reputable impacts on liquidity and market threats. Crypto offers an important tank of liquidity for global markets, and this dynamic has actually just enhanced.

Quinten Francois, founder of WeRate, has actually kept in mind a fad directing in the direction of a liquidity spike, and Bitcoin will definitely gain from it. Appears easy, best?

Learn More: Bitcoin Halving Background: Every Little Thing You Required To Know

Risks in a Volatile Market

Rob Viglione, Chief Executive Officer of Horizen Labs, likewise talked about these characteristics with BeInCrypto. Like Fritz, he likewise anticipated a 25-point price cut:

” Because a 25 basis factor cut is greatly anticipated, significant cost swings are not likely, yet the instructions of traveling in the short-term will likely declare as financiers relocate to much more unstable possessions. In the longer term, reduced rates of interest will certainly remain to prefer risk-on possessions like Bitcoin, as financiers remain to look for greater returns beyond standard financial investments,” Viglione declared.

Nevertheless, both took too lightly the level of these cuts. Viglione stated that significant cost swings were not likely in a 25-point circumstance, yet cuts are far more serious.

Simply put, the marketplace can be established for a significant spike. There are risks, also, however, that might separate Bitcoin and a large rating.

” A 50-point cut might likewise enhance issues concerning much deeper financial obstacles or the threat of an approaching economic crisis, which can cause a cost pullback. This is specifically appropriate thinking about Bitcoin’s current failing to appear the $60,000 mark and September’s traditionally inadequate efficiency for both Bitcoin and more comprehensive markets,” Fritz ended.

The Good News Is, Bitcoin has actually currently appeared $60,000. Bitcoin is seen, maybe inaccurately, as a risk-on property, and reduced rates of interest do profit these. In the meantime, all the conitions appear affordable to anticipate a cost spike, gave that capitalist self-confidence stays high. No one can recognize the future, yet we might without a doubt see $100,000 Bitcoin quicker than we assume.

Please Note

In adherence to the Depend on Task standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to supply precise, prompt details. Nevertheless, viewers are recommended to confirm realities separately and talk to a specialist prior to making any kind of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.