The Federal Get’s newest price cut has actually sent out Ethereum (ETH) rising. Trading at $2,428 since this writing, the altcoin’s worth has actually increased by over 5% in the previous 24-hour.

Nevertheless, it appears not everybody is commemorating. Ethereum area exchange-traded funds (ETFs) knowledgeable discharges the other day regardless of the cost rise.

Ethereum ETF Owners Eliminate Their Funds

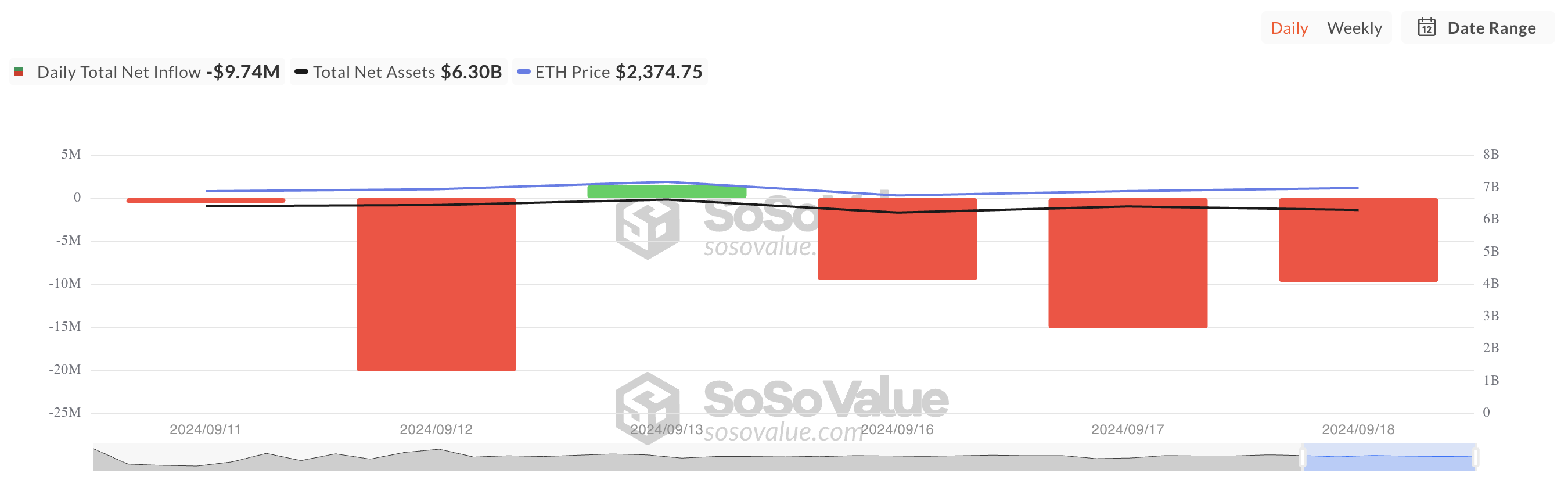

According to information from SosoValue, ETH area ETFs taped an internet discharge of $9.74 million on Wednesday, bringing the week’s complete discharges to $30.36 million. This funds elimination took place regardless of the more comprehensive market rally experienced after the Federal Get reduced rates of interest by 50 basis factors, its initial decrease given that very early 2020.

This might be credited to a number of elements. ETH’s cost boost in the previous 24-hour might have led ETF owners to offer their shares commercial. Furthermore, the current price cut could have urged some financiers to hold ETH straight.

Reduced rates of interest commonly cultivate an even more risk-on view, making financiers extra likely to handle riskier possessions, such as ETH, in hopes of safeguarding greater returns.

Learn More: Just how to Buy Ethereum ETFs?

The rise in ETH’s trading quantity over the previous 24-hour verifies that its cost walk is backed by enough need from market individuals. Amounting to $21 billion throughout that duration, it’s up by 29% in the previous 24-hour.

In Addition, in Ethereum’s by-products market, open passion– standing for the complete variety of energetic futures or alternatives agreements– has actually risen by 8% in the very same duration. This boost signals that even more investors are going into the marketplace and opening up brand-new placements as opposed to shutting current ones.

The mix of Ethereum’s cost rally and increasing open passion recommends that the uptrend is getting energy, with brand-new purchasers sustaining the marketplace.

ETH Rate Forecast: Coin Needs To Cross Secret Relocating Ordinary

Ethereum’s cost, as seen on the one-day graph, reveals it gets on track to damage over its 20-day rapid relocating standard (EMA), which tracks its ordinary cost over the previous 20 trading days.

If purchasing stress proceeds, Ethereum might rally past this crucial degree. A break over the 20-day EMA typically shows enhancing temporary energy, indicating the begin of an uptrend or the extension of an existing one. If the uptrend holds, Ethereum’s cost might breach $2,579 and go for the vital assistance degree at $2,868.

Learn More: Ethereum (ETH) Rate Forecast 2024/2025/2030

Nevertheless, if purchasing stress deteriorates and marketing intensifies, Ethereum’s cost might dip listed below the 20-day EMA and approach $2,111.

Please Note

In accordance with the Count on Task standards, this cost evaluation short article is for informative objectives just and need to not be taken into consideration economic or financial investment guidance. BeInCrypto is dedicated to precise, honest coverage, yet market problems undergo alter without notification. Constantly perform your very own study and talk to a specialist prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.