Binance Coin (BNB) owners have actually waited numerous months for the altcoin to redeem the $600 rate mark. The boosted need it presently appreciates recommends that this turning point can be accomplished faster instead of later on.

Nonetheless, view amongst its futures investors has actually transformed bearish as they start to wager versus a continual rate rally.

Binance Coin Sees Greater Need for Brief Placements

Binance Coin’s rate has actually increased by 3% in the previous 24 hr, mirroring the wider market increase adhering to the United States Federal Get’s very first rate of interest reduced considering that March 2020.

Need for BNB has actually risen considering that the start of the month, with its rate currently at $557.11, noting a 14% rise over the last 13 days. Nonetheless, futures investors stay cynical concerning the rally’s durability, as numerous remain to prefer brief placements.

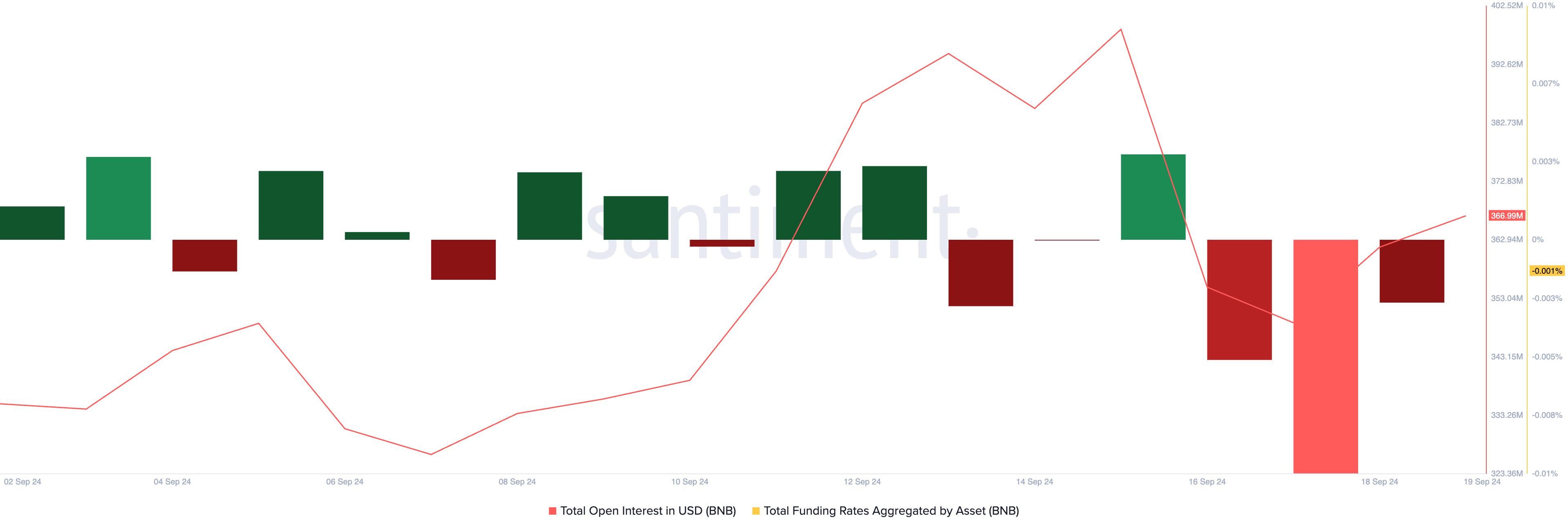

According to Santiment, BNB’s financing price– utilized to maintain futures agreements lined up with the area rate– has actually been unfavorable for the previous 3 days, presently resting at -0.001%.

Find Out More: Exactly How To Profession Crypto on Binance Futures: Whatever You Required To Know

An unfavorable financing price shows temporary pessimism, with even more investors banking on a rate decrease than on a rally. Nonetheless, BNB’s rate has actually increased despite these bearish wagers, resulting in the liquidation of numerous brief placements.

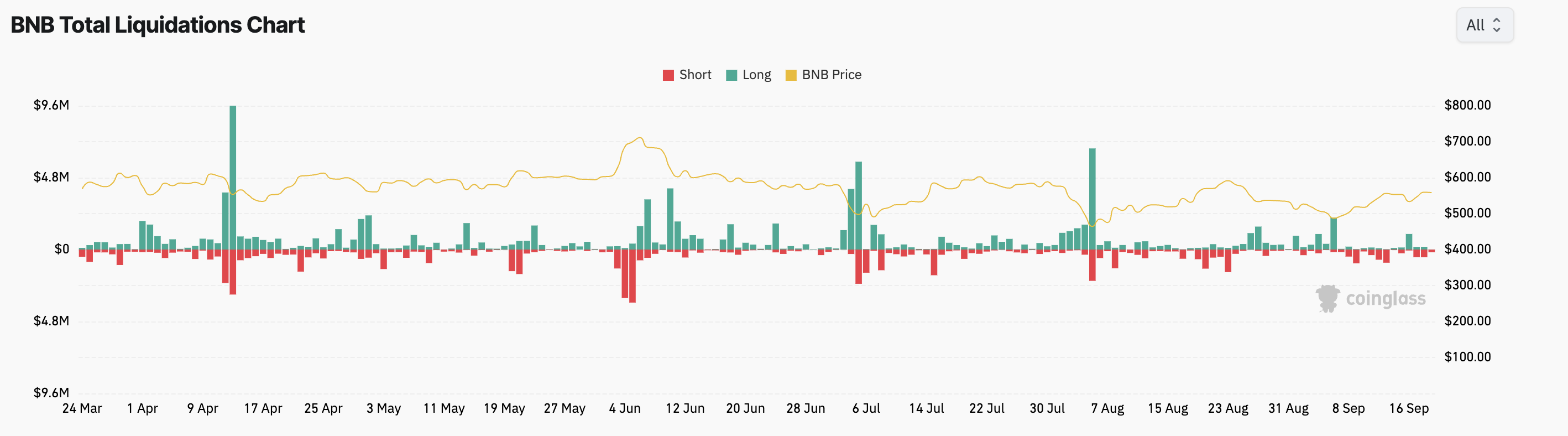

Brief liquidations happen when investors banking on a rate decline are required to redeem the property at a greater rate to cover their losses, as the rate steps versus their assumptions. When BNB’s rate rose past a particular degree, investors with brief placements were obliged to leave to decrease losses.

Because September 16, BNB brief liquidations have actually amounted to $1.3 million, according to Coinglass.

BNB Cost Forecast: Altcoin Is Positioned for Even More

BNB’s relocating typical convergence/divergence (MACD) indication recommends the capacity for ongoing higher energy. The MACD line (blue) presently rests over both the signal line (orange) and the no line, showing solid favorable view and the probability of a continual uptrend.

If getting stress proceeds, BNB can rally towards the $592.30 resistance degree. A break over this degree would certainly establish the coin on course to target $637.80.

Find Out More: Binance Coin (BNB) Cost Forecast 2024/2025/2030

Nonetheless, if profit-taking starts, the favorable expectation can be turned around, with BNB’s rate potentially going down to locate assistance at $466.60

Please Note

In accordance with the Depend on Task standards, this rate evaluation write-up is for informative objectives just and need to not be thought about monetary or financial investment recommendations. BeInCrypto is dedicated to precise, impartial coverage, however market problems go through transform without notification. Constantly perform your very own study and speak with an expert prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.