Regardless of current volatility, Binance Coin (BNB) seems revealing strength, with its cost holding over $500 given that September 11 and presently trading at $552.

With expanding market interest, this evaluation checks out why BNB might go for a greater worth in the close to term.

Binance Coin Energy Becomes Favorable

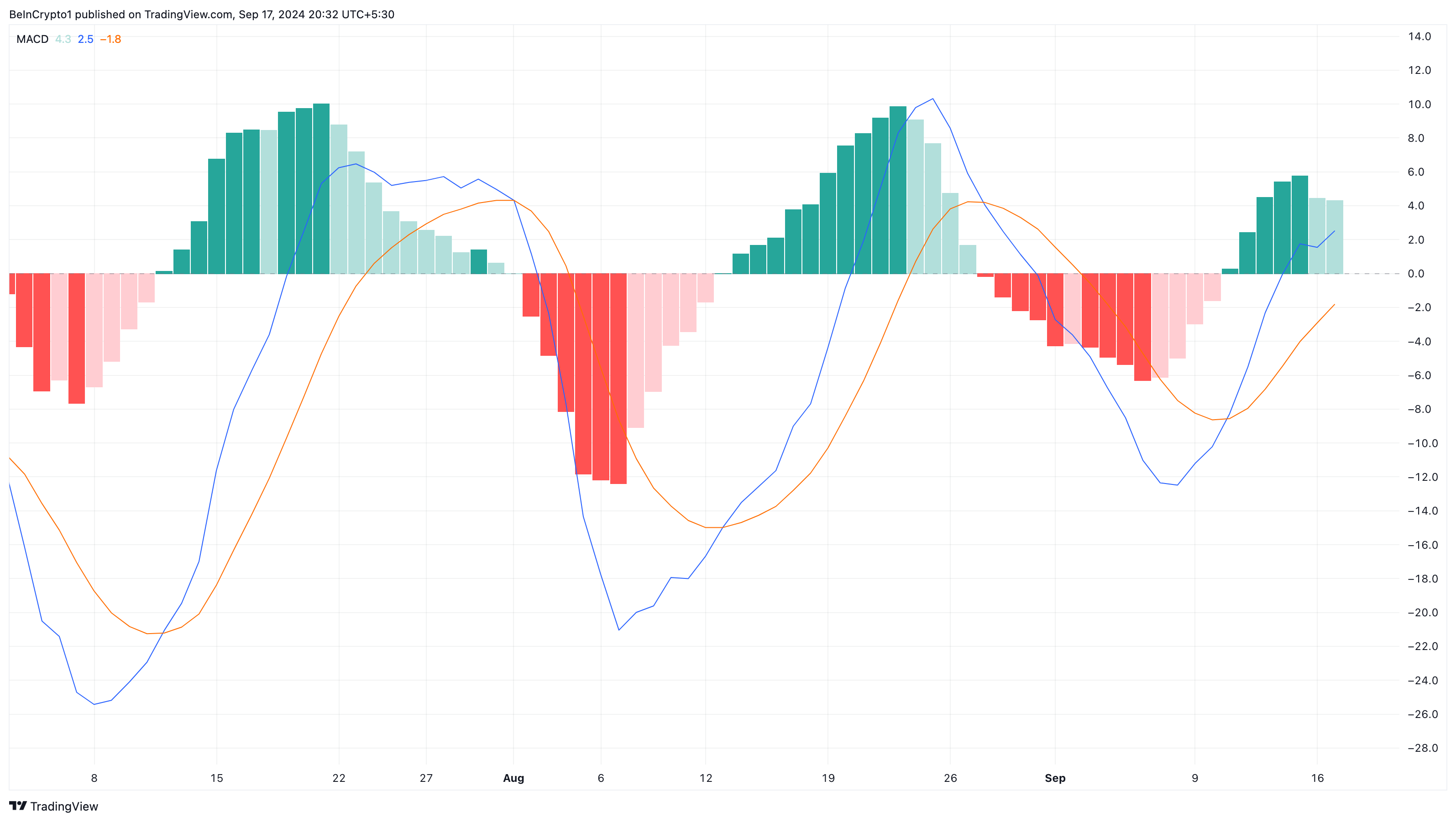

Based upon the day-to-day graph, Binance Coin’s (BNB) Relocating Ordinary Merging Aberration (MACD) indication is presently in the favorable area. The MACD determines energy by reviewing the connection in between the 12-day EMA (blue) and the 26-day EMA (orange) to determine prospective fad turnarounds.

Normally, when the 26-day EMA crosses over the 12-day EMA and the MACD analysis transforms adverse, vendors acquire control, and energy comes to be bearish, frequently resulting in a rate decrease. Historically, such situations have actually brought about BNB getting rid of a few of its previous gains.

Nonetheless, in today instance, the 12-day EMA has actually gone across over the 26-day EMA, suggesting that customers are presently leading. This crossover recommends that higher energy is constructing, and BNB’s cost might climb additionally if the purchasing stress proceeds.

Learn More: BNB Crypto Storage Space: Finest BNB Purses to Think About in 2024

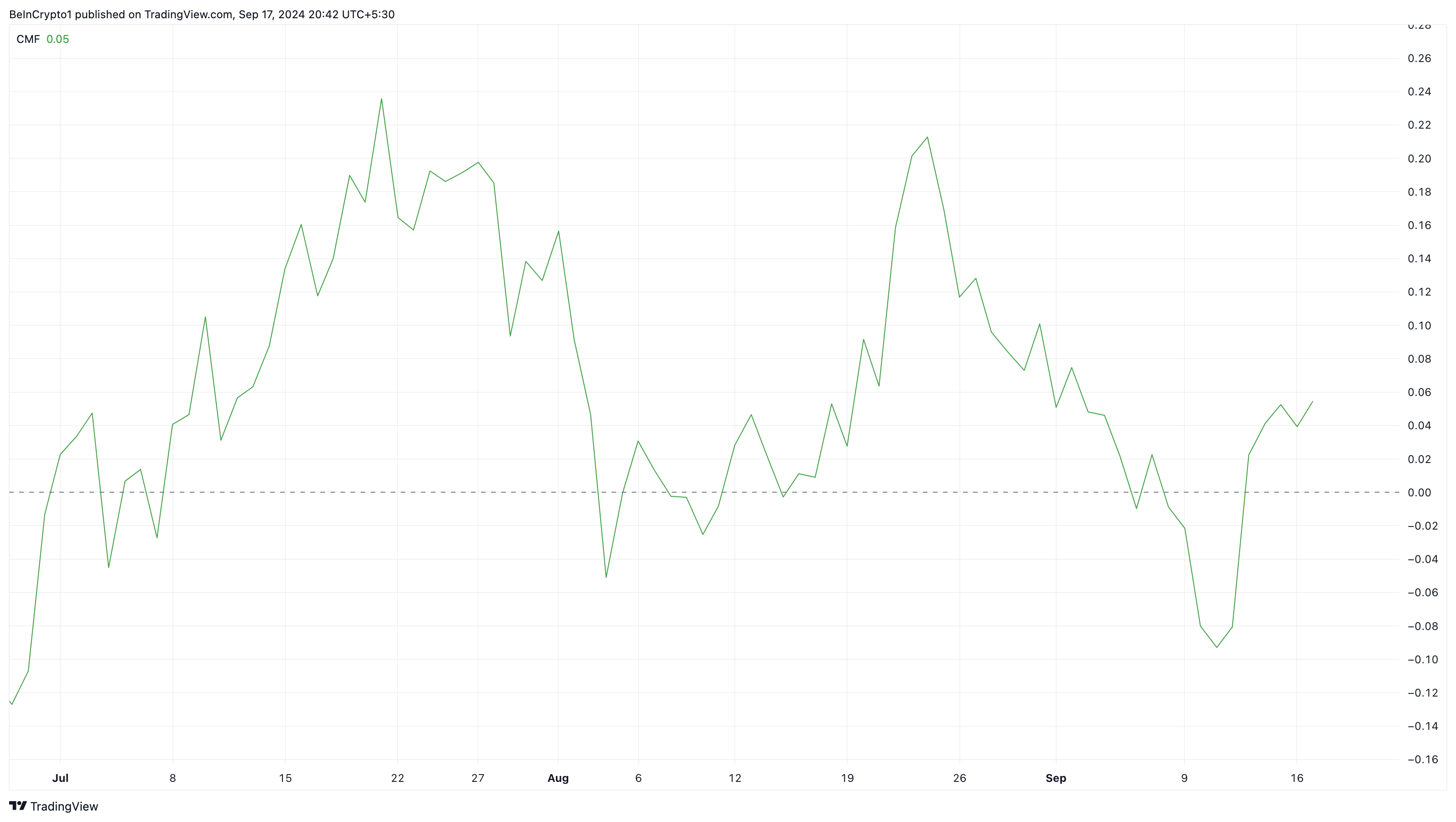

Along with the MACD, the Chaikin Cash Circulation (CMF) indication likewise sustains a favorable overview. The CMF determines the price of build-up or circulation over a provided duration. When the CMF increases over the absolutely no line, it recommends that build-up– purchasing stress– is more powerful than circulation, indicating favorable energy.

Presently, the CMF on the BNB/USD day-to-day graph has actually relocated over the absolutely no line, suggesting that bulls are functioning to press the cryptocurrency towards greater worths.

BNB Rate Forecast: The Go to $625 Begins

On the exact same day-to-day graph, BeInCrypto observed the development of a dropping wedge– a favorable technological pattern. Normally, the wedge shows up after costs on the swing highs struck reduced worths, and those on the swing lows do the exact same.

Nonetheless, as the trendlines assemble, vendors start to shed energy, and customers profit from the exhaustion. When purchasing stress boosts, BNB’s cost might climb greater than its existing setting.

By the appearance of points, the coin appears virtually specific to damage the resistance at $574.60. For this to occur, bulls need to protect the $517.50 assistance degree. If effective, BNB might climb up as high as $625 in the short-term.

Learn More: Binance Coin (BNB) Rate Forecast 2024/2025/2030

Nonetheless, the projection may be revoked if BNB stops working to damage over the resistance. Because circumstance, the coin may go down listed below the $517.50 assistance.

Please Note

According to the Depend on Task standards, this cost evaluation post is for informative objectives just and must not be thought about monetary or financial investment guidance. BeInCrypto is devoted to exact, impartial coverage, yet market problems undergo transform without notification. Constantly perform your very own research study and talk to a specialist prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.