Robbie Mitchnick, Head of Digital Possessions at BlackRock, shared understandings right into the company’s crypto technique. BlackRock has actually been establishing its technique for a lot longer than numerous may recognize.

Mitchnick went over BlackRock’s trip, Bitcoin’s duty as a property, ETFs, and the future of electronic properties.

A Lengthy Roadway to Public Fostering

Mitchnick disclosed that BlackRock’s rate of interest in crypto started as very early as 2016, although the company really did not take into consideration the possession course “all set for prime-time television” at the time. This noted the start of BlackRock’s crypto trip, silently constructing capacities prior to making bigger public steps.

” The advancement actually began to speed up in the 2021-2022 duration. There were 3 vital motorists behind this change: The framework around the system began to grow; An expanding acknowledgment that crypto was right here to remain; A sturdy pattern of customers revealing raising rate of interest in the room,” Mitchnick kept in mind.

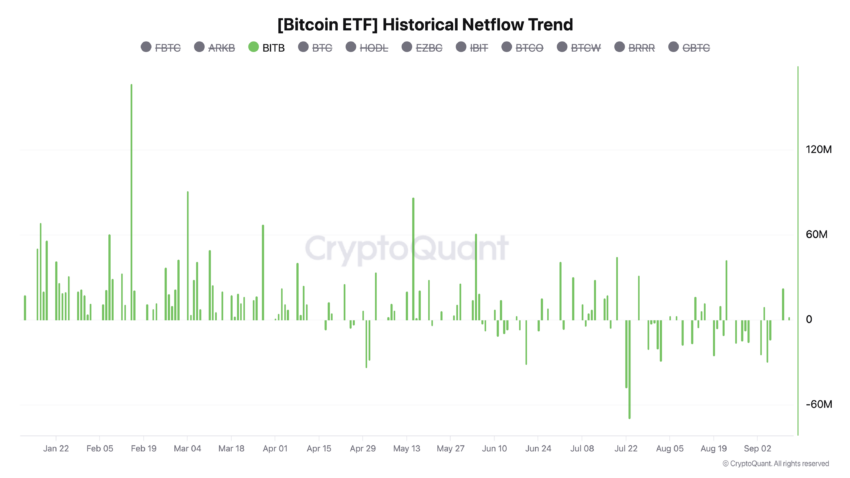

Considering that this transforming factor, BlackRock’s participation in crypto has actually raised, specifically with the launch of its Bitcoin and Ethereum ETFs, which Ryan Sean Adams referred to as a “Xmas wonder.” Education and learning has actually played a critical duty in BlackRock’s technique, as the company intends to present a mostly crypto-naive target market to the room.

Mitchnick highlighted the requirement to battle misconceptions, such as the concept that Bitcoin is a “risk-on” possession. While Bitcoin is taken into consideration dangerous, risk-on properties are normally preferred throughout booming market. The complication around Bitcoin being pitched as “electronic gold” has actually caused false impressions amongst beginners.

” If you check out the Silicon Valley Financial institution and local financial dilemma in March 2023, that was most likely the clearest instance of Bitcoin working as a bush. The primary factor it attracted attention was that the crypto study area really did not have time to overcomplicate it,” Mitchnick discussed.

BlackRock’s concentrate on education and learning is crucial in moving these understandings. In fast-moving markets, obscure ideas can rapidly form market habits.

Mitchnick additionally pointed out that BlackRock would certainly quickly launch an explainer on danger for their wider customer base, while keeping in mind that Bitcoin has a tendency to be preferred by investors and Ethereum by designers. When it comes to the opportunity of a 3rd ETF authorization, he really did not see a clear frontrunner right now.

A Future in Tokenization?

Mitchnick additionally discussed BlackRock’s sight of tokenization, keeping in mind that while the concept of “blockchain, not Bitcoin” is fading, “tokenization, not Bitcoin” is obtaining grip. Although the long-lasting practicality of tokenization stays unclear, BlackRock is working with the essential framework to sustain it.

” Our technique is to offer customers with affordable and very easy accessibility to these markets and to provide technical capacities. It would certainly be unusual if, one decade from currently, we just had 7 tokenized funds. It’s more probable we’ll have none, or numerous,” Mitchnick specified.

BlackRock’s systematic technique to crypto shows the company’s dedication to both long-lasting practicality and education and learning. As even more customers reveal rate of interest, BlackRock is placing itself as a leader in giving easily accessible electronic possession financial investments.

While the future of tokenization and ETFs stays unclear, BlackRock’s technique recommends that the company will certainly continue to be a substantial gamer in the sector, regardless of just how it moves.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is dedicated to impartial, clear coverage. This newspaper article intends to offer exact, prompt info. Nevertheless, visitors are encouraged to confirm truths individually and talk to an expert prior to making any type of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.