Pepe (PEPE) might be prone to more rate decreases, regardless of a boost in whale build-up. This possible decrease highlights the detach in between big owners’ task and wider market view.

As the meme coin deals with expanding stress, this on-chain evaluation checks out the sustainability of its present rate degrees and examines its temporary expectation.

Whales Get Pepe, After That Time Out

Information from Glassnode discloses that PEPE’s big owners’ netflow has actually risen by 108% over the previous 7 days. Netflow determines the distinction in between symbols gathered by crypto whales and those dispersed.

An adverse netflow signals much more circulation than build-up, while a surge recommends enhanced build-up. Nonetheless, in PEPE’s instance, the scenario is rather various.

Although whales at first purchased a significant quantity of the meme coin, build-up delayed around September 13. Ever since, there has actually been little boost in symbols acquired by big owners. Because of this, PEPE’s rate might have a hard time to stay clear of a substantial decrease.

Find Out More: 5 Ideal Pepe (PEPE) Purses for Beginners and Experienced Users

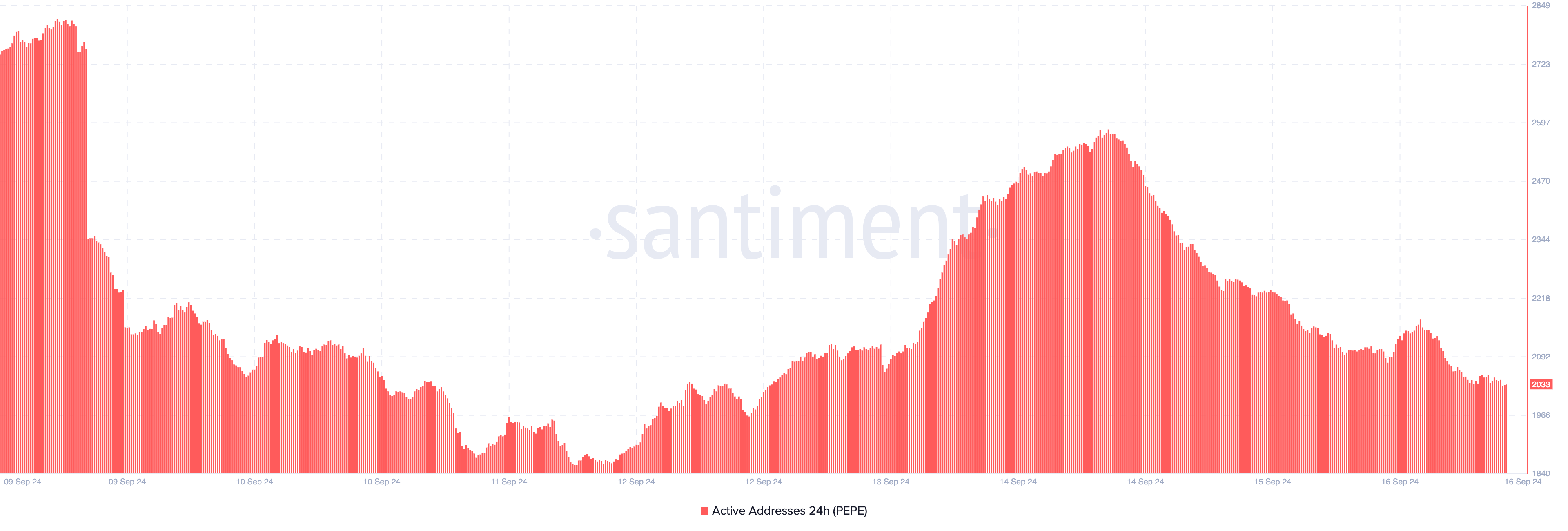

Along with whale task, Pepe’s energetic addresses likewise sustain the bearish expectation. Energetic addresses mirror customer interaction with a cryptocurrency; a boost normally signifies solid communication and is usually favorable.

Nonetheless, a decrease in energetic addresses recommends lowered grip and reduced need. For PEPE, the variety of energetic addresses has actually gone down substantially because coming to a head on September 14, even more enhancing the bearish view.

PEPE Cost Forecast: $0.0000060 Impends

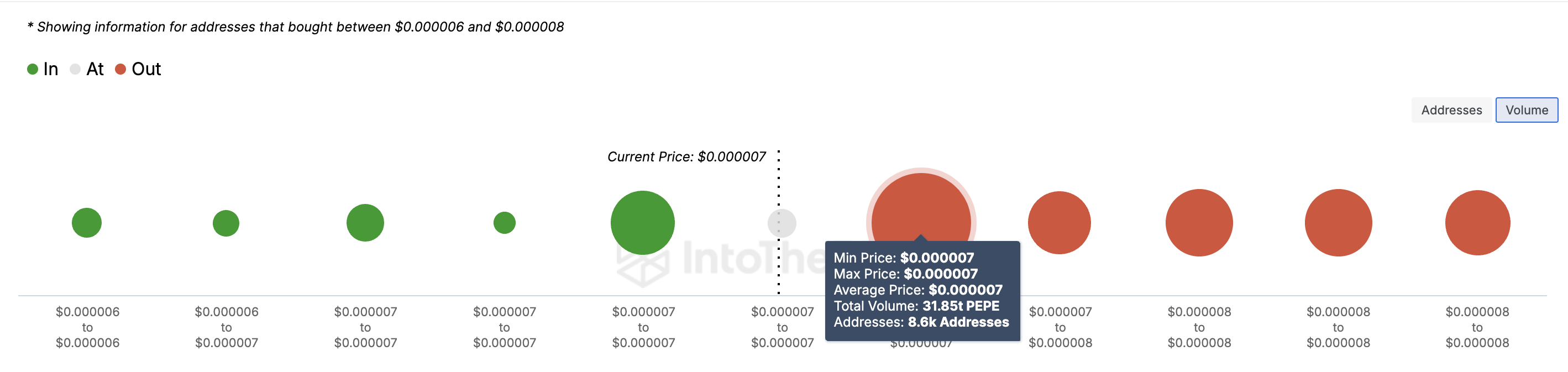

Presently, PEPE’s rate rests at $0.0000071, down 31% over the last 90 days. From an on-chain viewpoint, the In/Out of Cash Around Cost (IOMAP) indication discloses that the meme coin deals with resistance near the present rate, with 8,600 addresses holding over 31 trillion symbols.

The IOMAP aids determine vital assistance and resistance degrees by organizing addresses based upon earnings. A greater quantity of symbols in a lucrative array usually works as assistance. Alternatively, when a huge quantity is “out of the cash,” it comes to be a resistance area.

In PEPE’s instance, the quantity held listed below $0.0000069 is not likely to provide solid assistance. If owners at the resistance area sell, the rate might encounter a more improvement.

Find Out More: Pepe (PEPE) Cost Forecast 2024/2025/2030

If PEPE deals with an improvement, the following degree it might go down to is around $0.0000060. Nonetheless, if need rises sufficient to appear the present resistance, this bearish forecast may be revoked. Because circumstance, PEPE’s rate might rally towards $0.000010.

Please Note

According to the Depend on Job standards, this rate evaluation write-up is for informative objectives just and ought to not be taken into consideration monetary or financial investment suggestions. BeInCrypto is devoted to exact, impartial coverage, however market problems undergo transform without notification. Constantly perform your very own study and talk to an expert prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.