The United States Residence Subcommittee on Digital Properties, Financial Modern Technology, and Addition revealed a hearing labelled “Dazed and Baffled: Damaging Down the SEC’s Politicized Technique to Digital Properties.”

This hearing, established for September 18, is anticipated to study the Stocks and Exchange Compensation’s (SEC) enforcement schedule under Chair Gary Gensler.

Regulative Complication or Enforcement Overreach? Sector Leaders Will Certainly Consider In

According to the most recent memorandum, the hearing will certainly include a number of crucial witnesses from both electronic possessions and regulative fields. Previous SEC Commissioner Dan Gallagher, currently the Principal Legal Police Officer at Robinhood Markets, will certainly be among the key numbers indicating. Gallagher has actually been a forthright doubter of the SEC’s existing approach, supporting for more clear regulative structures.

Signing up with Gallagher will certainly be Michael Liftik, a previous elderly consultant and acting enforcement principal at the SEC that is currently a companion at Quinn Emanuel Urquhart & & Sullivan LLP. Teddy Fusaro, the Head Of State of Bitwise Property Monitoring, will certainly additionally offer testament. He is anticipated to review just how the SEC’s activities have actually influenced crypto companies and possession supervisors particularly.

In addition, testament will certainly originate from Lee Reiners, a talking other at Battle each other College, and Jennifer Schulp, the Supervisor of Financial Policy Research Studies at the Facility for Monetary and Financial Alternatives.

Learn More: Crypto Policy: What Are the Advantages and Drawbacks?

The hearing is the most recent pushback from legislators versus the SEC. They say that its existing strategy under Gary Gensler has actually suppressed technology in the electronic possession field.

Additionally, these legislators assert Gensler has actually concentrated on enforcement as opposed to offering clear regulative standards. Such a position leaves the crypto sector unpredictable regarding just how to run within the lawful structure.

Considering that taking workplace as SEC Chair, Gensler has actually boldy targeted crypto possessions, identifying most symbols as safety and securities under United States legislation. Gensler keeps that the majority of cryptocurrencies drop under the Howey Examination’s meaning of safety and securities.

The Howey Examination is a decades-old structure utilized to establish what certifies as a safety and security. It has actually gone to the facility of the SEC’s regulative initiatives. Its application has actually caused many enforcement activities versus significant crypto companies, triggering prevalent irritation.

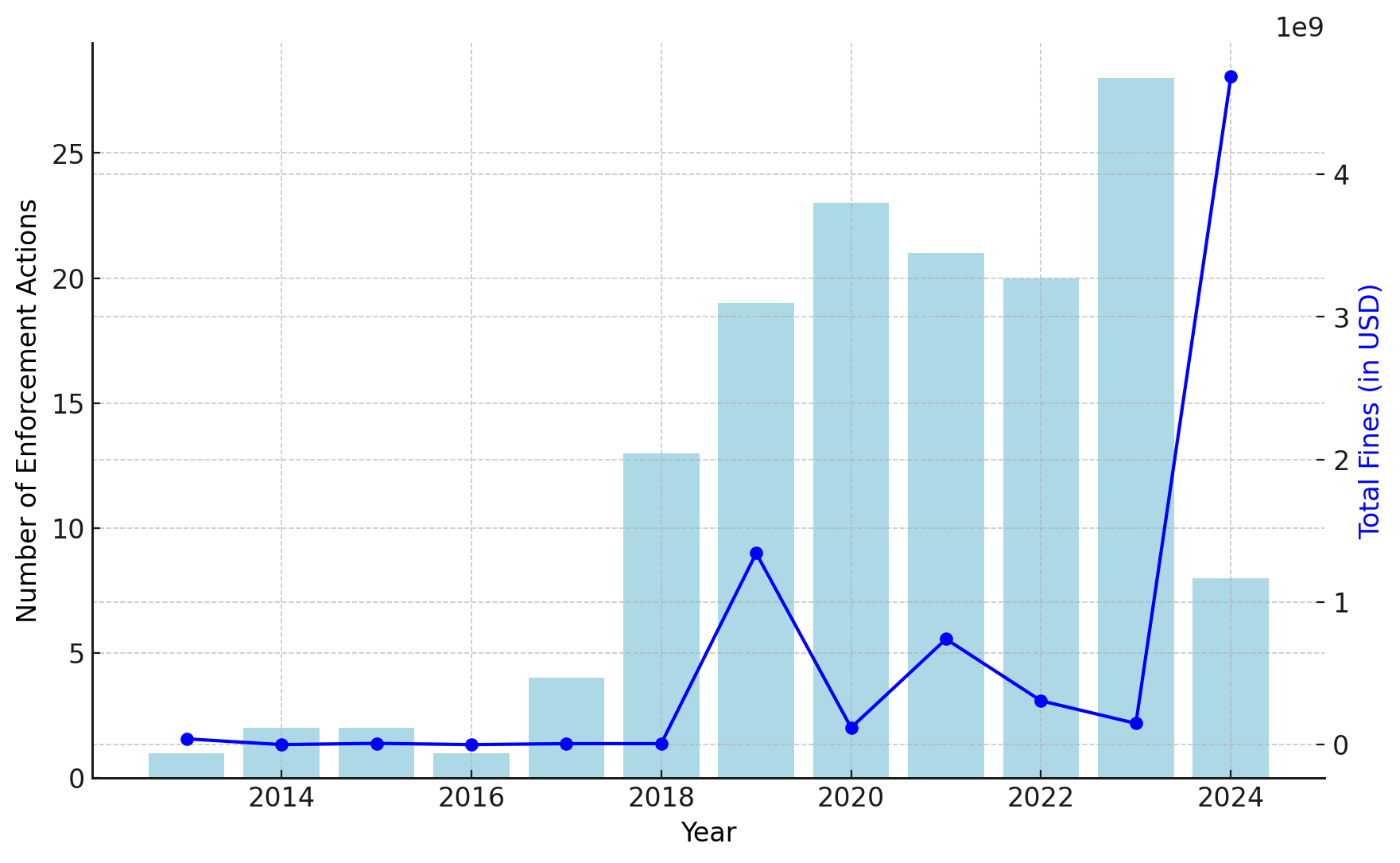

BeInCrypto reported that since September 10, the compensation had actually enforced $4.68 billion in penalties in situations versus crypto companies and their execs in 2024. This document quantity stands for a 3,018% boost contrasted to charges accumulated in 2023.

For this reason, movie critics say that his enforcement-driven strategy suppresses technology and presses organizations out of the United States. For example, SEC Commissioner Hester Peirce has actually tested Gensler’s analysis, asking for more clear assistance as opposed to depending entirely on enforcement.

” Commissioner Peirce has actually regularly stressed her worry about the SEC’s enforcement-centric strategy and highlighted leading concepts for managing the electronic possession community. Commissioner Uyeda has actually resembled this belief, preserving, ‘for as well long, the Compensation’s strategy to crypto possession law has actually been to utilize enforcement activities to present unique lawful and regulative concepts.’,” the memorandum reads.

Learn More: That Is Gary Gensler? Whatever To Learn About the SEC Chairman

The SEC’s enforcement additionally reaches various other electronic possessions like non-fungible symbols (NFTs). BeInCrypto reported that OpenSea, a leading NFT industry, just recently got a Wells notification from the SEC. In a similar way, in 2023, the SEC’s activity versus Stoner Cats, an NFT task connected to a computer animated collection, caused a $1 million negotiation for offering what the SEC considered non listed safety and securities.

Please Note

In adherence to the Count on Job standards, BeInCrypto is dedicated to impartial, clear coverage. This newspaper article intends to offer precise, prompt info. Nonetheless, visitors are recommended to confirm truths separately and speak with a specialist prior to making any type of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.