Chainlink Labs and Fireblocks have actually collaborated to provide a safe and secure and certified modern technology remedy for banks like financial institutions.

This will certainly allow organizations to release and negotiate stablecoins in international markets, with assistance for end-to-end tokenization abilities for stablecoin companies.

Chainlink and Fireblocks To Increase Managed Stablecoin Issuance

The collaboration in between Chainlink Labs and Fireblocks will certainly supply end-to-end modern technology remedies for banks collaborating with controlled stablecoins. This partnership establishes a brand-new sector requirement for stablecoin issuance, supplying a thorough tokenization engine to firmly mint, wardship, disperse, and handle tokenized properties.

The remedy additionally consists of innovative attributes such as information sychronisation, connection, conformity, wardship, interoperability, and liquidity circulation. These abilities will certainly offer banks (releasing representatives) a full sight of stablecoins, including their gets, market price, and overall supply throughout different blockchains.

Significantly, both Fireblocks and Chainlink contributed in the launch of the COPW stablecoin in July, component of Bancolombia Team’s initiatives to improve the openness of its 1:1 peso-backed stablecoin, according to an authorities press release.

” It is excellent to see Fireblocks and Chainlink, 2 of our COPW launch companions, team up to better improve the use of controlled stablecoins. By incorporating top-tier modern technology remedies with safe and dependable facilities, they are producing a win-win for the sector and progressing the fostering of electronic properties in an extra comprehensive, reliable, and available way,” Wenia chief executive officer Pablo Arboleda stated.

Find Out More: What Is Chainlink (WEB LINK)?

This is not the initial of Chainlink’s tactical cooperations in September. Lately, Sony’s Soneium incorporated Chainlink’s CCIP as its core cross-chain facilities for blockchain development.

In the middle of this information, experts state capitalists are putting favorable bank on the Chainlink (WEB LINK) token. As BeInCrypto reported, over 6 million web link symbols have actually been taken out from exchanges, with bulls surpassing bears. When token owners withdraw their holdings from exchanges, it commonly suggests self-confidence in the possession, which is why they are not seeking to market.

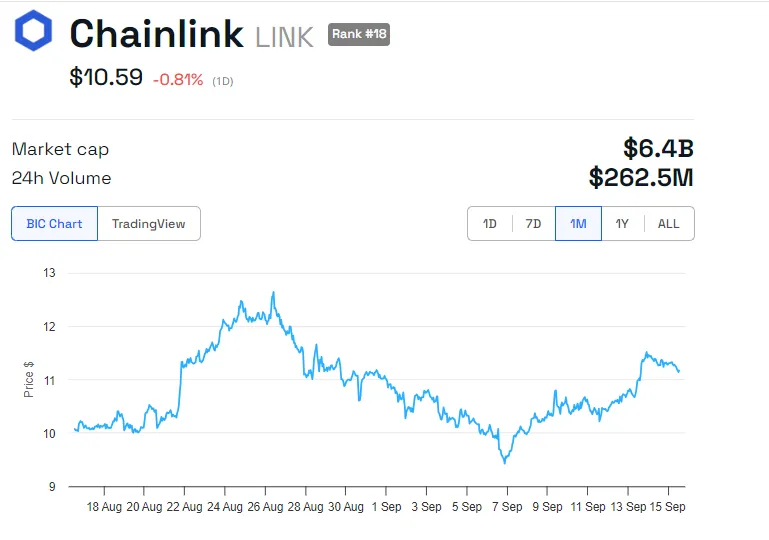

BeInCrypto information reveals that the web link cost has yet to sign up the results of financier self-confidence. Since this writing, it is trading for $10.59, down by 0.81% considering that Tuesday’s session opened up.

Stablecoins Driving Advancement in Financial Markets

Chainlink and Fireblocks’ current partnership suggests the expanding function of stablecoins in driving development throughout various industries. According to a Chainalysis record, stablecoin need is rising in arising markets, specifically in nations such as Nigeria, Turkey, Thailand, and Brazil, mirroring their significance in international monetary ecological communities.

Tether’s initiatives in broadening using stablecoins consist of the launch of Alloy, a gold-backed electronic money that breakthroughs real-world possession (RWA) tokenization. Tether has actually additionally ventured right into education and learning, buying blockchain and electronic possession discovering campaigns in Taiwan. Lately, Tether obtained a 9.8% risk in Adecoagro, a significant farming firm, for $100 million, better expanding its profile throughout industries, consisting of AI and Bitcoin mining.

On the various other hand, USDC is leading the controlled stablecoin market on quantity metrics. This makes it a calculated individual in the stablecoin development wave. On this account, Coinbase and Red stripe lately partnered to incorporate USDC on Base, boosting Red stripe’s crypto item collection. In a similar way, BlackRock’s tokenized RWAs can be traded for USDC, supplying quicker, a lot more clear, and a lot more reliable purchases.

” As regulative structures around tokenized cash remain to advance, the possibility for controlled stablecoin use at the institutional degree is broadening. Stablecoins are driving development in monetary markets, and companies require a thorough remedy– from gets to issuance, circulation, wardship, and conformity– that provides complete presence, consisting of throughout numerous chains,” Fireblocks handling supervisor Stephen Richardson informed BeInCrypto.

Find Out More: An Overview to the most effective Stablecoins in 2024

Regardless of extensive fostering, stablecoins stay under examination from regulatory authorities. A current record by Customers’ Study flagged problems in Tether’s audits, elevating worries regarding openness in the stablecoin market.

Please Note

In adherence to the Depend on Task standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to supply exact, prompt info. Nonetheless, viewers are recommended to validate truths separately and speak with a specialist prior to making any type of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.