Ethereum investors are expanding positive that the altcoin’s rate could quickly see a considerable recuperation. This favorable belief is a follow-up response to what several called ETH’s base.

In this evaluation, BeInCrypto takes a look at the aspects driving this positive overview and what it implies for Ethereum’s temporary efficiency.

Ethereum Investors Wager Big

On September 15, Ethereum’s Approximated Utilize Proportion (ELR)– a statistics revealing whether investors are taking high-leverage wagers in the by-products market– saw a noteworthy decrease, indicating careful market actions. Nevertheless, on September 16, the ELR rose to its highest degree in over a month, showing a change as investors started tackling much more high-leverage settings.

However why are they increasing down currently?

Based upon our searchings for, these dangerous wagers might be connected to the reality that ETH/BTC has actually reached its floor in greater than 3 years. Crypto expert and owner of Into the Cryptoverse Benjamin Cowen said that this advancement could have brought Ethereum near its base.

” It’s nearly over. I believe ETH/BTC will likely lower in between 0.03-0.04 and afterwards pattern up in 2025. It can base as very early as today or as late as December,” Cowen said.

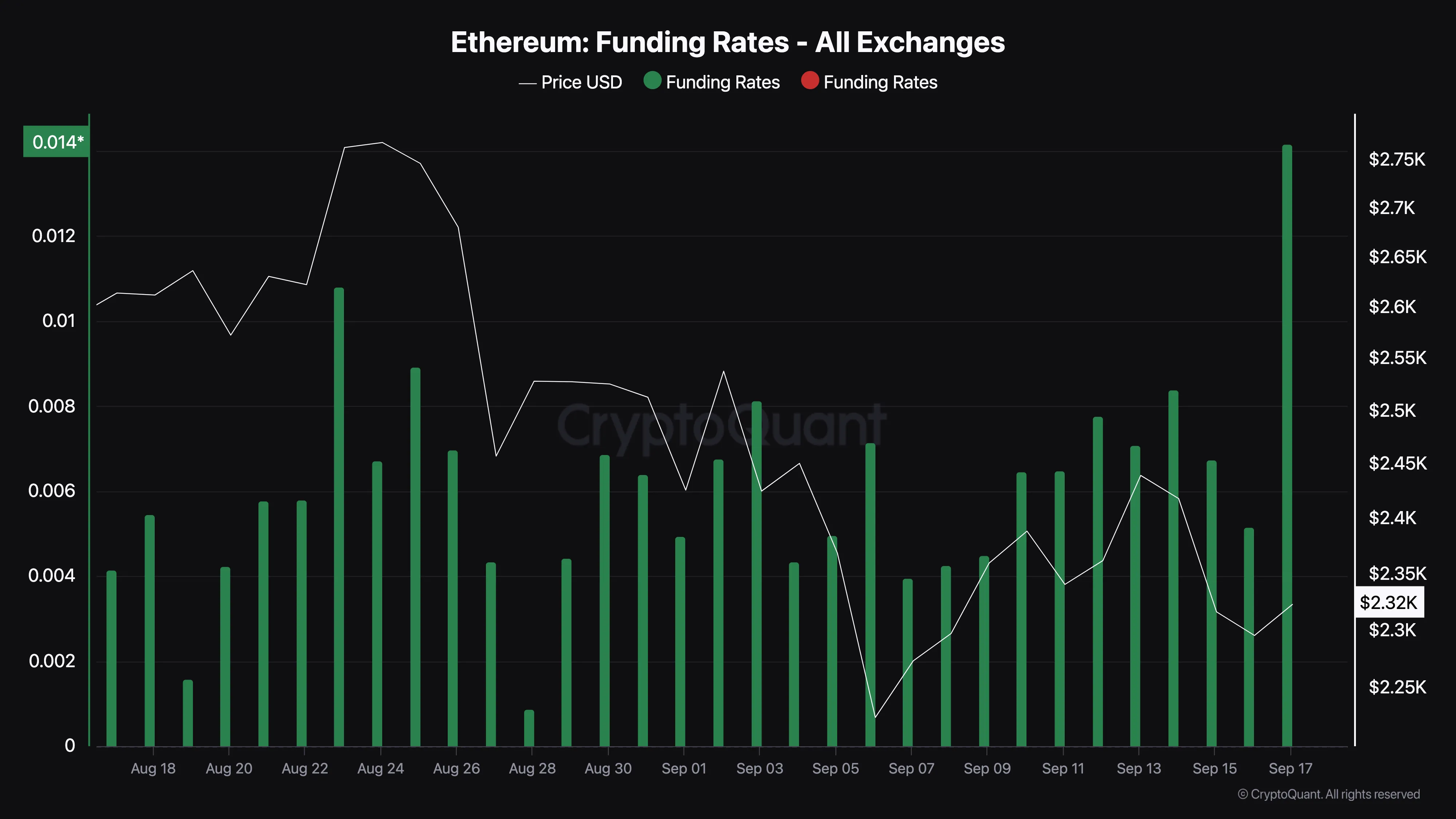

The existing Financing Price shows this favorable overview. An unfavorable Financing Price signals bearish belief and short-selling, yet ETH’s financing is highly favorable. This suggests that investors want to pay added to hold lengthy settings, expecting a rally towards $2,800.

Find Out More: Exactly How to Acquire Ethereum (ETH) and Whatever You Required to Know

ETH Rate Forecast: Outbreak Incoming

Ethereum’s rate presently relaxes $2,310. On September 13, the altcoin tried to damage above $2,441 yet encountered denial. Nevertheless, a favorable dropping wedge pattern has actually based on the day-to-day graph, indicating a prospective outbreak.

A dropping wedge happens when the rate kinds reduced swing low and high, developing a cone-like framework. If ETH breaks out of this pattern, it can recommend a solid higher relocation.

The Equilibrium of Power (BoP) indication, which gauges the toughness of purchasers versus vendors, sustains a favorable overview. The higher activity in the BoP reveals that purchasers are presently in control, implying the following target for Ethereum can be about $2,744.

Find Out More: Ethereum (ETH) Rate Forecast 2024/2025/2030

In an incredibly favorable situation, Ethereum can also go beyond $2,800, getting to $2,918. Nevertheless, if bears gain back control, the rate can be up to $2,114, revoking this positive projection.

Please Note

According to the Count on Task standards, this rate evaluation short article is for educational objectives just and must not be taken into consideration economic or financial investment suggestions. BeInCrypto is dedicated to exact, impartial coverage, yet market problems undergo transform without notification. Constantly perform your very own study and talk to a specialist prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.