Solana (SOL) has actually been trading within a straight network on the four-hour graph given that the start of September. Nevertheless, over the weekend break, the altcoin handled to damage over this network, getting to an optimal of $140.

Sadly, this outbreak was brief, as SOL promptly backtracked and went back to the network, showing a fakeout.

Solana Rate Fakeout Misguides Investors

Solana has actually been trading within a straight network given that the start of September, a pattern that establishes when a property’s rate steps within a specified variety. In this instance, the top line of the network stands for resistance, while the reduced line acts as assistance.

On September 13, SOL briefly damaged over its resistance at $138.12, meaning a possible extension of its uptrend. Nevertheless, the rate came to a head at $139.78 prior to turning around instructions and dropping back right into the network.

This activity is referred to as a fakeout, which takes place when a property bursts out of a fad yet promptly turns around, going back to its initial course. Investors that act upon these incorrect signals might sustain losses, particularly if they get in placements anticipating a continual outbreak.

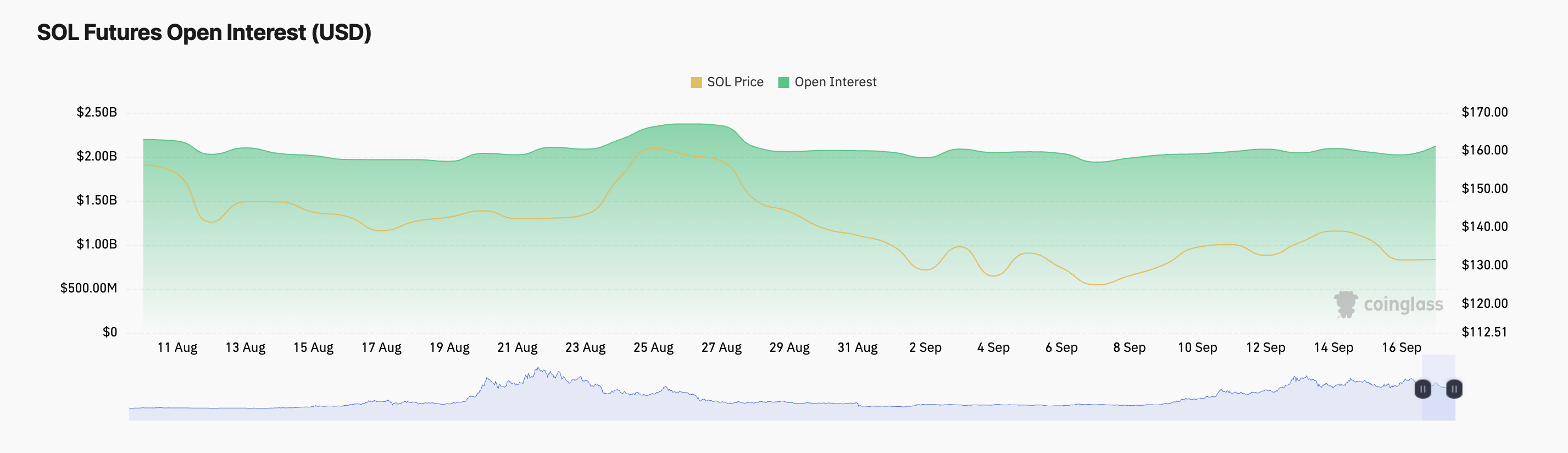

Because the fakeout, Solana (SOL) has actually experienced a noteworthy boost in by-products market task, mirrored in its climbing futures open rate of interest. Currently, SOL’s futures open rate of interest stands at $2.12 billion, a 3% boost given that September 13.

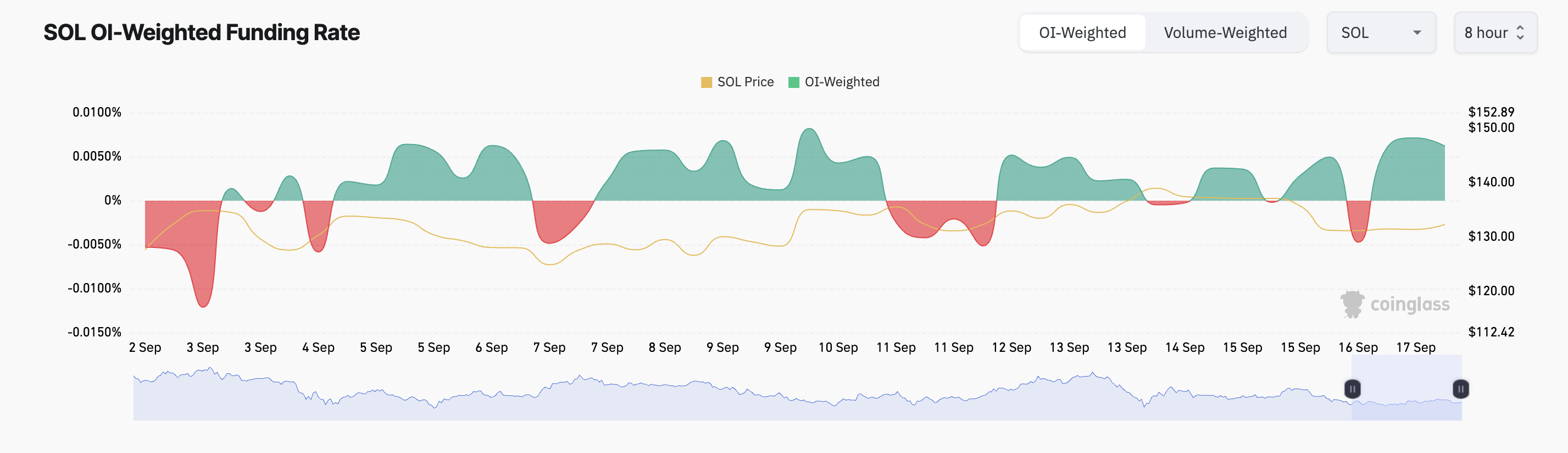

Furthermore, SOL futures investors have actually kept a favorable belief in spite of the coin’s current rate decrease. According to Coinglass information, the coin’s financing price, which assists keep continuous agreement rates according to the hidden property, has actually stayed mainly favorable given that last weekend break.

At press time, SOL’s financing price rests at 0.0062%, showing that even more investors are taking lengthy placements, preparing for a rally, as opposed to shorting the altcoin in hopes of a rate decrease.

Find Out More: 11 Leading Solana Meme Coins to See in August 2024

SOL Rate Forecast: Long Traders Must Beware

SOL’s technological overview on the four-hour graph recommends the capacity for an extensive decrease. The Elder-Ray Index, which determines the distinction in between bull power and bear power, has actually been constantly unfavorable given that September 15, showing that vendors are controling the marketplace.

More sustaining this bearish belief, the Directional Activity Index (DMI) reveals SOL’s unfavorable directional indication (red) over its favorable directional indication (blue), signaling that the marketplace is presently experiencing unfavorable energy, which surpasses any type of acquiring stress.

Find Out More: Solana (SOL) Rate Forecast 2024/2025/2030

If this sag proceeds, Solana’s rate can drop listed below its present assistance degree at $ 126.46 and come by an extra 13% to trade around $ 109.64. Nevertheless, if the altcoin sees restored need, it might retest the resistance degree and can rally towards $ 161.50 if the examination succeeds.

Please Note

In accordance with the Count on Job standards, this rate evaluation post is for educational functions just and need to not be taken into consideration monetary or financial investment suggestions. BeInCrypto is devoted to precise, impartial coverage, yet market problems undergo transform without notification. Constantly perform your very own research study and seek advice from an expert prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.