Boeing supply (BACHELOR’S DEGREE) floated near 52-week short on Tuesday as the airplane manufacturer wanted to strike an offer immediately with its biggest union on strike while at the very same time reducing expenses to maintain cash money.

On Tuesday, Boeing shares increased to around $157 each, simply $3 off its current lows.

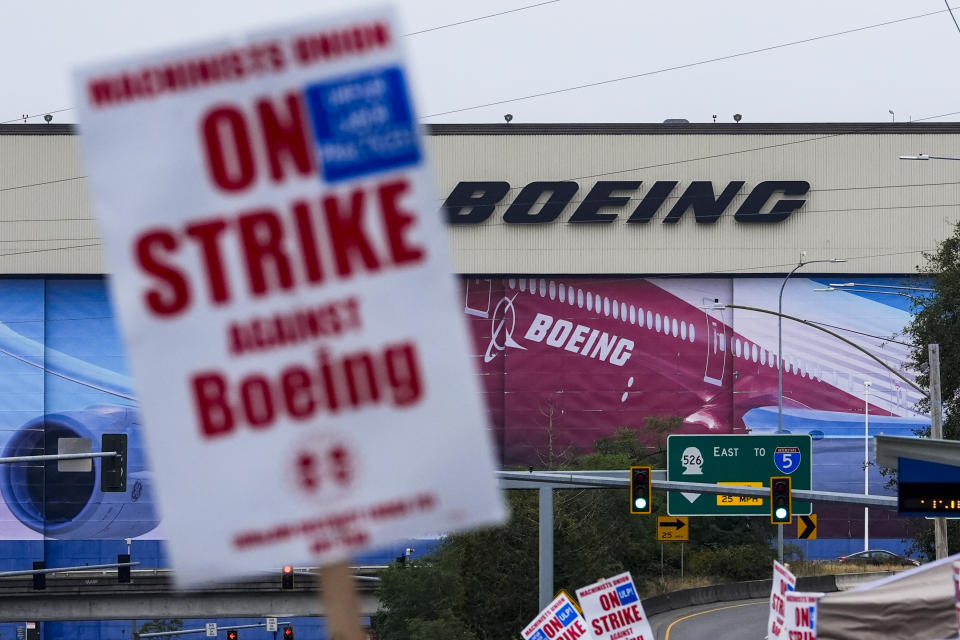

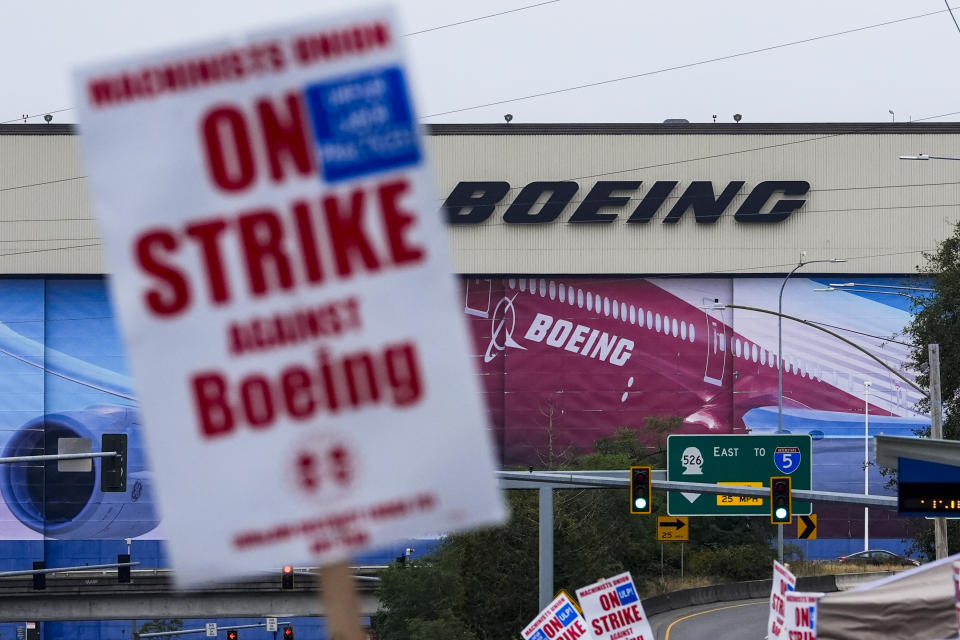

The Arlington, Va.-based firm is confronted with a machinist union strike over wage boosts that began last Friday. Seriously for the firm, it’s stopped manufacturing of its successful 737 Max.

The timing and size of the strike can place the firm’s healing at risk as its brand-new chief executive officer, Kelly Ortberg, attempts to securely place behind its current manufacturing errors.

” They have a great deal of stress to obtain their production line in great order. And the strike hinders that and hold-ups any kind of development they were making on essentially decertifying their setting up procedure for airplanes like the 737,” Morningstar equity expert Nicolas Owens informed Yahoo Financing on Wednesday.

A resource accustomed to the settlements informed Yahoo Financing both sides were fulfilling personally on Tuesday with an arbitrator to assist assist in the talks.

Boeing is “all set to negotiate an arrangement,” and Tuesday was the earliest the union had the ability to fulfill, according to the resource.

At the very same time, the firm set out hostile cost-cutting steps on Monday, that included an employing freeze. The firm is likewise taking into consideration short-term furloughs for numerous workers in the coming weeks.

While Moody’s just recently put Boeing’s credit history ranking under evaluation, S&P Global claimed its standing is secure in the meantime, offered the strike is brief, which numerous Wall surface Road experts anticipate it will certainly be.

” A much shorter strike, like weeks, would likely be workable for Boeing and not bring about an unfavorable ranking activity. Nonetheless, our company believe an extensive strike would certainly be expensive and tough to soak up, provided the firm’s currently stretched economic setting,” claimed S&P claimed in a declaration today.

The airplane production titan has actually been browsing a dreadful year, beginning in very early January when the body of a 737 Max 9 tore open at 16,000 feet throughout an Alaska Airlines (ALK) trip.

The case brought about a collection of regulative issues, examinations, legal actions, manufacturing hold-ups, a chief executive officer substitute, and a rolling supply rate.

Last month Ortberg, an aerospace sector professional and Boeing outsider, took control of the leading task at the firm.

At the Morgan Stanley Laguna Meeting last Friday, CFO Brian West kept in mind “great energy” before the strike, with “ramping manufacturing, while at the very same time, integrating substantial renovations” right into the maker’s top quality and manufacturing system.

Boeing shares are down greater than 35% year to day. They touched a 52-week short on Monday. The firm is anticipated to report quarterly outcomes following month.

Ines Ferre is an elderly company press reporter for Yahoo Financing. Follow her on X at @ines_ferre.

Go Here for the most up to date securities market information and extensive evaluation, consisting of occasions that relocate supplies

Review the most up to date economic and company information from Yahoo Financing

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.