Bitcoin’s (BTC) cost goes to a critical make-or-break factor as the marketplace expects Wednesday’s Federal Free market Board (FOMC) conference. Nonetheless, assumptions for the occasion are no more equally split, regardless of being so simply 2 days earlier.

If the conference causes a reduced basis factor (bps) change, historic fads recommend that BTC’s cost might undertake a substantial adjustment. A greater price reduced supplied by the Fed, led by Chair Jerome Powell, ought to improve Bitcoin’s cost. This on-chain evaluation clarifies why any kind of possible gains in the last circumstance might be brief.

Bitcoin Whales Market the Information

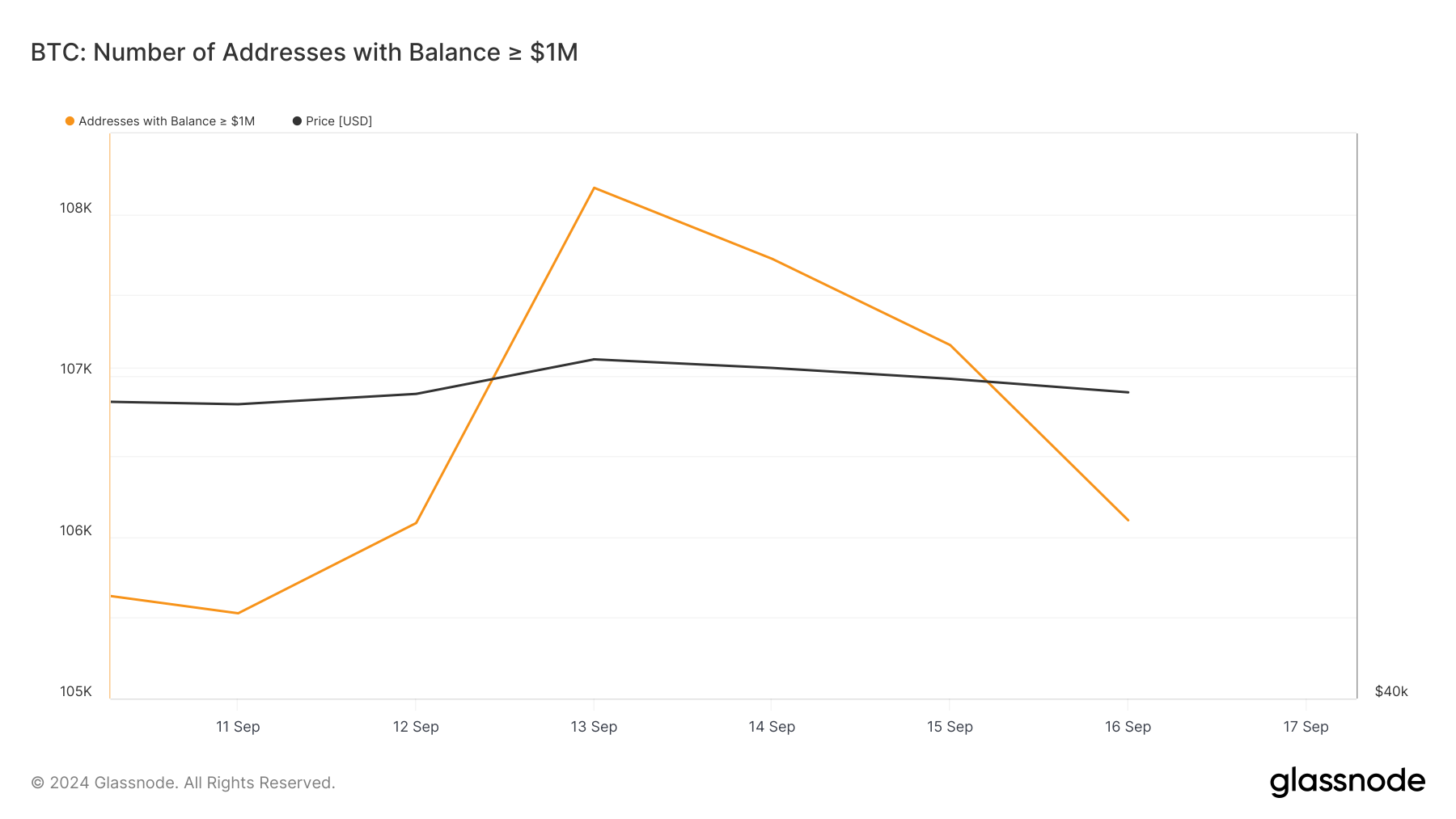

Information from Glassnode reveals that Bitcoin whales are liquidating in advance of the very prepared for FOMC conference. As an example, on September 13, the variety of addresses holding over $1 million well worth of BTC was 108,163.

Today, Bitcoin’s whale holdings have actually gone down to 106,104 BTC, indicating a sell-off of over 2,059 BTC valued at greater than $2 billion. This “market the information” habits mirrors expanding care amongst huge owners, that might be planning for possible volatility as the marketplace waits for hints on future financial plan.

As an example, Lookonchain reported that a whale sold 500 BTC on Monday. A day prior to that, an additional Bitcoin whale deposited 119 BTC to Binance. This large sell-off recommends that whales are placing themselves defensively, preparing for feasible temporary disturbance prior to, amidst, and after the conference.

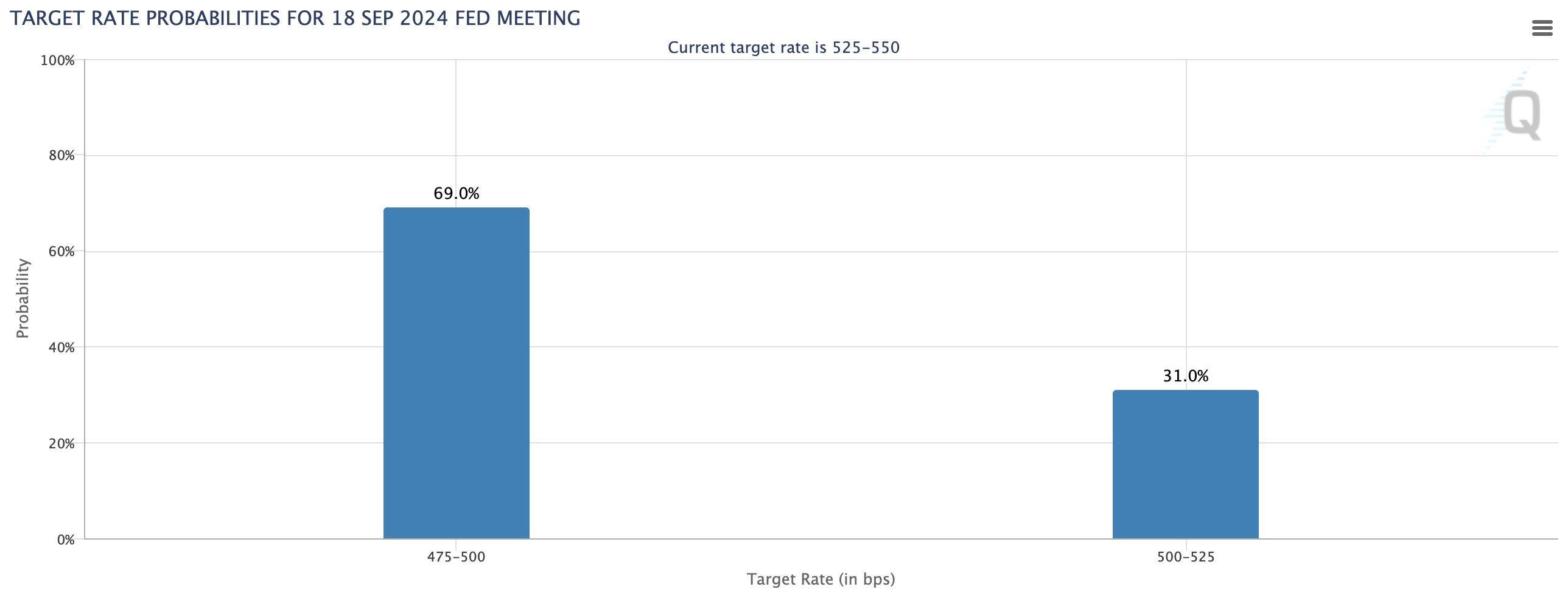

According to the CME FedWatch device, the opportunity of 50 bps is 69%, while that of 25 bps is 31%. For context, the device determines the chance of a rates of interest cut.

In August, Fed Chair Powell meant a price reduced throughout the Jackson Opening Speech. The declaration back then offered Bitcoin’s cost a quick press over $62,000. Over the weekend break, the cryptocurrency leapt to $60,000 yet presently trades listed below that area.

Find Out More: Leading 7 Systems To Gain Bitcoin Sign-Up Benefits in 2024

Likely Price Cut Might Deal Unsustainable Increase

While the wider market may be enlivening for a rebound as a result of the above-highlighted likelihood, some experts think the consequence may not be lasting.

Among those with such belief is Markus Theilien, head of study at 10xResearch. In a record outdated September 16, the company kept in mind that a 50 bps is likely to be the end result of the FOMC conference. Nonetheless, the record likewise mentioned that Bitcoin might not see the considerable cost increase numerous market individuals are preparing for.

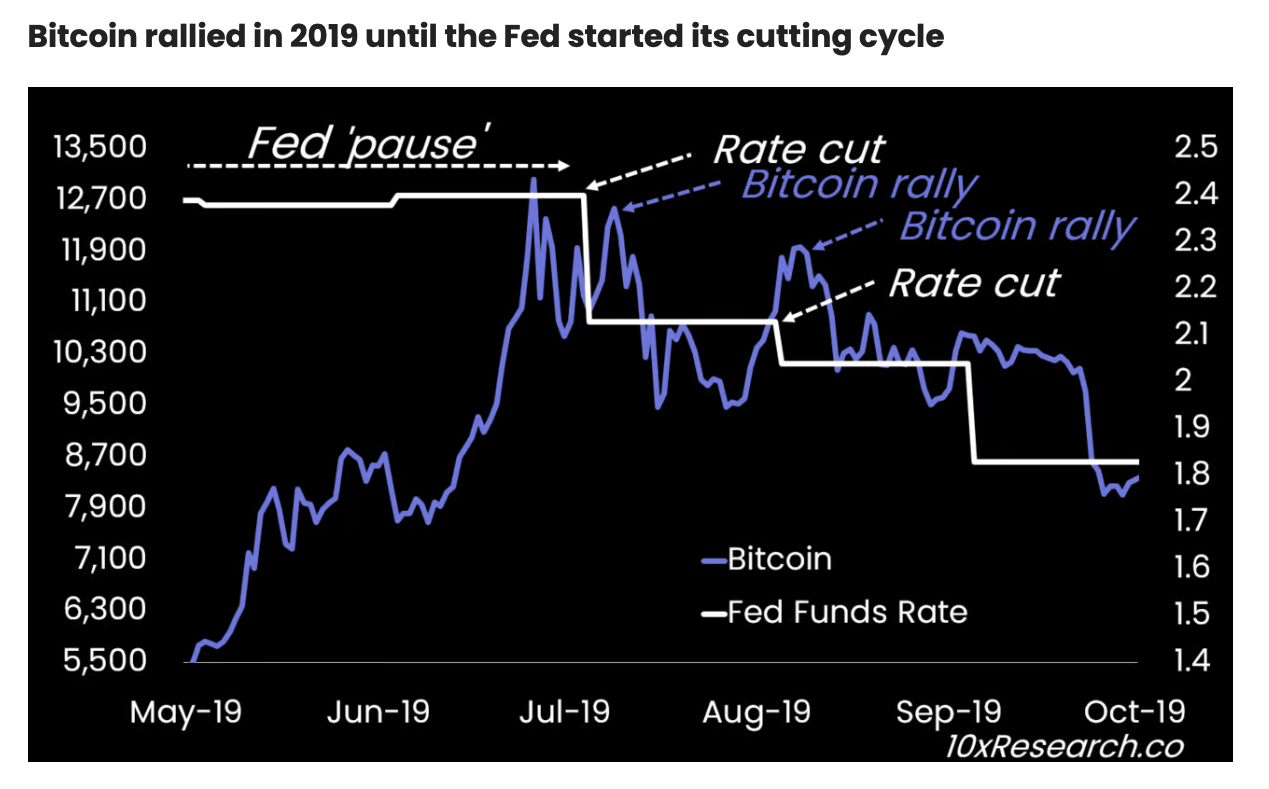

” The Federal Get ought to take into consideration a 50 basis factor price cut, yet whatever activity it takes today may not supply the considerable liquidity increase numerous expect. Historically, Bitcoin’s efficiency complying with price cuts has actually been blended; as an example, after the 2019 price cut, Bitcoin’s first gains were brief, and the cost come by 30% a couple of months later on,” Thielen emphasized.

On the day-to-day graph, Bitcoin’s cost is coming to grips with the 20-day Exponential Relocating Ordinary (EMA). Trading at $58,646, this setting indicates that bulls do not yet have a clear course to drive the cost greater.

Rather, bears have actually remained to put in stress, maintaining Bitcoin’s higher energy in check. BTC likewise stays listed below the 50 EMA (yellow), enhancing the idea that the temporary fad is bearish.

An analysis of the Loved one Stamina Index (RSI) likewise shows a prospective adjustment. As a momentum-measuring technological oscillator, the RSI analysis, regardless of being close to a neutral signal line, has actually fallen short to exceed it.

Find Out More: 10 Systems That Supply the very best Rates Of Interest on Stablecoins

Need to this continue to be the very same, BTC may go down to $56,224. A very bearish circumstance may likewise see the coin decrease to $52,975 after the FOMC conference. Nonetheless, if Bitcoin whales go back to buildup after the occasion, this forecast may be revoked.

Because circumstance, the cost may leap to $64,373 and might establish the phase for a Q4 rally, which 10x Study states it anticipates.

” Also if Bitcoin rallies complying with a Fed price cut, the rise might not be lasting, as recommended by the 2019 contrast. With on-chain information presently weak, there is little genuine task driving energy. While a rally in Q4 is most likely, timing it flawlessly will be important. An unforeseen occasion might reignite market interest and restore financier self-confidence,” the record mentioned.

Please Note

According to the Trust fund Task standards, this cost evaluation write-up is for informative functions just and ought to not be thought about economic or financial investment suggestions. BeInCrypto is dedicated to precise, impartial coverage, yet market problems undergo alter without notification. Constantly perform your very own study and speak with a specialist prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.