Allow’s go into the loved one efficiency of Yelp (NYSE: YELP) and its peers as we unwind the now-completed Q2 social networking incomes period.

Organizations need to satisfy their clients where they are, which over the previous years has actually concerned suggest on social media networks. In 2020, individuals invested over 2.5 hours a day on social media networks, a number that has actually raised annually considering that dimension started. Consequently, companies remain to change their marketing and advertising bucks online.

The 5 social networking supplies we track reported a blended Q2. En masse, profits defeated experts’ agreement price quotes by 2.2% while following quarter’s earnings assistance was 0.9% over.

Rising cost of living proceeded in the direction of the Fed’s 2% objective at the end of 2023, bring about solid securities market efficiency. On the various other hand, 2024 has actually been a bumpier experience as the marketplace changes in between positive outlook and pessimism around price cuts and rising cost of living, and social networking supplies have actually had a harsh stretch. Usually, share rates are down 8% considering that the most recent incomes outcomes.

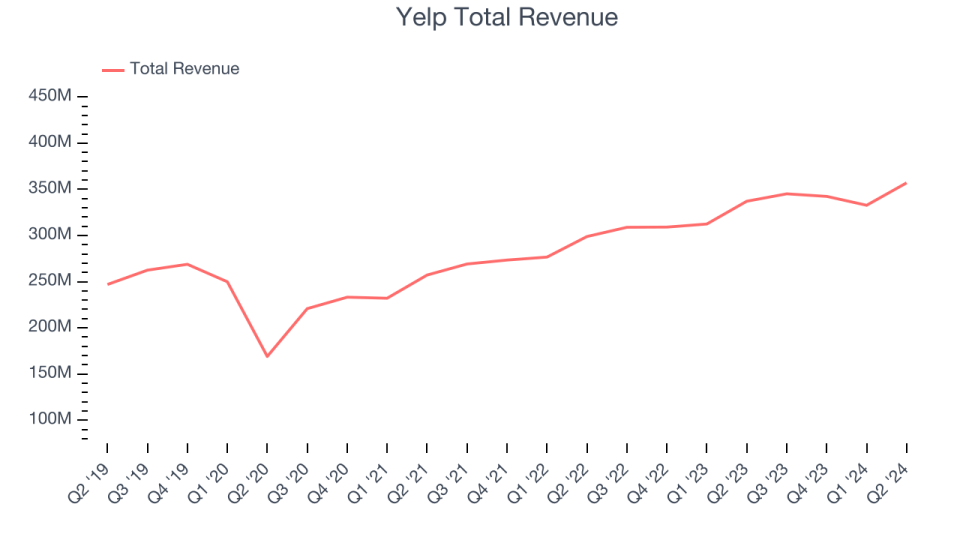

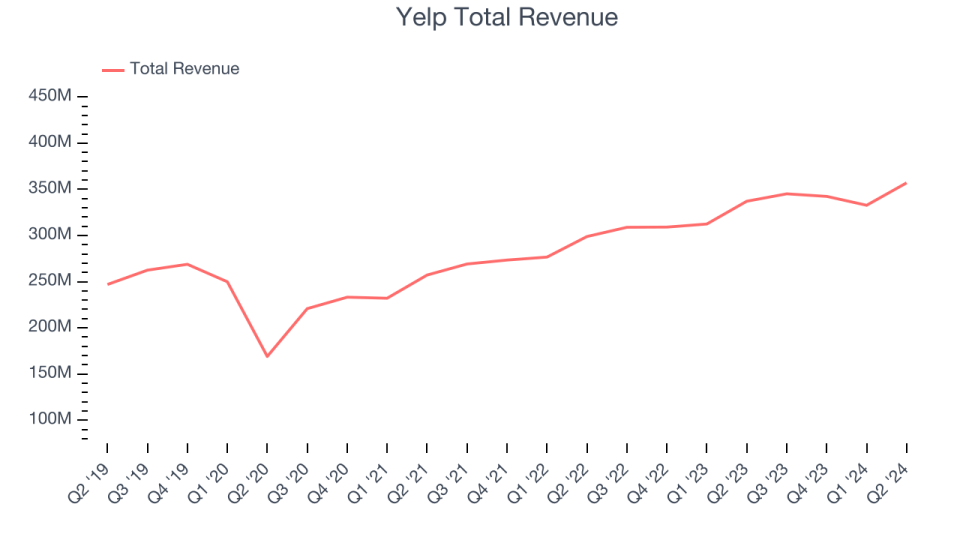

Yelp (NYSE: YELP)

Established by PayPal graduates Jeremy Stoppelman and Russel Simmons, Yelp (NYSE: YELP) is an on the internet system that aids individuals uncover regional companies with crowd-sourced evaluations.

Yelp reported profits of $357 million, up 5.9% year on year. This print surpassed experts’ assumptions by 1.1%. Regardless of the top-line beat, it was still a weak quarter for the business with slow-moving earnings development.

” Yelp provided solid productivity and document internet earnings in the 2nd quarter,” claimed Jeremy Stoppelman, Yelp’s founder and president.

Yelp provided the slowest earnings development of the entire team. Remarkably, the supply is up 2.8% considering that reporting and presently trades at $34.43.

Is currently the moment to get Yelp? Access our full analysis of the earnings results here, it’s free.

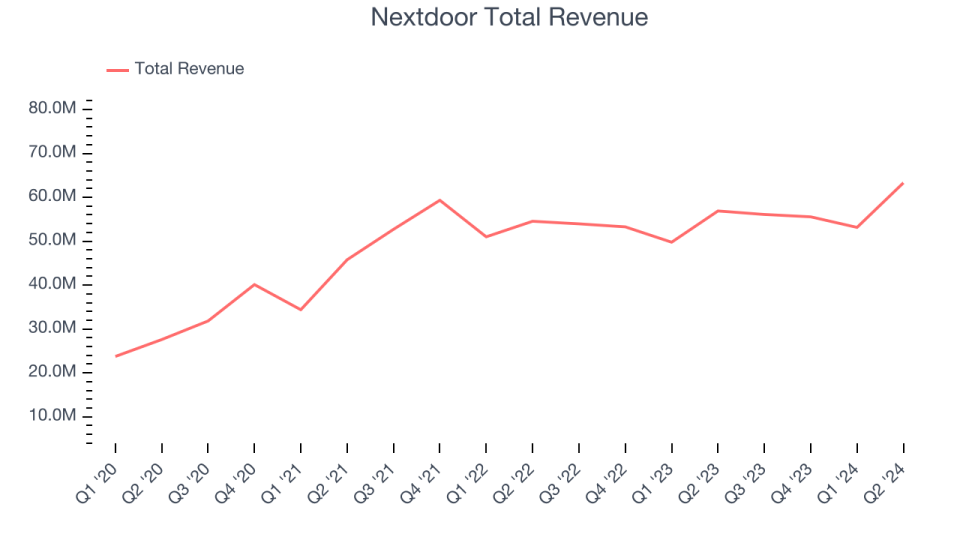

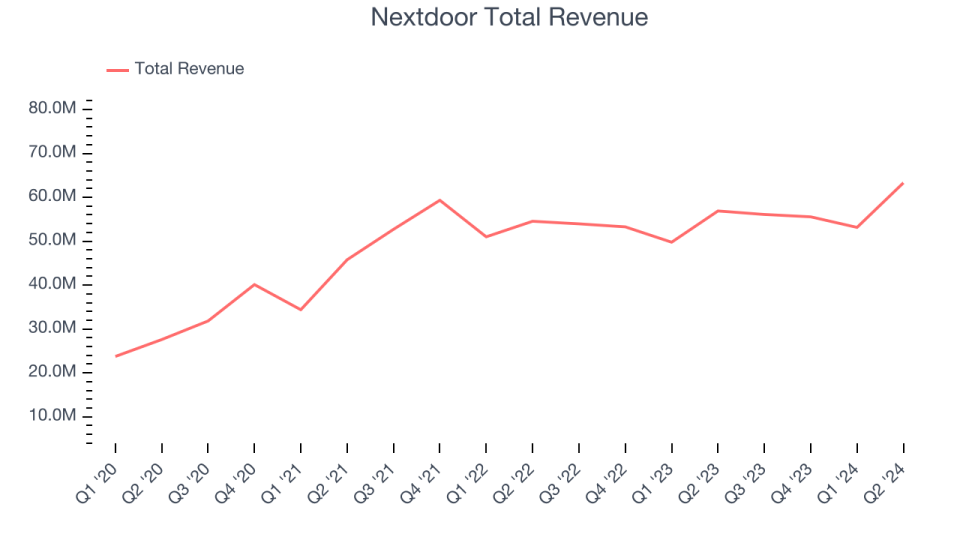

Ideal Q2: Nextdoor (NYSE: KIND)

Aiding locals determine what’s taking place on their block in actual time, Nextdoor (NYSE: KIND) is a social media that links next-door neighbors with each various other and with regional companies.

Nextdoor reported profits of $63.29 million, up 11.3% year on year, surpassing experts’ assumptions by 8.5%. Business had a solid quarter with confident earnings assistance for the following quarter and a good beat of experts’ customer price quotes.

Nextdoor managed the largest expert approximates defeat amongst its peers. The business reported 45.13 million month-to-month energetic individuals, up 8.5% year on year. Although it had a great quarter contrasted its peers, the marketplace appears miserable with the outcomes as the supply is down 5.6% considering that coverage. It presently trades at $2.37.

Is currently the moment to get Nextdoor? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Break (NYSE: BREEZE)

Established by Stanford College student Evan Spiegel, Reggie Brown, and Bobby Murphy, and initially called Picaboo, Snapchat (NYSE: BREEZE) is a picture driven social networks network.

Break reported profits of $1.24 billion, up 15.8% year on year, disappointing experts’ assumptions by 1.1%. It was a weak quarter as it uploaded underwhelming earnings assistance for the following quarter and slow-moving earnings development.

Break provided the weakest efficiency versus expert price quotes in the team. The business reported 432 million day-to-day energetic individuals, up 8.8% year on year. As anticipated, the supply is down 25.4% considering that the outcomes and presently trades at $9.55.

Read our full analysis of Snap’s results here.

Pinterest (NYSE: PINS)

Produced with the concept of basically changing paper brochures, Pinterest (NYSE: PINS) is an on the internet photo and social exploration system.

Pinterest reported profits of $853.7 million, up 20.6% year on year. This print satisfied experts’ assumptions. Zooming out, it was a slower quarter as it logged underwhelming earnings assistance for the following quarter and a miss out on of experts’ customer price quotes.

The business reported 522 million month-to-month energetic individuals, up 12.3% year on year. The supply is down 22.5% considering that reporting and presently trades at $28.94.

Read our full, actionable report on Pinterest here, it’s free.

Meta (NASDAQ: META)

Notoriously established by Mark Zuckerberg in his Harvard dormitory, Meta Systems (NASDAQ: META) runs a collection of the biggest social media networks on the planet – Facebook, Instagram, WhatsApp, and Carrier, together with its metaverse concentrated Truth Labs.

Meta reported profits of $39.07 billion, up 22.1% year on year. This outcome exceeded experts’ assumptions by 2%. Generally, it was an adequate quarter as it additionally generated solid sales assistance for the following quarter.

Meta provided the fastest earnings development amongst its peers. The business reported 3.27 billion day-to-day energetic individuals, up 6.5% year on year. The supply is up 10.9% considering that reporting and presently trades at $526.08.

Read our full, actionable report on Meta here, it’s free.

Sign Up With Paid Supply Financier Study

Assist us make StockStory a lot more useful to capitalists like on your own. Join our paid customer research study session and obtain a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.