Solana (SOL) lately fell short to breach the regional resistance obstacle of $138, which can have stimulated a brand-new rally for the cryptocurrency. In spite of its solid efficiency over the previous year, the marketplace belief has actually changed, and the assistance degree of $120 might not hold for long.

Solana’s cost activity currently deals with enhanced analysis as it floats near to vital degrees that can change its future trajectory.

Solana Encounters New Dangers

Solana gets on the edge of developing a fatality cross, a bearish technological pattern where the 200-day Exponential Relocating Typical (EMA) goes across over the 50-day EMA. Need to this take place, it would certainly signify a possible end to the 11-month bull run that began in October 2023.

The impending fatality cross has actually developed issue amongst financiers that have actually been favorable on Solana for almost a year. A malfunction out there framework can revoke the gains that SOL has actually made throughout this duration.

Learn More: 11 Leading Solana Meme Coins to Enjoy in August 2024

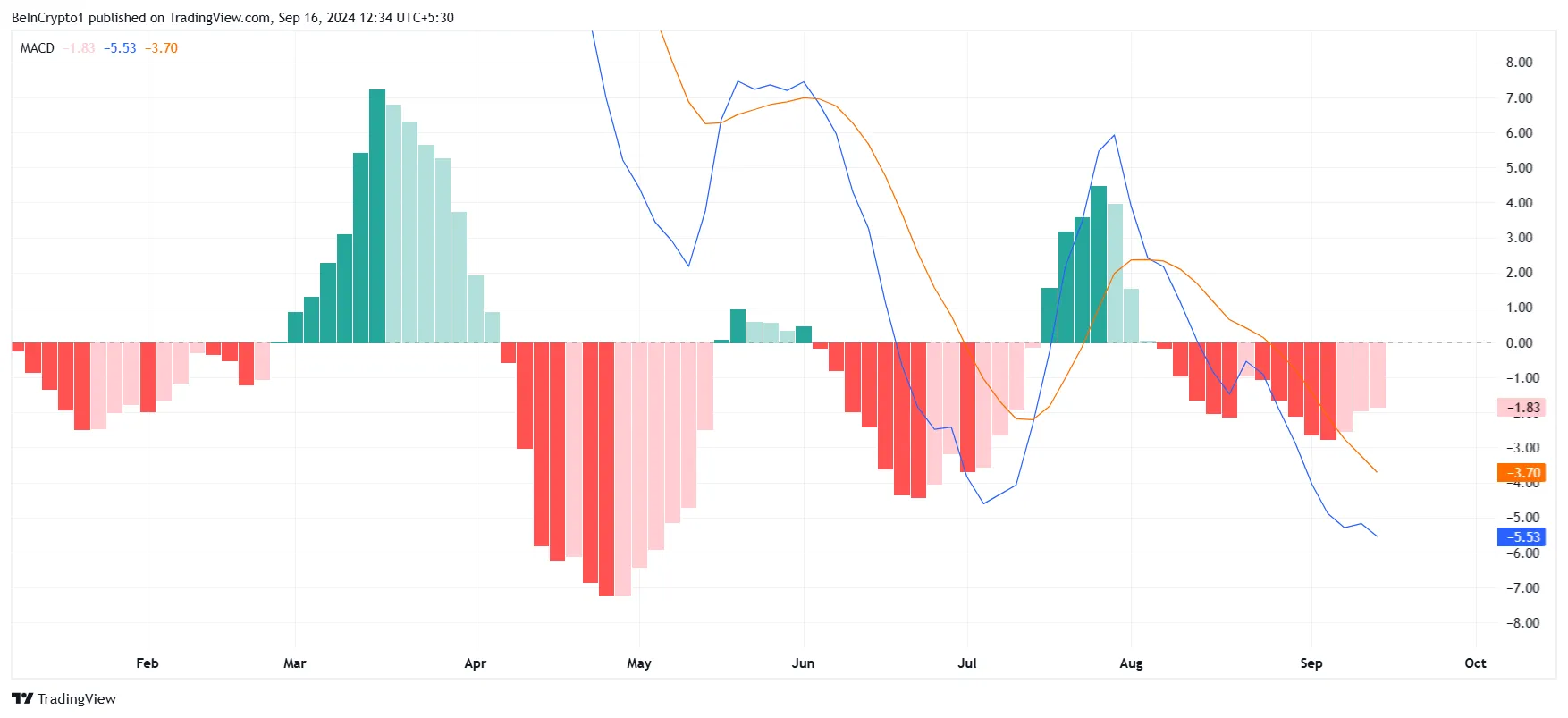

While the macro overview leans bearish as a result of the prospective fatality cross, the Relocating Typical Merging Aberration (MACD) indication paints an extra nuanced mini photo. On the temporary duration, the MACD recommends that bearish energy can be winding down, indicating a feasible recover for Solana. This indication has actually revealed indications of a possible healing near the $124 assistance degree, offering a twinkle of expect financiers trying to find a turnaround.

If Solana can jump off the $124 degree as it performed in very early September, it might ward off additional losses. The MACD signals show that while the long-lasting overview may be unpredictable, there is area for positive outlook in the short-term.

SOL Cost Forecast: Discovering a Course

Presently trading at $130, Solana is looking at a possible bounce off the $124 assistance degree, comparable to its cost activity previously this month. A break listed below this degree is not likely in the prompt future, and also if it happens, Solana has an essential safeguard at the $120 assistance flooring.

Solana has actually been combining over the $120 mark because March, making $138 a crucial resistance degree in the meantime. Breaching this resistance would certainly show that SOL can proceed its higher trajectory in spite of current bearish issues.

Learn More: Solana (SOL) Cost Forecast 2024/2025/2030

Yet if the fatality cross happens, Solana can encounter extreme marketing stress, driving its cost listed below $120. This would certainly revoke the bullish-neutral thesis and can cause substantial losses.

Please Note

According to the Trust fund Job standards, this cost evaluation post is for educational objectives just and must not be taken into consideration economic or financial investment recommendations. BeInCrypto is dedicated to precise, honest coverage, however market problems undergo alter without notification. Constantly perform your very own research study and seek advice from an expert prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.