Amidst the continuous range-bound activity of Bitcoin (BTC), crypto investors and financiers are concentrating on vital United States financial occasions today that might affect rates and establish a directional pattern.

Bitcoin remains to trade in between the mental $60,000 degree and the $57,000 limit. In spite of September’s common obstacles, investors continue to be enthusiastic that “Uptober” will certainly bring far better market problems.

Trick Occasions on the United States Economic Schedule

The United States market will certainly awaken to the launch of Donald Trump’s decentralized money (DeFi) job, Globe Freedom Financial (WLFI), on Monday.

” Join me survive on Twitter Rooms at 8 PM, this September 16, for the launch of Globe Freedom Financial. We are accepting the future with crypto, and leaving the slow-moving and out-of-date large financial institutions behind,” Trump stated in a current video clip message on X.

Nonetheless, 3 vital United States financial information launches today might likewise influence crypto profiles. With Bitcoin up almost 7% over the previous 7 days, whether those gains proceed will certainly rely on exactly how the marketplace responds to these records.

United States Retail Sales

The Business Division’s Demographics Bureau will certainly launch United States retail sales information on Tuesday, giving vital understandings right into customer investing fads, that make up a big part of the United States economic situation.

In July, United States retail sales all of a sudden rose by 1% contrasted to the previous month, a sharp comparison to June’s modified 0.2% decrease and much surpassing economic experts’ assumptions of a 0.3% increase.

Given that customer investing is a significant motorist of financial development, solid August retail sales numbers would certainly reduce economic crisis worries, signifying a healthy and balanced economic situation and improving self-confidence in riskier possessions like cryptocurrencies and supplies.

FOMC Rate Of Interest Choice

The much-anticipated rates of interest choice from the Federal Free Market Board (FOMC) is established for Wednesday. Complying with the current United States Customer Rate Index (CPI) analysis and various other vital financial information, a price cut appears practically particular as rising cost of living cools down.

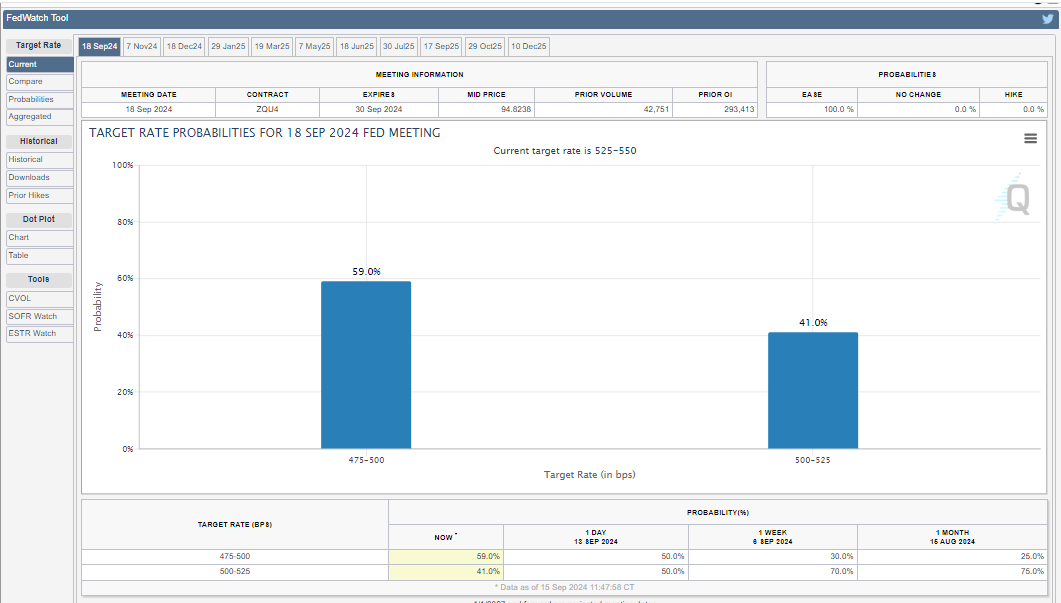

Nonetheless, the dimension of the cut continues to be vague, with market individuals excited to discover the Federal Book’s recommended strategy. According to the CME FedWatch Device, there is a 59% likelihood of a 50 basis factors (bps) price cut and a 49% opportunity of a 25 bps reduced.

The possible effect on Bitcoin and various other risk-on possessions will certainly rely on what investors have actually currently valued in. A 50 bps reduced might shock financiers, possibly driving market volatility. On the other hand, a 25 bps reduced would certainly straighten with assumptions, most likely triggering a much more calculated reaction from Bitcoin.

Noteworthy, JPMorgan sustains a 50 bps reduced, in spite of the Fed’s tighter financial plan as rising cost of living nears the 2% target.

” We assume there’s an excellent situation for rushing in their speed of price cuts,” stated Michael Feroli, JPMorgan Chase’s primary United States financial expert.

Nonetheless, BeInCrypto kept in mind that such an action might indicate more comprehensive financial worries, motivating financiers to avoid riskier possessions like Bitcoin. Consequently, the majority of experts anticipate a 25 bps reduced, considered that the present actual Federal Finances price recommends the Fed’s plan is currently rather limiting.

” The present assumption is for the Fed to reduce rates of interest by 0.25%, which would certainly be favorable for economic possessions like supplies and crypto, as it decreases the expense to obtain cash,” Mati Greenspan, Chief Executive Officer of Quantum Business economics, informed BeInCrypto.

After Wednesday’s price choice, markets will very closely adhere to Fed Chair Jerome Powell’s interview for understandings on future price cuts. Based upon present information and market view, a soft touchdown for the rest of the year promises.

United States Joblessness Cases

First out of work insurance claims are likewise on the watchlist today, giving understanding right into the present state of the labor market. While the work market has actually softened, joblessness prices continue to be reasonably reduced.

Task openings have actually gone down dramatically, straightening with a much more stabilized market. As reported by BeInCrypto, the United States economic situation included simply 142,000 tasks in August, disappointing assumptions.

Nonetheless, the joblessness price for August satisfied projections, standing at 4.2%, noting a mild renovation from the 4.3% tape-recorded in July, signifying a decrease in joblessness.

Learn More: Exactly How To Purchase Bitcoin (BTC) and Whatever You Required To Know

Thursday’s information will certainly disclose the current development in the United States labor market. While its effect might not be as straight or substantial as various other financial signs, an increase in out of work insurance claims might indicate financial weak point. This could motivate some financiers to transform to alternate possessions, like cryptocurrencies, as a bush versus typical markets.

Please Note

In adherence to the Count on Task standards, BeInCrypto is dedicated to impartial, clear coverage. This newspaper article intends to offer exact, prompt details. Nonetheless, viewers are recommended to validate truths separately and talk to a specialist prior to making any type of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.