TRX, the indigenous coin of the Tron blockchain, has actually kept a sag because August 25. Trading hands at $0.14 since this writing, the coin’s worth has actually because plunged by 13%.

With an expanding bearish prejudice towards the tenth-largest cryptocurrency by market capitalization, its technological arrangement recommends that TRX is positioned to prolong this decrease.

Tron Derivatives Traders Avert

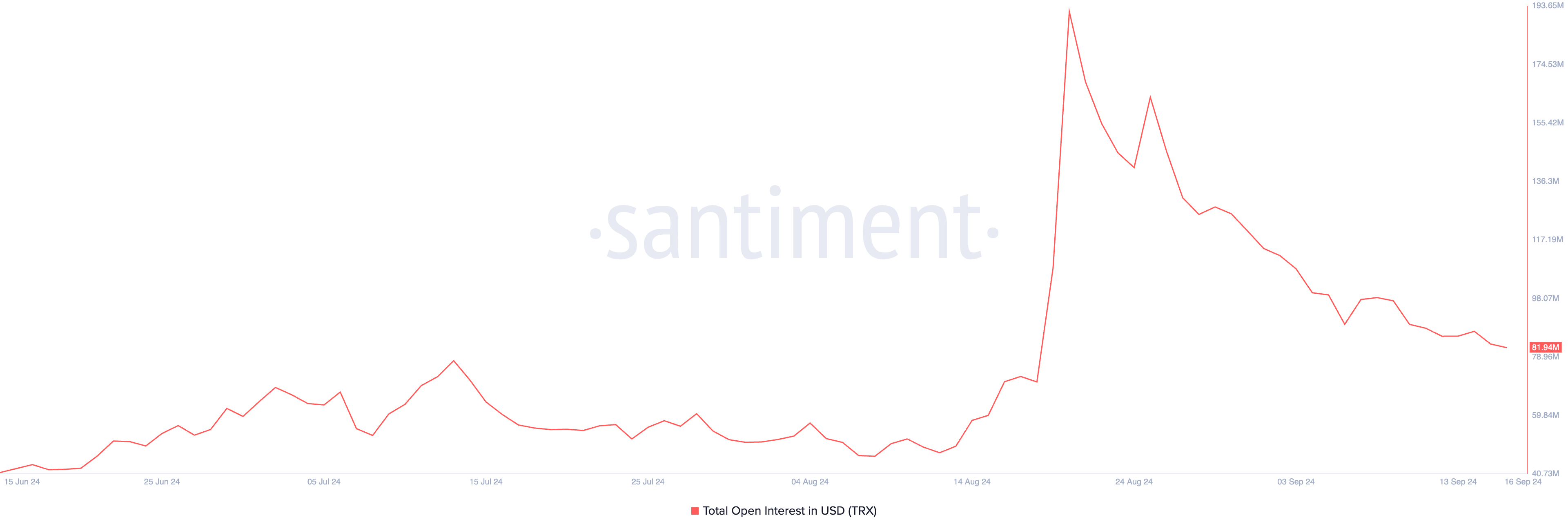

The decrease in TRX’s by-products market task signifies a clear decrease sought after for the altcoin. Its Open Rate of interest, which gauges the overall variety of exceptional futures or alternatives agreements that have yet to be worked out or shut, has actually been trending downward because getting to a year-to-date high of $191 million on August 21.

Since press time, TRX’s Open Rate of interest stands at $82 million, showing a 57% decrease because August 21.

When a property’s Open Rate of interest lowers, it usually signifies minimized trading task or winding down financier rate of interest. This additionally mirrors a loss of self-confidence in the property’s favorable cost energy, which appears in TRX’s adverse financing price.

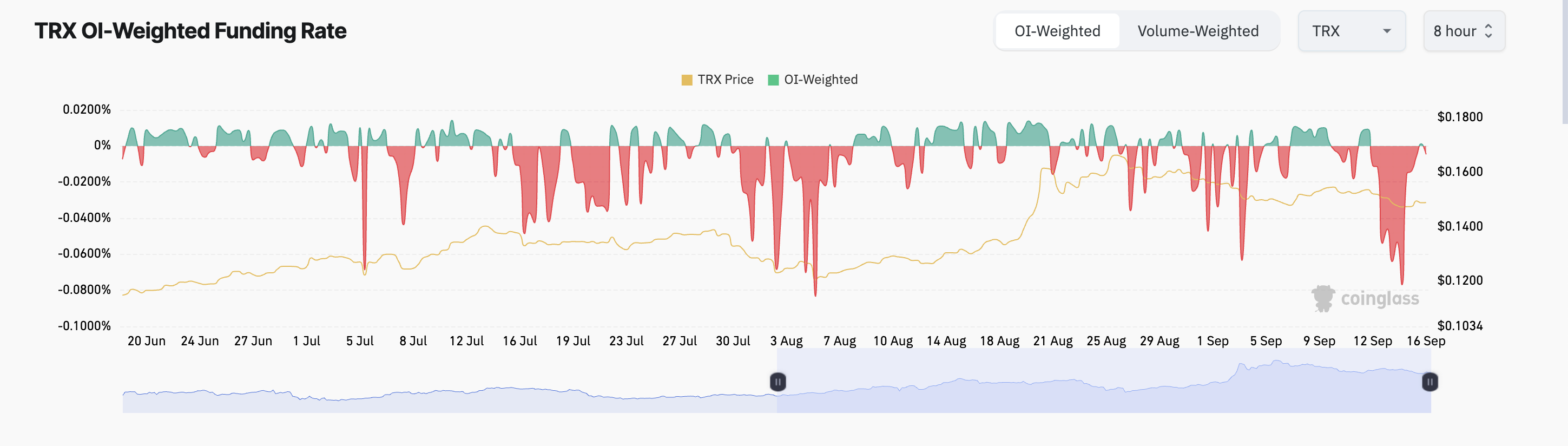

On-chain information reveals that TRX’s financing price has actually been mostly adverse over the previous month. The financing price, which is the cost to maintain the agreement cost straightened with the area cost, stands at -0.0047% at press time.

Find Out More: 7 Best Tron Wallets for Storage TRX

An adverse financing price implies extra investors are holding brief settings, suggesting that a bigger variety of investors anticipate TRX’s cost to decrease as opposed to increase.

TRX Cost Forecast: Cost Is Positioned to Violation Assistance

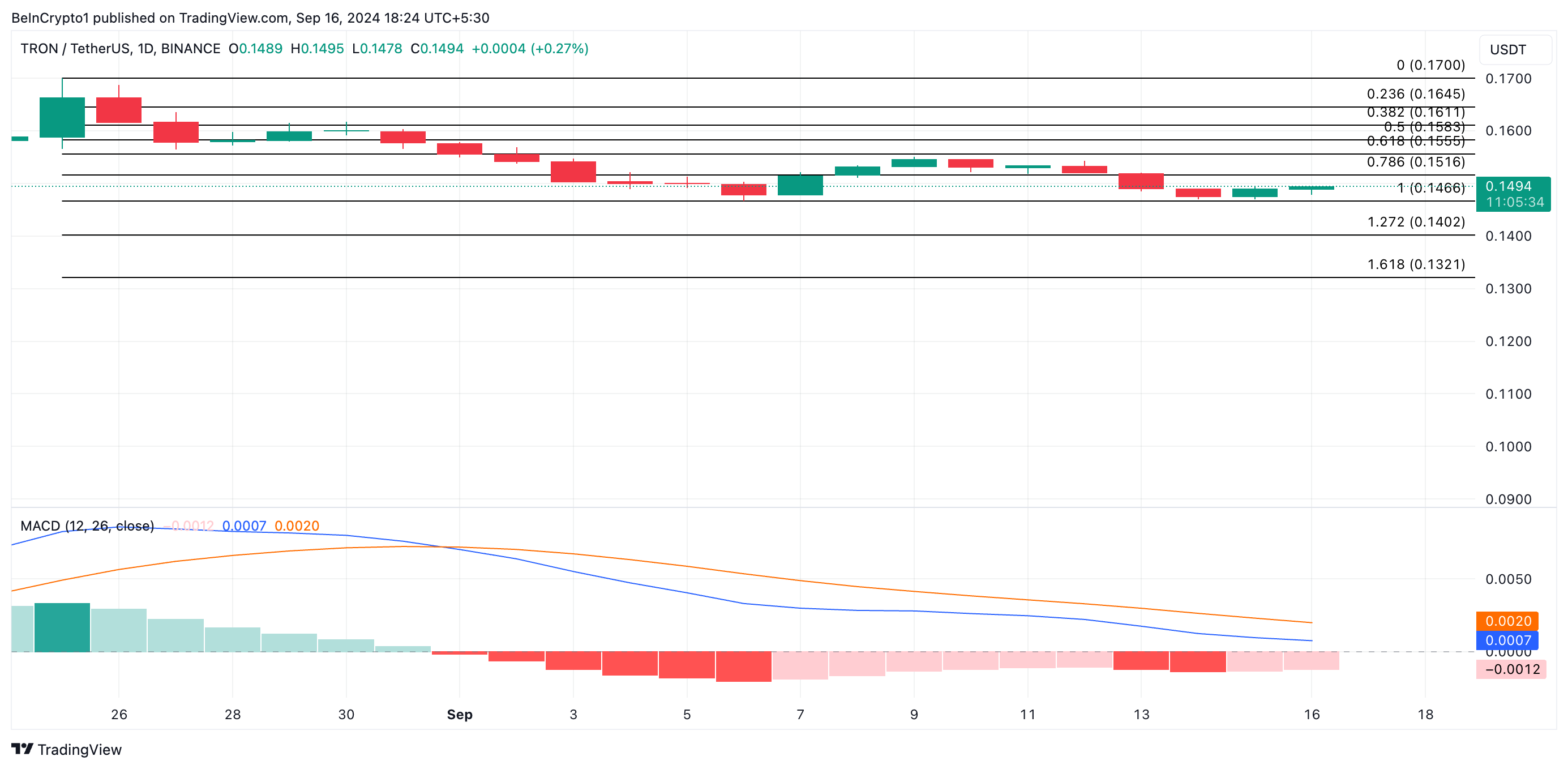

Tron’s cost decrease because August 25 has actually brought about the development of a coming down network, a bearish pattern identified by reduced highs and reduced lows. The top line of the network serves as resistance, presently at $0.14 for TRX, while the reduced line functions as assistance, additionally at $0.14.

Analyses from Tron’s Relocating Ordinary Convergence/Divergence (MACD) indication– which gauges pattern instructions and possible cost turnarounds– show the opportunity of an ongoing decrease. At press time, TRX’s MACD line (blue) rests listed below the signal line (orange) and is trending towards the no line.

When the MACD line goes across listed below the signal line, it signifies weak temporary energy. An additional decline listed below the no line verifies a sag, boosting the opportunities of a prolonged decrease.

Find Out More: Exactly How To Acquire TRON (TRX) and Every Little Thing You Required To Know

If need for TRX remains to compromise, its cost might breach the assistance line, possibly being up to $0.13. Nevertheless, if market belief changes and need for TRX reinforces, the cost might damage previous resistance, going for its current high of $0.17.

Please Note

In accordance with the Count on Task standards, this cost evaluation post is for educational functions just and need to not be thought about economic or financial investment guidance. BeInCrypto is dedicated to precise, objective coverage, yet market problems go through alter without notification. Constantly perform your very own study and seek advice from a specialist prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.