Ethereum’s (ETH) efficiency about Bitcoin (BTC) has actually seen a sharp decrease because July 24, with the ETH/BTC set currently at its floor in 3 years. As market view for ETH transforms significantly bearish, numerous experts forecast more decreases in the coin’s worth.

This write-up breaks down crucial understandings that ETH owners ought to understand as the scenario remains to unravel.

Ethereum Eclipsed by Bitcoin as Network Task Suffers

The ETH/BTC set stands for the proportion in between the costs of Ethereum (ETH) and Bitcoin (BTC), demonstrating how much BTC is required to get one ETH. When this proportion enhances, it indicates ETH is outshining BTC, either because of ETH increasing quicker or BTC dropping. If the proportion reduces, it suggests BTC is outshining ETH, either since BTC is increasing quicker or ETH is underperforming.

Presently, the ETH/BTC proportion stands at 0.039, its cheapest degree because April 2021. The decrease started on July 24 after both damaged listed below the straight network it had actually been selling between May 21 and July 24.

Surprisingly, regardless of Bitcoin (BTC) battling to damage above $65,000 in current months, its market supremacy (BTC.D) has actually gradually boosted. At 57.95% currently, it goes to its highest degree because April 2021.

The synchronised decrease in the ETH/BTC set and the surge in BTC supremacy signal Ethereum’s loss of market share and Bitcoin’s expanding toughness on the market. Past more comprehensive bearish macro fads, the minimized task on the Ethereum network in current months has most likely added to this change.

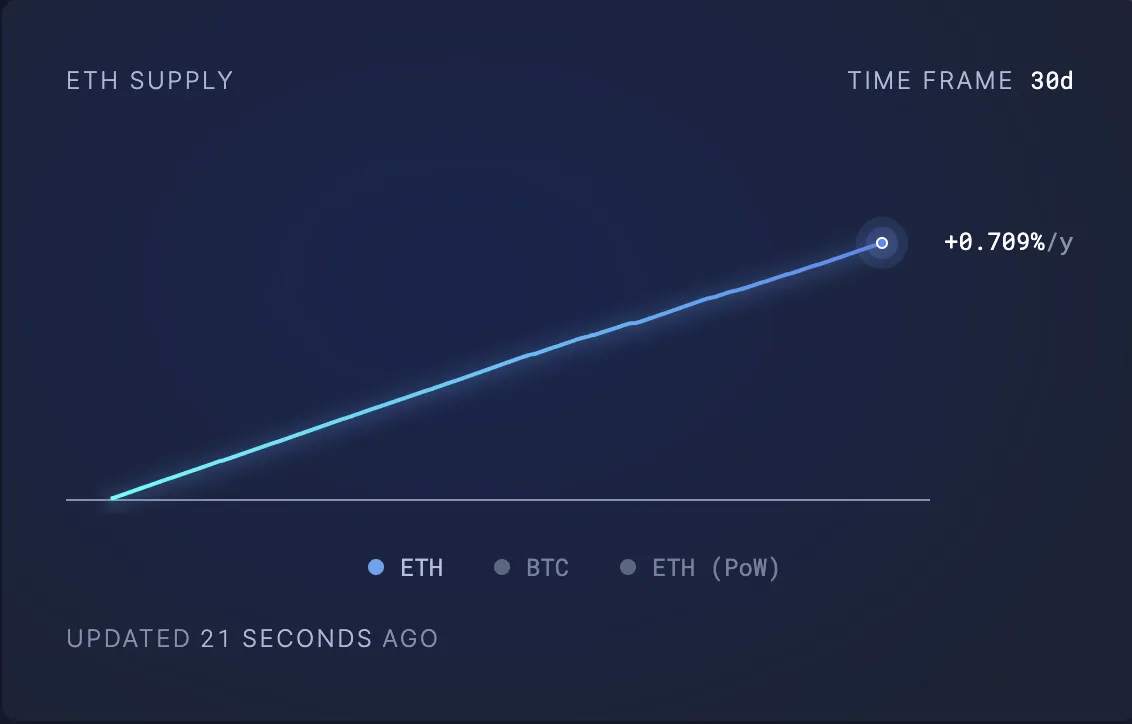

Reduced network use has actually brought about a reduced melt price of ETH, enhancing its flowing supply and including stress on its cost.

Learn More: 9 Finest Places To Bet Ethereum in 2024

Information from Ultrasoundmoney reveals that 70,111 ETH well worth over $163 million went into the flowing supply over the previous thirty days. As even more symbols flooding the marketplace, the rise in supply outmatches need, creating descending stress on the cost.

ETH Rate Forecast: Is the Altcoin Ready For a Surprise?

The Federal Book is anticipated to reveal a price reduced on September 18, which can cause market volatility in the coming days. Nevertheless, Ethereum’s increasing Chaikin Cash Circulation (CMF) recommends a build-up fad, suggesting that its cost might rally if need energy stays solid.

Presently, ETH’s CMF, which determines the circulation of cash right into and out of its market, rests at 0.12. In spite of ETH’s current cost decrease, the CMF has actually been trending upwards, producing a favorable aberration. This signals underlying need for ETH, which can cause a favorable cost change in the close to term.

If this need continues, Ethereum’s cost can rebound towards the resistance degree of $2,579. Appearing this obstacle can lead the way for more gains, possibly pressing the cost towards $2,868.

Learn More: Exactly How to Acquire Ethereum (ETH) and Whatever You Required to Know

Nevertheless, this favorable expectation would certainly be revoked if need compromises in the coming days, perhaps resulting in a decrease towards the August 5 reduced of $2,111.

Please Note

In accordance with the Trust fund Job standards, this cost evaluation write-up is for educational functions just and ought to not be thought about monetary or financial investment suggestions. BeInCrypto is dedicated to exact, impartial coverage, yet market problems go through alter without notification. Constantly perform your very own study and seek advice from an expert prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.