Bitcoin’s (BTC) recurring battle to damage previous the $60,000 mark hasn’t caused a sell-off amongst owners. Rather, lots of are keeping their possessions, as revealed by the decrease in exchange task.

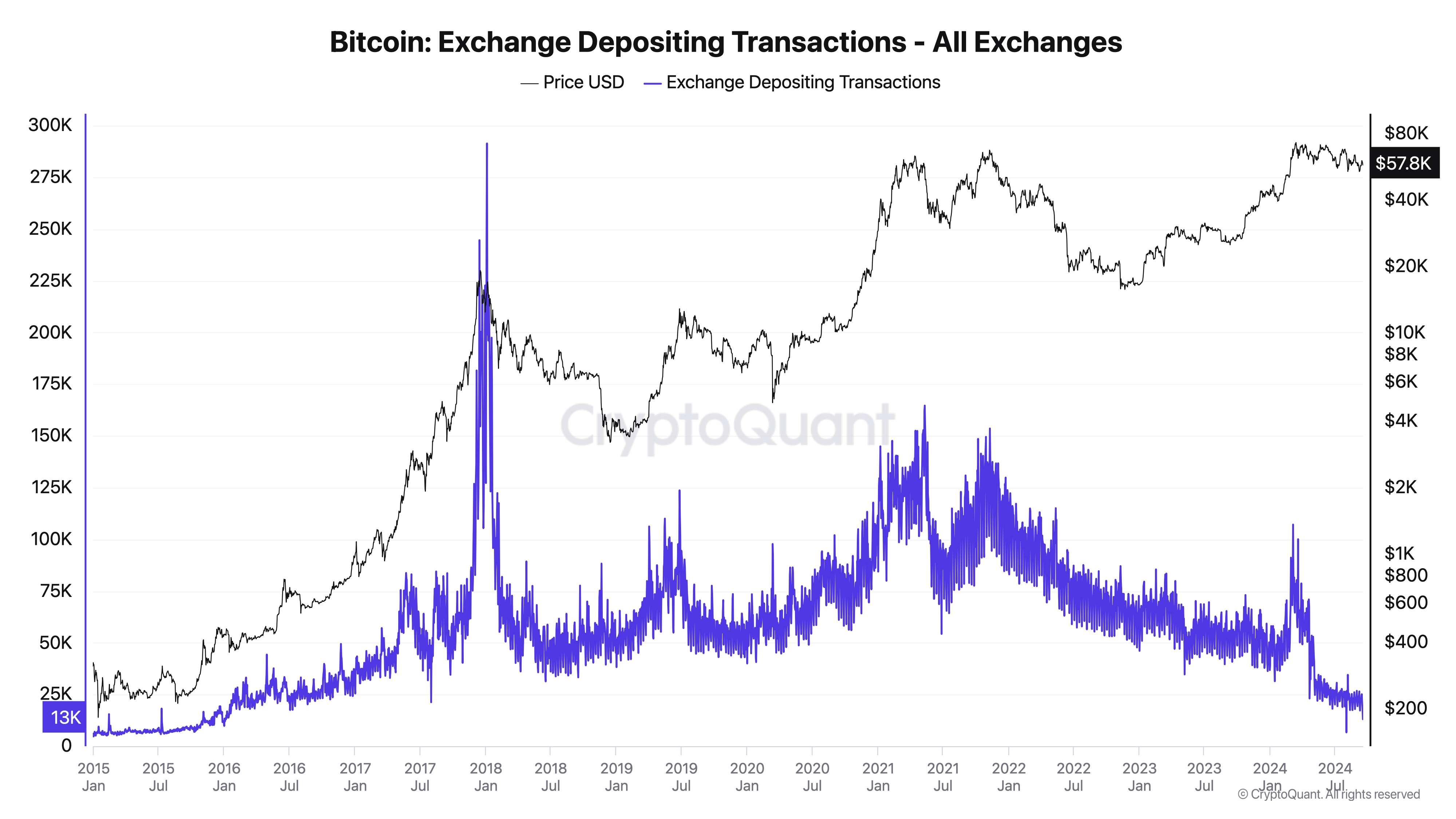

The variety of everyday addresses sending out BTC to exchanges has actually struck a multi-year reduced, a fad that accompanies the marketplace’s expectancy of the Federal Book’s choice at its September 18 conference.

Bitcoin Investors Keep Their Coins

On-chain information reveals a decrease in BTC’s Exchange Depositing Addresses, which track the variety of addresses sending out inflow deals from the Bitcoin network to crypto exchanges. This statistics has actually been trending downward because reaching its year-to-date top on March 5.

Over the previous week, the variety of addresses that have actually transferred their coins on exchanges has actually visited 19%. When this statistics drops, investors or financiers are keeping their coins as opposed to marketing them.

The current decrease in exchange task accompanies market forecasts of a 50% possibility for a half-percentage-point price reduced at the Federal Book’s conference on Wednesday.

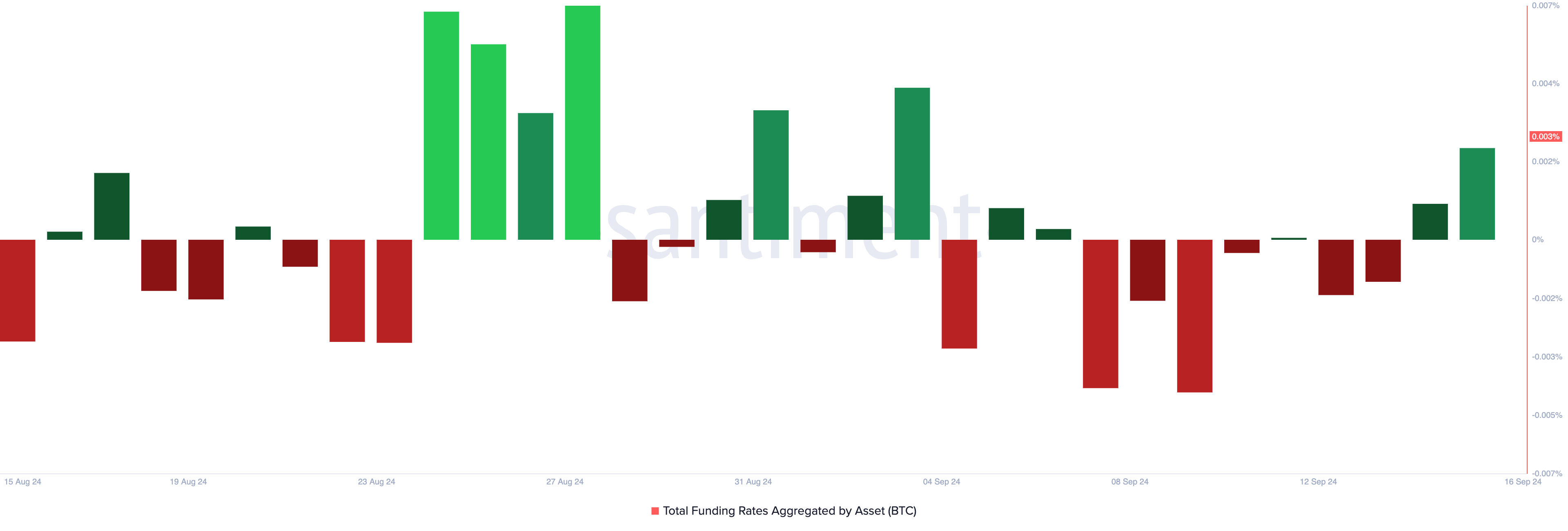

When Bitcoin’s marketing stress relieves in advance of a possible price cut, it usually recommends that financiers expect an extra beneficial market atmosphere. This expanding favorable view is mirrored in Bitcoin’s financing price, which transformed favorable 2 days earlier after 6 successive days of adverse worths.

At 0.003% since press time, BTC’s financing price suggests more powerful need for lengthy placements over brief ones.

Find Out More: 5 Ideal Systems To Purchase Bitcoin Mining Supplies After 2024 Halving

BTC Cost Forecast: A Rally Past $61,000 Is Feasible

At press time, Bitcoin (BTC) is trading at $58,726, proceeding its rate decrease from last weekend break. Nevertheless, the increasing Chaikin Cash Circulation (CMF) recommends that build-up is happening.

Presently, the CMF, which tracks the circulation of cash right into and out of BTC’s market, rests at 0.06, creating a favorable aberration with the dropping rate. This suggests that market individuals are collecting even more BTC in advance of Wednesday’s Federal Book conference.

If the coin rebounds, it might retest the resistance degree at $61,388, possibly pressing BTC’s rate towards $64,312.

Find Out More: Where To Profession Bitcoin Futures: A Comprehensive Overview

Nevertheless, if build-up reduces and the sag proceeds, BTC may shed assistance at $54,302 and go down to the August 5 reduced of $49,000.

Please Note

According to the Count on Job standards, this rate evaluation post is for educational functions just and need to not be thought about monetary or financial investment recommendations. BeInCrypto is dedicated to exact, objective coverage, yet market problems undergo transform without notification. Constantly perform your very own study and talk to an expert prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.