Digital property financial investment items taped $436 million in inflows recently, a standard change after a collection of discharges getting to $1.2 billion.

Crypto markets have much to expect today, with a vital minute on Wednesday as the Federal Free Market Board (FOMC) makes a decision the range of September’s rate of interest cuts.

Crypto Investments Inflows Get To $436 Million

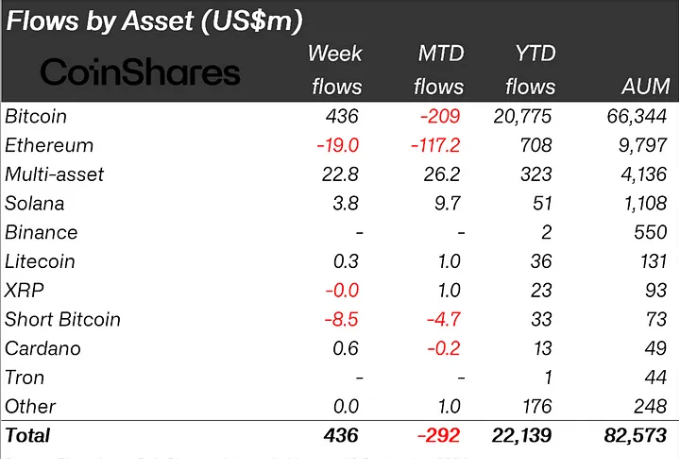

Bitcoin (BTC) led crypto inflows recently, generating as much as $436 million and turning around the adverse circulations from the week finishing September 6. On the other hand, Ethereum (ETH) remained to experience adverse circulations, with $19 million in discharges complying with the $98 million discharges taped the previous week.

The most up to date CoinShares report features Bitcoin’s favorable inflows to assumptions of a 50 basis factor (0.50%) price cut. Regional inflows sustain this concept, with the United States blazing a trail, bookkeeping for as much as $416 million.

Particularly, remarks from Expense Dudley sustained positive outlook. The previous New york city Fed Head of state mentioned on Thursday that there was a solid instance for a 50 basis factor rate of interest cut.

” I believe there’s a solid instance for 50, whether they’re mosting likely to do it or otherwise,” Dudley stated at the Bretton Woods Board’s yearly Future of Financing Discussion Forum in Singapore.

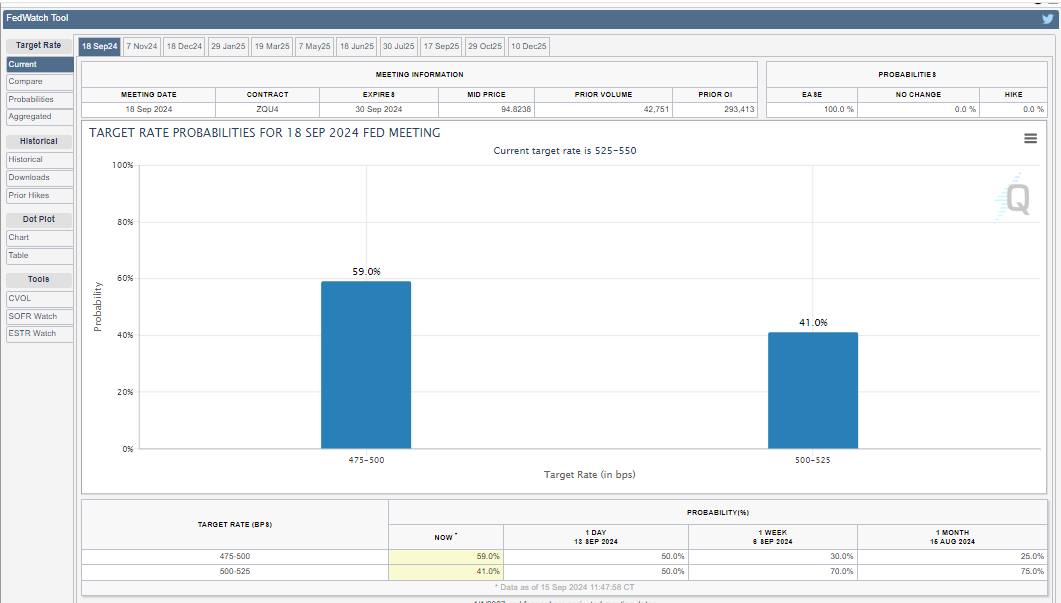

The FOMC’s rate of interest reduced choice on Wednesday is a vital occasion that crypto markets will very closely enjoy today. Investors and financiers are planning for the effect on their profiles, relying on the policymakers’ selected price cut. Information from the CME FedWatch Device reveals a 59% likelihood of a 50 bps price cut, contrasted to a 41% possibility of a 25 bps reduced.

Learn More: How to Protect Yourself From Inflation Using Cryptocurrency

JPMorgan likewise supports for a 50 bps rate of interest cut, however unpredictable times exist in advance for Bitcoin despite whether the cut is 50 or 25 bps. A 25 bps reduced is currently valued in, while experts warn that a larger 50 bps cut can adversely influence Bitcoin.

No matter the end result, markets are excitedly waiting for Wednesday’s FOMC choice, which can bring the initial price reduced because very early 2020.

Turning of ETFs Is Expanding

On the other hand, CoinShares records that trading quantities in exchange-traded funds (ETFs) stayed level at $8 billion recently. Nonetheless, Eric Balchunas notes that information reveals a rise in circulations right into worth ETFs, getting to $11.4 billion over the previous thirty day. This mirrors a substantial change of funding towards these economic tools.

” If we do rolling thirty day the circulations right into worth ETFs are $11.4 b, which is big. While lots of worth ETFs have actually absorbed cash money a large portion of this is using BlackRock’s version profile which revolved greatly right into EFV,” Balchunas added.

The ETF specialist recognizes that numerous worth ETFs have actually taken advantage of the current increase of cash money, with a substantial part credited to BlackRock’s version profile. Balchunas highlights the expanding turning right into worth ETFs, pointing out $5.6 billion in inflows in the initial 2 weeks of September.

He contrasts this rise to the “Excellent Head Counterfeit of Late 2020,” when markets experienced an unforeseen change in patterns. Throughout that duration, development supplies, especially in the technology industry, considerably split in efficiency from worth supplies, unexpected lots of financiers.

It continues to be unpredictable whether this worth turning will certainly remain to enhance or encounter challenges, especially from the supremacy of tech-heavy ETFs like Invesco NASDAQ Futures (QQQs). Balchunas concerns the long life of the change, offered the ongoing charm of technology-focused financial investments.

Reviewing the “Excellent Head Counterfeit,” which triggered a review of conventional techniques and disputes concerning its sustainability, the present turning increases comparable concerns. Whether this turning will certainly sustain or encounter obstacles from contending financial investment motifs is yet to be figured out, however it offers an engaging advancement for financiers to very closely keep an eye on.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to offer precise, prompt info. Nonetheless, visitors are suggested to confirm realities individually and speak with a specialist prior to making any kind of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.