On April 19, 2024, Bitcoin miners saw their block incentives cut in half from 6.250 BTC to 3.125 BTC. This quadrennial occasion has actually traditionally triggered a booming market for Bitcoin, mixing expectancy throughout the crypto neighborhood.

The cost activity has actually been warm considering that the Bitcoin halving. Therefore, some experts are computing when the Bitcoin booming market will certainly begin.

Bitcoin Booming Market in 20 Days?

Crypto expert Quinten Francois has highlighted a regular pattern in Bitcoin’s cycles. He mentioned that the ordinary Bitcoin cycle starts approximately 170 days after the halving.

Presently, 150 days have actually passed considering that the Bitcoin halving. Therefore, a favorable turn might arise in around 20 days if patterns straighten with historic information.

Find Out More: What Took place at the Last Bitcoin Halving? Forecasts for 2024

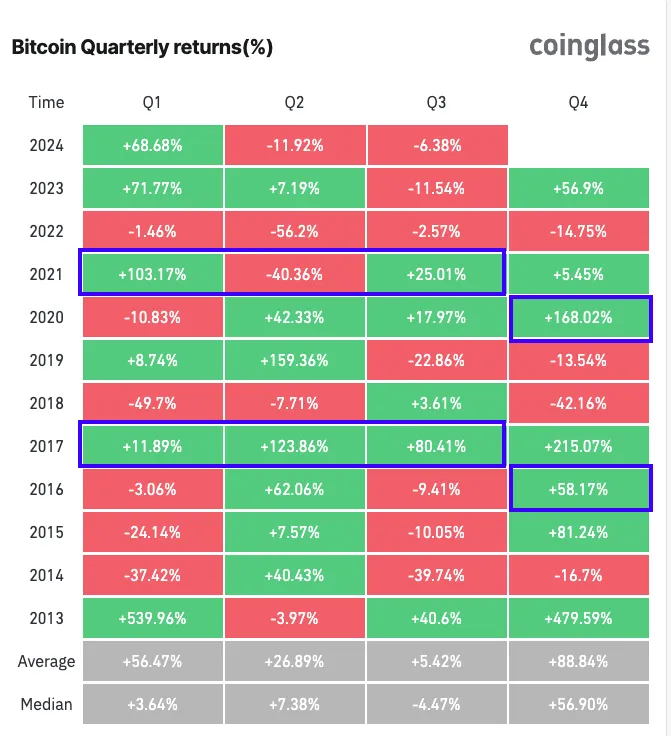

Including in the favorable view, expert Lark Davis goes over the outstanding quarterly returns in previous cutting in half years– 2016 and 2020. He mentions that the 4th quarter has actually continually been favorable post-halving.

In Addition, in the years adhering to the halving– 2017 and 2021, Bitcoin’s cost activity was favorable from the very first to the 3rd quarter of the year.

” If background repeats itself, it might let loose astonishing gains that lots of people can not also fathom,” Davis stated, projecting chances for development in 2025.

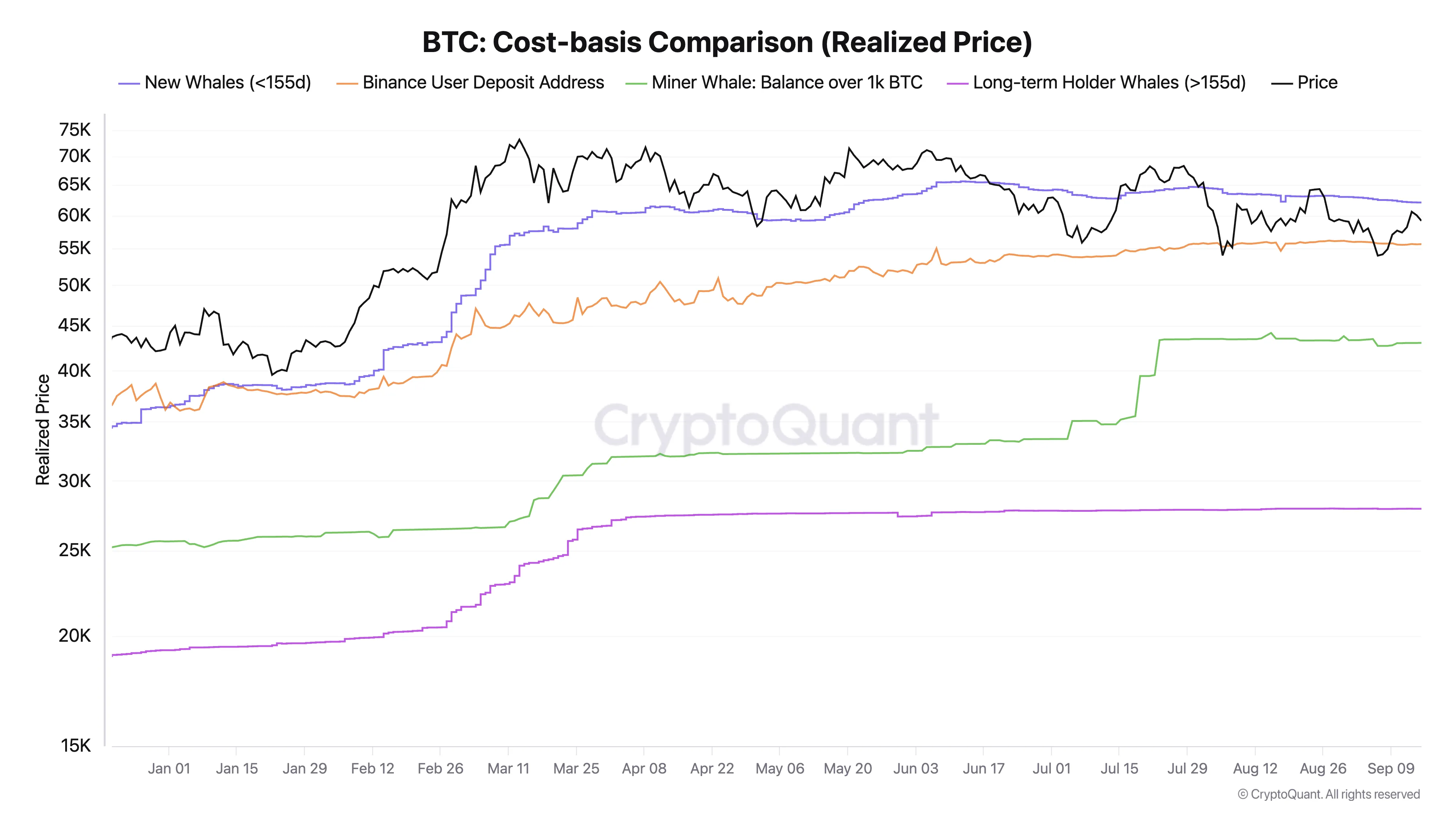

On The Other Hand, Ki Youthful Ju, creator of the on-chain evaluation system CryptoQuant, determines vital cost degrees for financiers to keep an eye on. These degrees stand for the ordinary price of Bitcoin for various teams of financiers and act as considerable emotional and technological pens.

The very first noteworthy degree is $62,000, noting the price basis for recently developed custodial pocketbooks and exchange-traded funds (ETFs) that began selling January 2024. Returning to this degree at a loss could generate marketing as some financiers could look for to leave their profession at a break-even, possibly developing it as a resistance area.

An additional essential degree is $55,000, which is the ordinary acquisition cost for Binance investors. With Bitcoin presently concerning 7% over this variety, at around $58,500, this degree is positioned to function as near-term assistance.

The mining market’s price basis stands at $43,000. Because Bitcoin trades substantially greater, this degree might function as a solid assistance area in the mid-term. Nevertheless, a decline listed below this limit might show distress amongst miners, possibly applying descending stress on Bitcoin’s cost.

Ultimately, the $27,000 mark is important as it stands for the ordinary access factor for Bitcoin whales. This degree is taken into consideration long-lasting assistance and might stand for the flooring needs to the marketplace get on a bear stage.

Find Out More: Bitcoin Halving Cycles and Financial Investment Techniques: What To Know

As the awaited booming market countdown nears, the communication of these cost limits with well-known historic patterns will certainly play an essential duty in establishing Bitcoin’s temporary cost motions.

Please Note

In accordance with the Depend on Job standards, this cost evaluation short article is for educational functions just and need to not be taken into consideration monetary or financial investment recommendations. BeInCrypto is devoted to exact, impartial coverage, however market problems go through alter without notification. Constantly perform your very own study and seek advice from an expert prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.